Reset Form

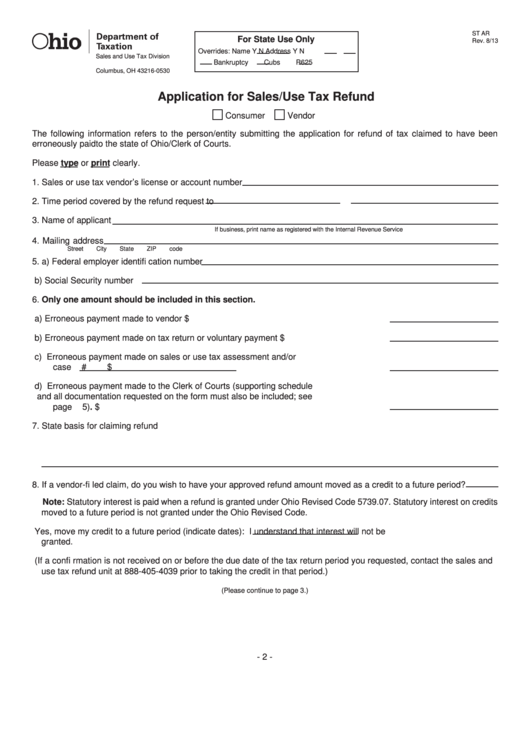

ST AR

For State Use Only

Rev. 8/13

Overrides: Name Y

N

Address Y

N

Sales and Use Tax Division

Bankruptcy

Cubs

R625

P.O. Box 530

Columbus, OH 43216-0530

Click here

tax.ohio.gov

to print a

Application for Sales/Use Tax Refund

blank form

Consumer

Vendor

The following information refers to the person/entity submitting the application for refund of tax claimed to have been

erroneously paid to the state of Ohio/Clerk of Courts.

Please type or print clearly.

1. Sales or use tax vendor’s license or account number

2. Time period covered by the refund request

to

3. Name of applicant

If business, print name as registered with the Internal Revenue Service

4. Mailing address

Street

City

State

ZIP code

5. a) Federal employer identifi cation number

b) Social Security number

6. Only one amount should be included in this section.

a) Erroneous payment made to vendor

$

b) Erroneous payment made on tax return or voluntary payment

$

c) Erroneous payment made on sales or use tax assessment and/or

case #

$

d) Erroneous payment made to the Clerk of Courts (supporting schedule

and all documentation requested on the form must also be included; see

page 5).

$

7. State basis for claiming refund

8. If a vendor-fi led claim, do you wish to have your approved refund amount moved as a credit to a future period?

Note: Statutory interest is paid when a refund is granted under Ohio Revised Code 5739.07. Statutory interest on credits

moved to a future period is not granted under the Ohio Revised Code.

Yes, move my credit to a future period (indicate dates):

I understand that interest will not be

granted.

(If a confi rmation is not received on or before the due date of the tax return period you requested, contact the sales and

use tax refund unit at 888-405-4039 prior to taking the credit in that period.)

(Please continue to page 3.)

- 2 -

1

1 2

2 3

3