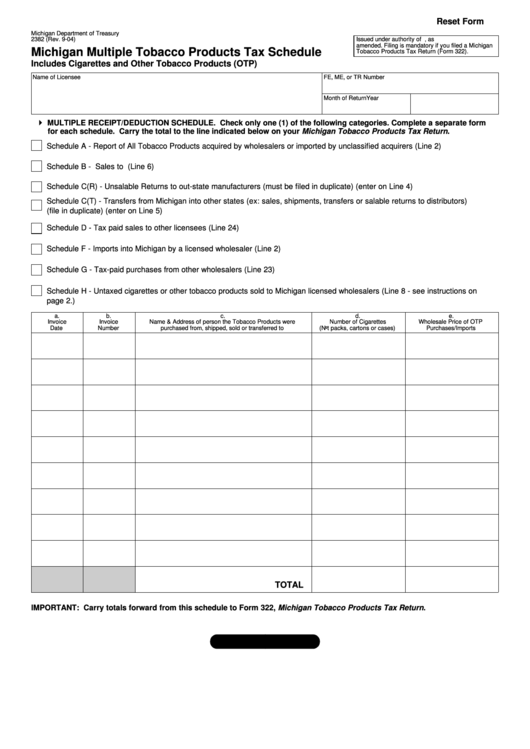

Reset Form

Michigan Department of Treasury

2382 (Rev. 9-04)

Issued under authority of P.A. 327 of 1993, as

amended. Filing is mandatory if you filed a Michigan

Michigan Multiple Tobacco Products Tax Schedule

Tobacco Products Tax Return (Form 322).

Includes Cigarettes and Other Tobacco Products (OTP)

Name of Licensee

FE, ME, or TR Number

Month of Return

Year

4

MULTIPLE RECEIPT/DEDUCTION SCHEDULE. Check only one (1) of the following categories. Complete a separate form

for each schedule. Carry the total to the line indicated below on your Michigan Tobacco Products Tax Return.

Schedule A - Report of All Tobacco Products acquired by wholesalers or imported by unclassified acquirers (Line 2)

Schedule B - Sales to U.S. Agencies (Line 6)

Schedule C(R) - Unsalable Returns to out-state manufacturers (must be filed in duplicate) (enter on Line 4)

Schedule C(T) - Transfers from Michigan into other states (ex: sales, shipments, transfers or salable returns to distributors)

(file in duplicate) (enter on Line 5)

Schedule D - Tax paid sales to other licensees (Line 24)

Schedule F - Imports into Michigan by a licensed wholesaler (Line 2)

Schedule G - Tax-paid purchases from other wholesalers (Line 23)

Schedule H - Untaxed cigarettes or other tobacco products sold to Michigan licensed wholesalers (Line 8 - see instructions on

page 2.)

a.

b.

c.

d.

e.

Invoice

Invoice

Name & Address of person the Tobacco Products were

Number of Cigarettes

Wholesale Price of OTP

Date

Number

purchased from, shipped, sold or transferred to

(Not packs, cartons or cases)

Purchases/Imports

TOTAL

IMPORTANT: Carry totals forward from this schedule to Form 322, Michigan Tobacco Products Tax Return.

1

1 2

2