Form St-930 - Instructions

ADVERTISEMENT

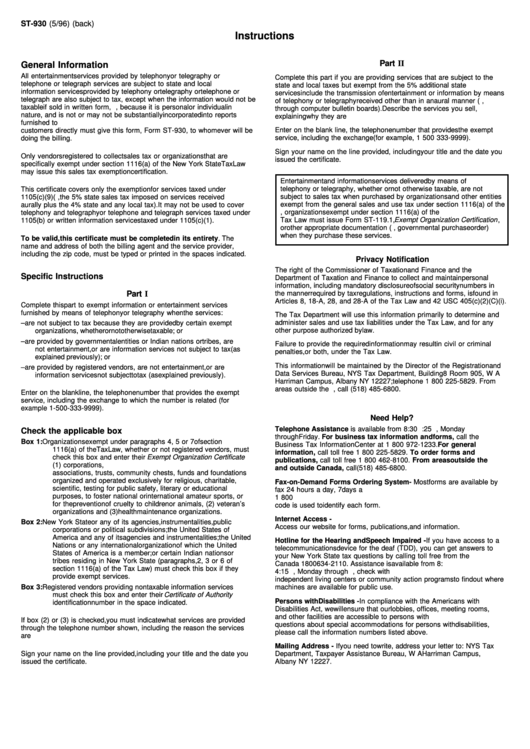

ST-930 (5/96) (back)

Instructions

Part II

General Information

All entertainment services provided by telephony or telegraphy or

Complete this part if you are providing services that are subject to the

telephone or telegraph services are subject to state and local sales tax. All

state and local taxes but exempt from the 5% additional state tax. These

information services provided by telephony or telegraphy or telephone or

services include the transmission of entertainment or information by means

telegraph are also subject to tax, except when the information would not be

of telephony or telegraphy received other than in an aural manner ( e.g.,

taxable if sold in written form, e.g., because it is personal or individual in

through computer bulletin boards). Describe the services you sell,

nature, and is not or may not be substantially incorporated into reports

explaining why they are exempt. Please be brief but specific.

furnished to others. Providers of nontaxable services who do not bill their

customers directly must give this form, Form ST-930, to whomever will be

Enter on the blank line, the telephone number that provides the exempt

doing the billing.

service, including the exchange (for example, 1 500 333-9999).

Sign your name on the line provided, including your title and the date you

Only vendors registered to collect sales tax or organizations that are

issued the certificate.

specifically exempt under section 1116(a) of the New York State Tax Law

may issue this sales tax exemption certification.

Entertainment and information services delivered by means of

telephony or telegraphy, whether or not otherwise taxable, are not

This certificate covers only the exemption for services taxed under

subject to sales tax when purchased by organizations and other entities

1105(c)(9)(i.e., the 5% state sales tax imposed on services received

exempt from the general sales and use tax under section 1116(a) of the

aurally plus the 4% state and any local tax). It may not be used to cover

Tax Law. However, organizations exempt under section 1116(a) of the

telephony and telegraphy or telephone and telegraph services taxed under

Tax Law must issue Form ST-119.1, Exempt Organization Certification ,

1105(b) or written information services taxed under 1105(c)(1).

or other appropriate documentation (e.g., governmental purchase order)

when they purchase these services.

To be valid, this certificate must be completed in its entirety. The

name and address of both the billing agent and the service provider,

including the zip code, must be typed or printed in the spaces indicated.

Privacy Notification

The right of the Commissioner of Taxation and Finance and the

Specific Instructions

Department of Taxation and Finance to collect and maintain personal

information, including mandatory disclosure of social security numbers in

Part I

the manner required by tax regulations, instructions and forms, is found in

Articles 8, 18-A, 28, and 28-A of the Tax Law and 42 USC 405(c)(2)(C)(i).

Complete this part to exempt information or entertainment services

furnished by means of telephony or telegraphy when the services:

The Tax Department will use this information primarily to determine and

administer sales and use tax liabilities under the Tax Law, and for any

–

are not subject to tax because they are provided by certain exempt

other purpose authorized by law.

organizations, whether or not otherwise taxable; or

–

are provided by governmental entities or Indian nations or tribes, are

Failure to provide the required information may result in civil or criminal

not entertainment, or are information services not subject to tax (as

penalties, or both, under the Tax Law.

explained previously); or

This information will be maintained by the Director of the Registration and

–

are provided by registered vendors, are not entertainment, or are

Data Services Bureau, NYS Tax Department, Building 8 Room 905, W A

information services not subject to tax (as explained previously).

Harriman Campus, Albany NY 12227; telephone 1 800 225-5829. From

areas outside the U.S. and Canada, call (518) 485-6800.

Enter on the blank line, the telephone number that provides the exempt

service, including the exchange to which the number is related (for

example 1-500-333-9999).

Need Help?

Telephone Assistance is available from 8:30 a.m. to 4:25 p.m., Monday

Check the applicable box

through Friday. For business tax information and forms, call the

Box 1:

Organizations exempt under paragraphs 4, 5 or 7 of section

Business Tax Information Center at 1 800 972-1233. For general

1116(a) of the Tax Law, whether or not registered vendors, must

information, call toll free 1 800 225-5829. To order forms and

check this box and enter their Exempt Organization Certificate

publications, call toll free 1 800 462-8100. From areas outside the U.S.

number. These organizations include (1) corporations,

and outside Canada, call (518) 485-6800.

associations, trusts, community chests, funds and foundations

organized and operated exclusively for religious, charitable,

Fax-on-Demand Forms Ordering System - Most forms are available by

scientific, testing for public safety, literary or educational

fax 24 hours a day, 7 days a week. Call toll free from the U.S. and Canada

purposes, to foster national or international amateur sports, or

1 800 748-3676. You must use a Touch Tone phone to order by fax. A fax

for the prevention of cruelty to children or animals, (2) veteran’s

code is used to identify each form.

organizations and (3) health maintenance organizations.

Internet Access -

Box 2:

New York State or any of its agencies, instrumentalities, public

Access our website for forms, publications, and information.

corporations or political subdivisions; the United States of

America and any of its agencies and instrumentalities; the United

Hotline for the Hearing and Speech Impaired - If you have access to a

Nations or any international organization of which the United

telecommunications device for the deaf (TDD), you can get answers to

States of America is a member; or certain Indian nations or

your New York State tax questions by calling toll free from the U.S. and

tribes residing in New York State (paragraphs, 2, 3 or 6 of

Canada 1 800 634-2110. Assistance is available from 8:30 a.m. to

section 1116(a) of the Tax Law) must check this box if they

4:15 p.m., Monday through Friday. If you do not own a TDD, check with

provide exempt services.

independent living centers or community action programs to find out where

Box 3:

Registered vendors providing nontaxable information services

machines are available for public use.

must check this box and enter their Certificate of Authority

Persons with Disabilities - In compliance with the Americans with

identification number in the space indicated.

Disabilities Act, we will ensure that our lobbies, offices, meeting rooms,

and other facilities are accessible to persons with disabilities. If you have

If box (2) or (3) is checked, you must indicate what services are provided

questions about special accommodations for persons with disabilities,

through the telephone number shown, including the reason the services

please call the information numbers listed above.

are exempt. Please be brief but specific.

Mailing Address - If you need to write, address your letter to: NYS Tax

Sign your name on the line provided, including your title and the date you

Department, Taxpayer Assistance Bureau, W A Harriman Campus,

issued the certificate.

Albany NY 12227.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1