Form Tsb-M-04(3)i, Tsb-M-04(1)s, Tsb-M-04(2)c - Office Of Tax Policy Analysis Technical Services Division 2004 - New York State Department Of Taxation And Finance

ADVERTISEMENT

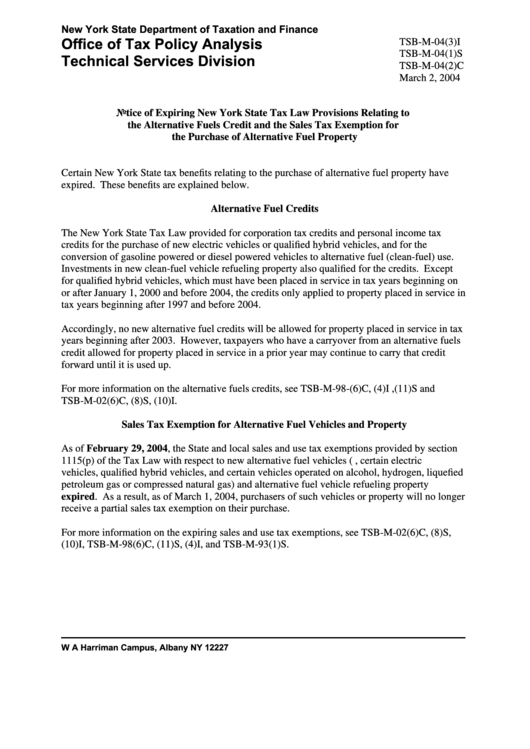

New York State Department of Taxation and Finance

TSB-M-04(3)I

Office of Tax Policy Analysis

TSB-M-04(1)S

Technical Services Division

TSB-M-04(2)C

March 2, 2004

Notice of Expiring New York State Tax Law Provisions Relating to

the Alternative Fuels Credit and the Sales Tax Exemption for

the Purchase of Alternative Fuel Property

Certain New York State tax benefits relating to the purchase of alternative fuel property have

expired. These benefits are explained below.

Alternative Fuel Credits

The New York State Tax Law provided for corporation tax credits and personal income tax

credits for the purchase of new electric vehicles or qualified hybrid vehicles, and for the

conversion of gasoline powered or diesel powered vehicles to alternative fuel (clean-fuel) use.

Investments in new clean-fuel vehicle refueling property also qualified for the credits. Except

for qualified hybrid vehicles, which must have been placed in service in tax years beginning on

or after January 1, 2000 and before 2004, the credits only applied to property placed in service in

tax years beginning after 1997 and before 2004.

Accordingly, no new alternative fuel credits will be allowed for property placed in service in tax

years beginning after 2003. However, taxpayers who have a carryover from an alternative fuels

credit allowed for property placed in service in a prior year may continue to carry that credit

forward until it is used up.

For more information on the alternative fuels credits, see TSB-M-98-(6)C, (4)I ,(11)S and

TSB-M-02(6)C, (8)S, (10)I.

Sales Tax Exemption for Alternative Fuel Vehicles and Property

As of February 29, 2004, the State and local sales and use tax exemptions provided by section

1115(p) of the Tax Law with respect to new alternative fuel vehicles (e.g., certain electric

vehicles, qualified hybrid vehicles, and certain vehicles operated on alcohol, hydrogen, liquefied

petroleum gas or compressed natural gas) and alternative fuel vehicle refueling property

expired. As a result, as of March 1, 2004, purchasers of such vehicles or property will no longer

receive a partial sales tax exemption on their purchase.

For more information on the expiring sales and use tax exemptions, see TSB-M-02(6)C, (8)S,

(10)I, TSB-M-98(6)C, (11)S, (4)I, and TSB-M-93(1)S.

W A Harriman Campus, Albany NY 12227

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2