Instructions For Form 706-Gs(D-1)

ADVERTISEMENT

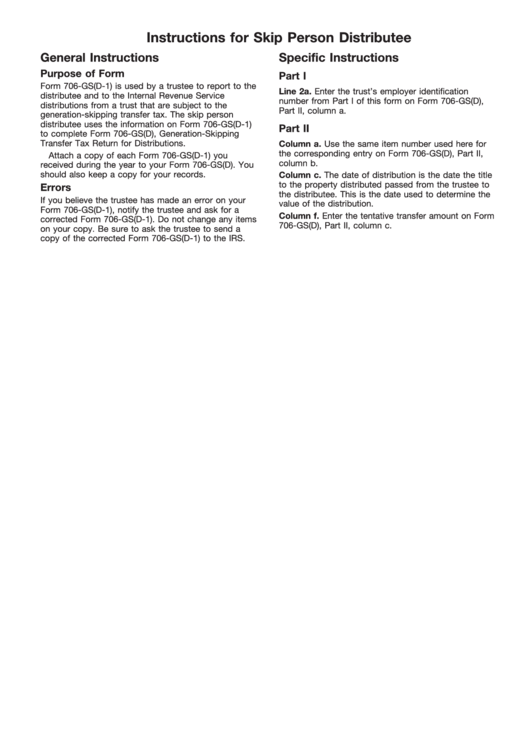

Instructions for Skip Person Distributee

General Instructions

Specific Instructions

Purpose of Form

Part I

Form 706-GS(D-1) is used by a trustee to report to the

Line 2a. Enter the trust’s employer identification

distributee and to the Internal Revenue Service

number from Part I of this form on Form 706-GS(D),

distributions from a trust that are subject to the

Part II, column a.

generation-skipping transfer tax. The skip person

distributee uses the information on Form 706-GS(D-1)

Part II

to complete Form 706-GS(D), Generation-Skipping

Transfer Tax Return for Distributions.

Column a. Use the same item number used here for

the corresponding entry on Form 706-GS(D), Part II,

Attach a copy of each Form 706-GS(D-1) you

column b.

received during the year to your Form 706-GS(D). You

should also keep a copy for your records.

Column c. The date of distribution is the date the title

to the property distributed passed from the trustee to

Errors

the distributee. This is the date used to determine the

If you believe the trustee has made an error on your

value of the distribution.

Form 706-GS(D-1), notify the trustee and ask for a

Column f. Enter the tentative transfer amount on Form

corrected Form 706-GS(D-1). Do not change any items

706-GS(D), Part II, column c.

on your copy. Be sure to ask the trustee to send a

copy of the corrected Form 706-GS(D-1) to the IRS.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6