Instructions For Schedule O (Form 1120) - 2008

ADVERTISEMENT

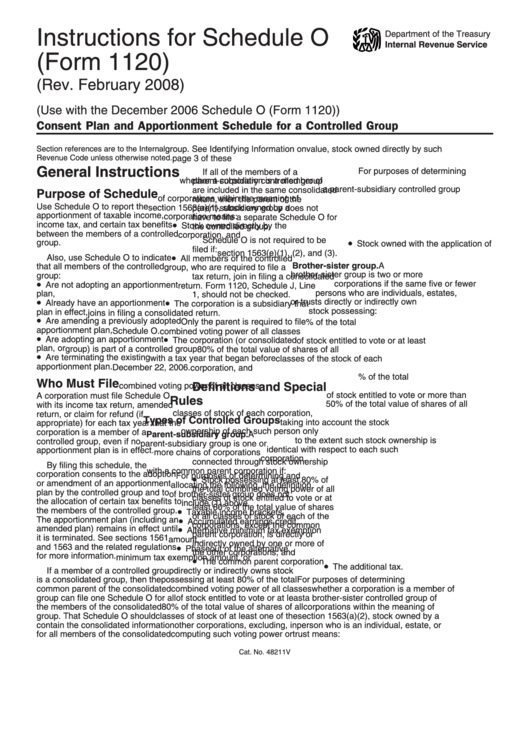

Instructions for Schedule O

Department of the Treasury

Internal Revenue Service

(Form 1120)

(Rev. February 2008)

(Use with the December 2006 Schedule O (Form 1120))

Consent Plan and Apportionment Schedule for a Controlled Group

Section references are to the Internal

group. See Identifying Information on

value, stock owned directly by such

Revenue Code unless otherwise noted.

page 3 of these instructions.

other corporations.

General Instructions

For purposes of determining

If all of the members of a

whether a corporation is a member of

parent-subsidiary controlled group

a parent-subsidiary controlled group

are included in the same consolidated

Purpose of Schedule

of corporations within the meaning of

return, then the parent of the

Use Schedule O to report the

section 1563(a)(1), stock owned by a

parent-subsidiary group does not

apportionment of taxable income,

corporation means:

have to file a separate Schedule O for

•

income tax, and certain tax benefits

Stock owned directly by the

the controlled group.

between the members of a controlled

corporation, and

Schedule O is not required to be

•

group.

Stock owned with the application of

filed if:

section 1563(e)(1), (2), and (3).

•

Also, use Schedule O to indicate

All members of the controlled

Brother-sister group. A

that all members of the controlled

group, who are required to file a U.S.

brother-sister group is two or more

group:

tax return, join in filing a consolidated

•

corporations if the same five or fewer

Are not adopting an apportionment

return. Form 1120, Schedule J, Line

persons who are individuals, estates,

plan,

1, should not be checked.

•

•

or trusts directly or indirectly own

Already have an apportionment

The corporation is a subsidiary that

stock possessing:

plan in effect,

joins in filing a consolidated return.

•

Are amending a previously adopted

Only the parent is required to file

1. At least 80% of the total

apportionment plan,

Schedule O.

combined voting power of all classes

•

•

Are adopting an apportionment

The corporation (or consolidated

of stock entitled to vote or at least

plan, or

group) is part of a controlled group

80% of the total value of shares of all

•

Are terminating the existing

with a tax year that began before

classes of the stock of each

apportionment plan.

December 22, 2006.

corporation, and

2. More than 50% of the total

Who Must File

Definitions and Special

combined voting power of all classes

of stock entitled to vote or more than

A corporation must file Schedule O

Rules

50% of the total value of shares of all

with its income tax return, amended

classes of stock of each corporation,

return, or claim for refund (if

Types of Controlled Groups

taking into account the stock

appropriate) for each tax year that the

ownership of each such person only

corporation is a member of a

Parent-subsidiary group. A

to the extent such stock ownership is

controlled group, even if no

parent-subsidiary group is one or

identical with respect to each such

apportionment plan is in effect.

more chains of corporations

corporation.

connected through stock ownership

By filing this schedule, the

with a common parent corporation if:

corporation consents to the adoption

•

For purposes of determining and

Stock possessing at least 80% of

or amendment of an apportionment

allocating the following, the definition

the total combined voting power of all

plan by the controlled group and to

of brother-sister group does not

classes of stock entitled to vote or at

the allocation of certain tax benefits to

include (1) above.

least 80% of the total value of shares

•

the members of the controlled group.

Taxable income brackets,

of all classes of stock of each of the

•

The apportionment plan (including an

Accumulated earnings credit,

corporations, except the common

•

amended plan) remains in effect until

Alternative minimum tax exemption

parent corporation, is directly or

it is terminated. See sections 1561

amount,

indirectly owned by one or more of

•

and 1563 and the related regulations

Phaseout of the alternative

the other corporations; and

for more information.

•

minimum tax exemption amount, or

The common parent corporation

•

The additional tax.

If a member of a controlled group

directly or indirectly owns stock

is a consolidated group, then the

possessing at least 80% of the total

For purposes of determining

common parent of the consolidated

combined voting power of all classes

whether a corporation is a member of

group can file one Schedule O for all

of stock entitled to vote or at least

a brother-sister controlled group of

the members of the consolidated

80% of the total value of shares of all

corporations within the meaning of

group. That Schedule O should

classes of stock of at least one of the

section 1563(a)(2), stock owned by a

contain the consolidated information

other corporations, excluding, in

person who is an individual, estate, or

for all members of the consolidated

computing such voting power or

trust means:

Cat. No. 48211V

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4