Form 103 - Denver Consumer'S Use Tax Return - Department Of Revenue, Treasury Division Of City And County Of Denver

ADVERTISEMENT

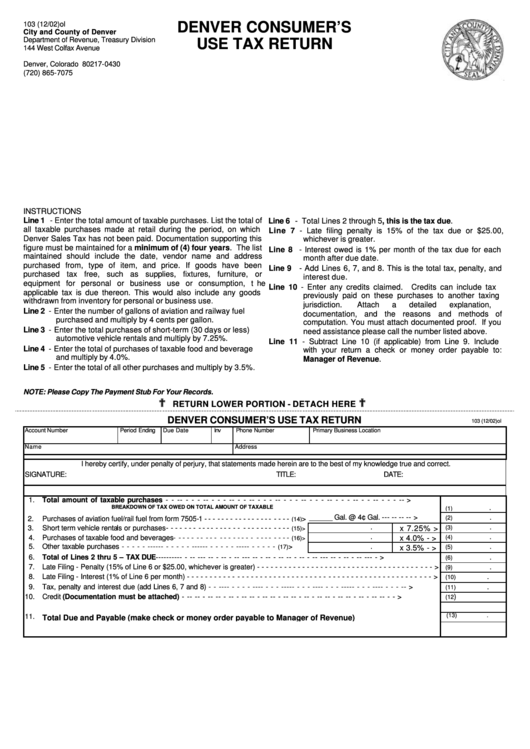

DENVER CONSUMER’S

103 (12/02)ol

City and County of Denver

Department of Revenue, Treasury Division

USE TAX RETURN

144 West Colfax Avenue

P.O. Box 17430

Denver, Colorado 80217-0430

(720) 865-7075

INSTRUCTIONS

Line 1 - Enter the total amount of taxable purchases. List the total of

Line 6 - Total Lines 2 through 5, this is the tax due.

all taxable purchases made at retail during the period, on which

Line 7 - Late filing penalty is 15% of the tax due or $25.00,

Denver Sales Tax has not been paid. Documentation supporting this

whichever is greater.

figure must be maintained for a minimum of (4) four years. The list

Line 8 - Interest owed is 1% per month of the tax due for each

maintained should include the date, vendor name and address

month after due date.

purchased from, type of item, and price. If goods have been

Line 9 - Add Lines 6, 7, and 8. This is the total tax, penalty, and

purchased tax free, such as supplies, fixtures, furniture, or

interest due.

equipment for personal or business use or consumption, the

Line 10 - Enter any credits claimed.

Credits can include tax

applicable tax is due thereon. This would also include any goods

previously paid on these purchases to another taxing

withdrawn from inventory for personal or business use.

jurisdiction.

Attach

a

detailed

explanation,

Line 2 - Enter the number of gallons of aviation and railway fuel

documentation, and the reasons and methods of

purchased and multiply by 4 cents per gallon.

computation. You must attach documented proof. If you

Line 3 - Enter the total purchases of short-term (30 days or less)

need assistance please call the number listed above.

automotive vehicle rentals and multiply by 7.25%.

Line 11 - Subtract Line 10 (if applicable) from Line 9. Include

Line 4 - Enter the total of purchases of taxable food and beverage

with your return a check or money order payable to:

and multiply by 4.0%.

Manager of Revenue.

Line 5 - Enter the total of all other purchases and multiply by 3.5%.

NOTE: Please Copy The Payment Stub For Your Records.

?

?

RETURN LOWER PORTION - DETACH HERE

DENVER CONSUMER’S USE TAX RETURN

103 (12/02)ol

Account Number

Period Ending

Due Date

Inv

Phone Number

Primary Business Location

Name

Address

I hereby certify, under penalty of perjury, that statements made herein are to the best of my knowledge true and correct.

SIGNATURE:

TITLE:

DATE:

1.

Total amount of taxable purchases - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - >

.

BREAKDOWN OF TAX OWED ON TOTAL AMOUNT OF TAXABLE

(1)

PURCHASES

> ______ Gal. @ 4¢ Gal. - - - - - - - - - >

.

(2)

2.

Purchases of aviation fuel/rail fuel from form 7505-1 - - - - - - - - - - - - - - - - - - - -

(14)

.

.

3.

Short term vehicle rentals or purchases - - - - - - - - - - - - - - - - - - - - - - - - - - - -

x 7.25% >

(3)

(15)>

.

.

4.

Purchases of taxable food and beverages - - - - - - - - - - - - - - - - - - - - - - - - - -

x 4.0% - >

(4)

(16)>

5.

Other taxable purchases - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

>

.

.

(17)

x 3.5% - >

(5)

6.

Total of Lines 2 thru 5 – TAX DUE- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - >

.

(6)

7.

Late Filing - Penalty (15% of Line 6 or $25.00, whichever is greater) - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - >

.

(9)

8.

Late Filing - Interest (1% of Line 6 per month) - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - >

.

(10)

9.

Tax, penalty and interest due (add Lines 6, 7 and 8) - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - >

.

(11)

10.

Credit (Documentation must be attached) - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - >

)

(12

11.

(13)

.

Total Due and Payable (make check or money order payable to Manager of Revenue)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1