Form Sc3911 - Refund Tracer - South Carolina Department Of Revenue

ADVERTISEMENT

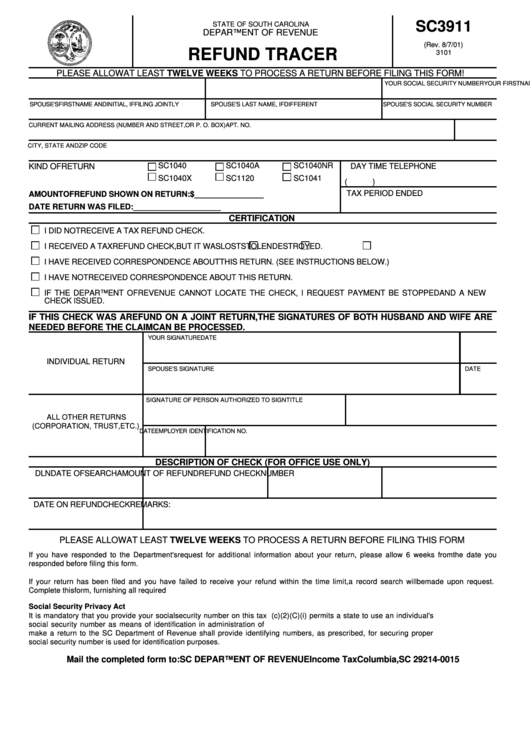

SC3911

STATE OF SOUTH CAROLINA

DEPARTMENT OF REVENUE

(Rev. 8/7/01)

REFUND TRACER

3101

PLEASE ALLOW AT LEAST TWELVE WEEKS TO PROCESS A RETURN BEFORE FILING THIS FORM!

YOUR FIRST NAME AND INITIAL

LAST NAME

YOUR SOCIAL SECURITY NUMBER

SPOUSE'S FIRST NAME AND INITIAL, IF FILING JOINTLY

SPOUSE'S LAST NAME, IF DIFFERENT

SPOUSE'S SOCIAL SECURITY NUMBER

CURRENT MAILING ADDRESS (NUMBER AND STREET, OR P. O. BOX)

APT. NO.

CITY, STATE AND ZIP CODE

SC1040

SC1040A

SC1040NR

KIND OF RETURN

DAY TIME TELEPHONE

SC1040X

SC1120

SC1041

(

)

TAX PERIOD ENDED

AMOUNT OF REFUND SHOWN ON RETURN: $________________

DATE RETURN WAS FILED: ____________________

CERTIFICATION

I DID NOT RECEIVE A TAX REFUND CHECK.

I RECEIVED A TAX REFUND CHECK, BUT IT WAS

LOST

STOLEN

DESTROYED.

I HAVE RECEIVED CORRESPONDENCE ABOUT THIS RETURN. (SEE INSTRUCTIONS BELOW.)

I HAVE NOT RECEIVED CORRESPONDENCE ABOUT THIS RETURN.

IF THE DEPARTMENT OF REVENUE CANNOT LOCATE THE CHECK, I REQUEST PAYMENT BE STOPPED AND A NEW

CHECK ISSUED.

IF THIS CHECK WAS A REFUND ON A JOINT RETURN, THE SIGNATURES OF BOTH HUSBAND AND WIFE ARE

NEEDED BEFORE THE CLAIM CAN BE PROCESSED.

YOUR SIGNATURE

DATE

INDIVIDUAL RETURN

SPOUSE'S SIGNATURE

DATE

SIGNATURE OF PERSON AUTHORIZED TO SIGN

TITLE

ALL OTHER RETURNS

(CORPORATION, TRUST,ETC.)

DATE

EMPLOYER IDENTIFICATION NO.

DESCRIPTION OF CHECK (FOR OFFICE USE ONLY)

DLN

DATE OF SEARCH

AMOUNT OF REFUND

REFUND CHECK NUMBER

DATE ON REFUND CHECK

REMARKS:

PLEASE ALLOW AT LEAST TWELVE WEEKS TO PROCESS A RETURN BEFORE FILING THIS FORM

If you have responded to the Department's request for additional information about your return, please allow 6 weeks from the date you

responded before filing this form.

If your return has been filed and you have failed to receive your refund within the time limit, a record search will be made upon request.

Complete this form, furnishing all required information. A reply will be made advising you of the results of the record search.

Social Security Privacy Act

It is mandatory that you provide your social security number on this tax form. 42 U.S.C 405(c)(2)(C)(i) permits a state to use an individual's

social security number as means of identification in administration of any tax. SC Regulation 117-1 mandates that any person required to

make a return to the SC Department of Revenue shall provide identifying numbers, as prescribed, for securing proper identification. Your

social security number is used for identification purposes.

Mail the completed form to:

SC DEPARTMENT OF REVENUE Income Tax Columbia, SC 29214-0015

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1