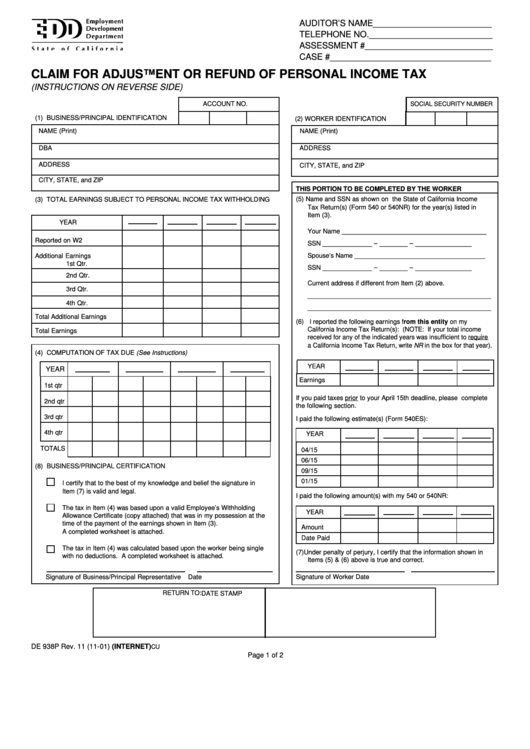

Form De 938p - Claim For Adjustment Or Refund Of Personal Income Tax

ADVERTISEMENT

AUDITOR’S NAME _________________________

TELEPHONE NO. __________________________

ASSESSMENT # ___________________________

CASE # __________________________________

CLAIM FOR ADJUSTMENT OR REFUND OF PERSONAL INCOME TAX

(INSTRUCTIONS ON REVERSE SIDE)

ACCOUNT NO.

SOCIAL SECURITY NUMBER

(1) BUSINESS/PRINCIPAL IDENTIFICATION

(2) WORKER IDENTIFICATION

NAME (Print)

NAME (Print)

DBA

ADDRESS

ADDRESS

CITY, STATE, and ZIP

CITY, STATE, and ZIP

THIS PORTION TO BE COMPLETED BY THE WORKER

(5) Name and SSN as shown on the State of California Income

(3) TOTAL EARNINGS SUBJECT TO PERSONAL INCOME TAX WITHHOLDING

Tax Return(s) (Form 540 or 540NR) for the year(s) listed in

Item (3).

YEAR

_________________________________________

Your Name

Reported on W2

______________ – ________ – ________________

SSN

_____________________________________

Spouse’s Name

Additional Earnings

1st Qtr.

______________ – ________ – ________________

SSN

2nd Qtr.

Current address if different from Item (2) above.

3rd Qtr.

____________________________________________________

4th Qtr.

____________________________________________________

Total Additional Earnings

(6) I reported the following earnings from this entity on my

California Income Tax Return(s): (NOTE: If your total income

Total Earnings

received for any of the indicated years was insufficient to require

a California Income Tax Return, write NR in the box for that year).

(4) COMPUTATION OF TAX DUE (See Instructions)

YEAR

YEAR

Earnings

1st qtr

If you paid taxes prior to your April 15th deadline, please complete

2nd qtr

the following section.

3rd qtr

I paid the following estimate(s) (Form 540ES):

4th qtr

YEAR

TOTALS

04/15

06/15

(8) BUSINESS/PRINCIPAL CERTIFICATION

09/15

01/15

I certify that to the best of my knowledge and belief the signature in

Item (7) is valid and legal.

I paid the following amount(s) with my 540 or 540NR:

The tax in Item (4) was based upon a valid Employee’s Withholding

YEAR

Allowance Certificate (copy attached) that was in my possession at the

time of the payment of the earnings shown in Item (3).

Amount

A completed worksheet is attached.

Date Paid

The tax in Item (4) was calculated based upon the worker being single

(7) Under penalty of perjury, I certify that the information shown in

with no deductions. A completed worksheet is attached.

Items (5) & (6) above is true and correct.

Signature of Worker

Date

Signature of Business/Principal Representative

Date

RETURN TO:

DATE STAMP

DE 938P Rev. 11 (11-01) (INTERNET)

CU

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1