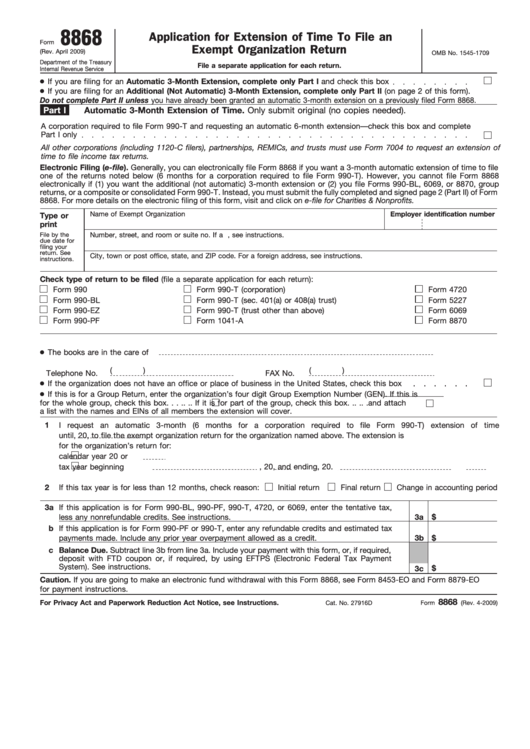

8868

Application for Extension of Time To File an

Form

Exempt Organization Return

(Rev. April 2009)

OMB No. 1545-1709

Department of the Treasury

File a separate application for each return.

Internal Revenue Service

If you are filing for an Automatic 3-Month Extension, complete only Part I and check this box

If you are filing for an Additional (Not Automatic) 3-Month Extension, complete only Part II (on page 2 of this form).

Do not complete Part II unless you have already been granted an automatic 3-month extension on a previously filed Form 8868.

Part I

Automatic 3-Month Extension of Time. Only submit original (no copies needed).

A corporation required to file Form 990-T and requesting an automatic 6-month extension—check this box and complete

Part I only

All other corporations (including 1120-C filers), partnerships, REMICs, and trusts must use Form 7004 to request an extension of

time to file income tax returns.

Electronic Filing (e-file). Generally, you can electronically file Form 8868 if you want a 3-month automatic extension of time to file

one of the returns noted below (6 months for a corporation required to file Form 990-T). However, you cannot file Form 8868

electronically if (1) you want the additional (not automatic) 3-month extension or (2) you file Forms 990-BL, 6069, or 8870, group

returns, or a composite or consolidated Form 990-T. Instead, you must submit the fully completed and signed page 2 (Part II) of Form

8868. For more details on the electronic filing of this form, visit and click on e-file for Charities & Nonprofits.

Name of Exempt Organization

Employer identification number

Type or

print

File by the

Number, street, and room or suite no. If a P.O. box, see instructions.

due date for

filing your

return. See

City, town or post office, state, and ZIP code. For a foreign address, see instructions.

instructions.

Check type of return to be filed (file a separate application for each return):

Form 990

Form 990-T (corporation)

Form 4720

Form 990-BL

Form 5227

Form 990-T (sec. 401(a) or 408(a) trust)

Form 990-EZ

Form 990-T (trust other than above)

Form 6069

Form 990-PF

Form 1041-A

Form 8870

The books are in the care of

(

)

(

)

Telephone No.

FAX No.

If the organization does not have an office or place of business in the United States, check this box

If this is for a Group Return, enter the organization’s four digit Group Exemption Number (GEN)

. If this is

for the whole group, check this box . . . . . .

. If it is for part of the group, check this box . . . . . .

and attach

a list with the names and EINs of all members the extension will cover.

1

I request an automatic 3-month (6 months for a corporation required to file Form 990-T) extension of time

until

, 20

, to file the exempt organization return for the organization named above. The extension is

for the organization’s return for:

calendar year 20

or

tax year beginning

, 20

, and ending

, 20

.

2

If this tax year is for less than 12 months, check reason:

Initial return

Final return

Change in accounting period

3a If this application is for Form 990-BL, 990-PF, 990-T, 4720, or 6069, enter the tentative tax,

less any nonrefundable credits. See instructions.

$

3a

b If this application is for Form 990-PF or 990-T, enter any refundable credits and estimated tax

payments made. Include any prior year overpayment allowed as a credit.

3b

$

c Balance Due. Subtract line 3b from line 3a. Include your payment with this form, or, if required,

deposit with FTD coupon or, if required, by using EFTPS (Electronic Federal Tax Payment

System). See instructions.

$

3c

Caution. If you are going to make an electronic fund withdrawal with this Form 8868, see Form 8453-EO and Form 8879-EO

for payment instructions.

8868

For Privacy Act and Paperwork Reduction Act Notice, see Instructions.

Cat. No. 27916D

Form

(Rev. 4-2009)

1

1 2

2