Form Ct-198.1 - Franchise Tax Return Information - New York State Department Of Taxation And Finance

ADVERTISEMENT

CT-198.1

New York State Department of Taxation and Finance

(1/05)

Franchise Tax Return Information

General information

New York State business corporations (Article 9-A)

The dissolution by proclamation procedure is not a substitute for voluntary

dissolution and will result in substantial penalties against the corporation.

All general business corporations organized under the laws of New York

Any franchise tax delinquency becomes an automatic lien against any

State are taxable under Article 9-A of the Tax Law.

assets of the corporation, even if it was dissolved by proclamation.

A general business corporation includes all corporations except the

following:

Forms

Taxable under

Annual franchise tax return forms for general business corporations can be

1. Banking corporations ................................................ Article 32

obtained by accessing our Web site: or by calling

2. Insurance corporations .............................................. Article 33

1 800 462-8100. Failure to receive forms does not relieve the corporation of

3. Certain transportation and transmission corporations Art. 9, § 183 & 184

the filing requirements.

4. Certain utilities ........................................................... Art. 9, § 186 & 186-A

5. Farmers and agriculture co-ops ................................ Art. 9, § 185

To determine the forms you are eligible to use, consult the instructions in

Form CT-3/4-P, General Business Corporation Franchise Tax Returns and

6. Not-for-profit corporations subject to

unrelated business tax ........................................... Article 13

Instructions, for Article 9-A taxpayers.

A New York State business corporation is required to file an annual

If you are not a general business corporation, contact the Business Tax

franchise tax return and pay a tax for the privilege of exercising its

Information Center at 1 800 972-1233 for help in determining which forms

corporate franchise. Accordingly, a New York State corporation is subject to

to use.

tax for each fiscal or calendar year, or part thereof, during which it is in

From areas outside the U.S. and outside Canada, call (518) 485-6800.

existence, regardless of whether it does any business, employs any capital,

owns or leases any property, maintains any office or engages in any

Foreign business corporations (Article 9-A)

activity, within or outside New York State. A New York State corporation is

All general business corporations organized under the laws of any other

subject to tax even if it conducts its business entirely outside New York

state or country, doing business, employing capital, owning or leasing

State.

property in a corporate or organized capacity or maintaining an office in

Reporting periods

New York State are taxable under Article 9-A of the Tax Law. Refer to

paragraph 1 for a list of corporations that are not considered general

Generally, the tax year for which the franchise tax imposed by Article 9-A is

business corporations.

to be computed, and for which a franchise tax return is to be filed, must be

the same as the taxpayer’s tax year for federal income tax purposes.

Foreign corporations are required to file a franchise tax return and pay a tax

from the date the corporation begins to do business or engages in taxable

The first franchise tax return is due from the date of incorporation, as

activities in New York State.

recorded by the Secretary of State. Reporting periods may not exceed a

twelve-month period. The return must be filed within 2½ months after the

In addition to the franchise taxes, a foreign corporation doing business in

close of the corporation’s tax period.

New York State must pay a license fee based on capital stock employed

within New York State (Article 9, section 181). See Form CT-240, Foreign

Example:

Corporation License Fee Return, for more information.

XYZ, Inc. was incorporated by the Secretary of State on December 29, 2003,

and has decided to use a calendar-year reporting period.

All foreign corporations authorized by the Secretary of State to do business

in New York State must pay a maintenance fee of $300 (Article 9,

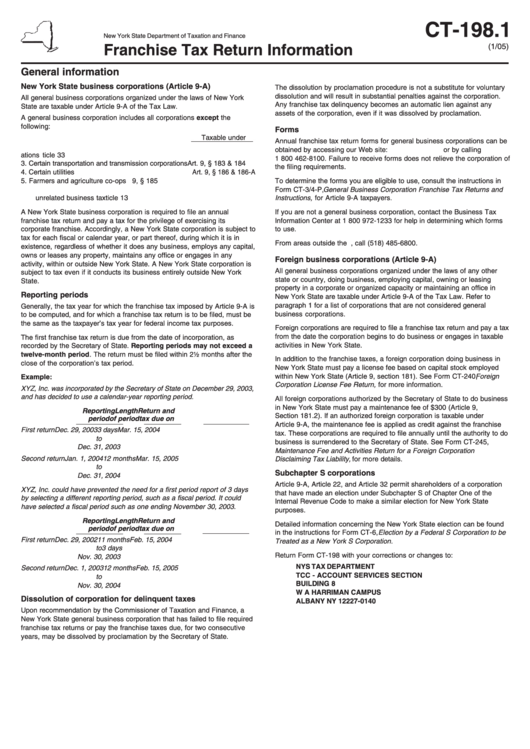

Reporting

Length

Return and

Section 181.2). If an authorized foreign corporation is taxable under

period

of period

tax due on

Article 9-A, the maintenance fee is applied as credit against the franchise

First return

Dec. 29, 2003

3 days

Mar. 15, 2004

tax. These corporations are required to file annually until the authority to do

to

business is surrendered to the Secretary of State. See Form CT-245,

Dec. 31, 2003

Maintenance Fee and Activities Return for a Foreign Corporation

Second return

Jan. 1, 2004

12 months

Mar. 15, 2005

Disclaiming Tax Liability, for more details.

to

Subchapter S corporations

Dec. 31, 2004

Article 9-A, Article 22, and Article 32 permit shareholders of a corporation

XYZ, Inc. could have prevented the need for a first period report of 3 days

that have made an election under Subchapter S of Chapter One of the

by selecting a different reporting period, such as a fiscal period. It could

Internal Revenue Code to make a similar election for New York State

have selected a fiscal period such as one ending November 30, 2003.

purposes.

Reporting

Length

Return and

Detailed information concerning the New York State election can be found

period

of period

tax due on

in the instructions for Form CT-6, Election by a Federal S Corporation to be

First return

Dec. 29, 2002

11 months

Feb. 15, 2004

Treated as a New York S Corporation.

to

3 days

Return Form CT-198 with your corrections or changes to:

Nov. 30, 2003

NYS TAX DEPARTMENT

Second return

Dec. 1, 2003

12 months

Feb. 15, 2005

TCC - ACCOUNT SERVICES SECTION

to

BUILDING 8

Nov. 30, 2004

W A HARRIMAN CAMPUS

Dissolution of corporation for delinquent taxes

ALBANY NY 12227-0140

Upon recommendation by the Commissioner of Taxation and Finance, a

New York State general business corporation that has failed to file required

franchise tax returns or pay the franchise taxes due, for two consecutive

years, may be dissolved by proclamation by the Secretary of State.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1