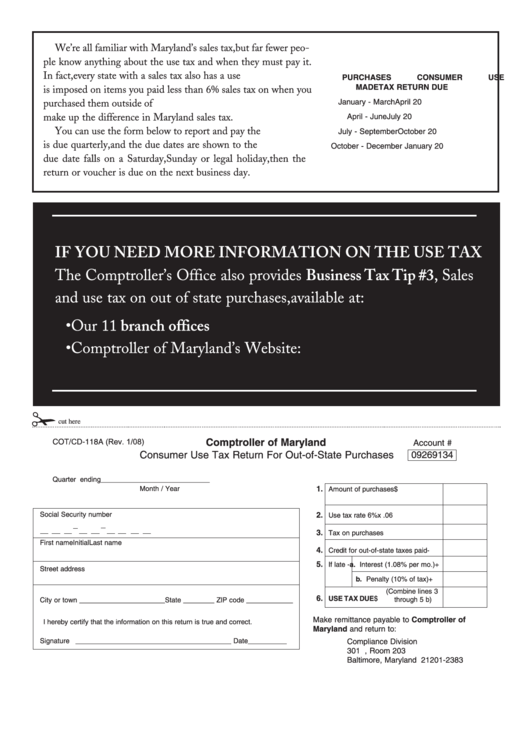

We’re all familiar with Maryland’s sales tax, but far fewer peo-

ple know anything about the use tax and when they must pay it.

In fact, every state with a sales tax also has a use tax. The use tax

PURCHASES

CONSUMER USE

is imposed on items you paid less than 6% sales tax on when you

MADE

TAX RETURN DUE

purchased them outside of Maryland. The use tax requires you to

January - March

April 20

make up the difference in Maryland sales tax.

April - June

July 20

You can use the form below to report and pay the tax. The tax

July - September

October 20

is due quarterly, and the due dates are shown to the right. If the

October - December

January 20

due date falls on a Saturday, Sunday or legal holiday, then the

return or voucher is due on the next business day.

IF YOU NEED MORE INFORMATION ON THE USE TAX

The Comptroller’s Office also provides Business Tax Tip #3, Sales

and use tax on out of state purchases, available at:

• Our 11 branch offices

• Comptroller of Maryland’s Web site:

✁

cut here

COT/CD-118A (Rev. 1/08)

Comptroller of Maryland

Account #

Consumer Use Tax Return For Out-of-State Purchases

09269134

Quarter ending ____________________________

1.

Month / Year

Amount of purchases

$

Social Security number

Use tax rate 6%

2.

x .06

3.

Tax on purchases

First name

Initial

Last name

4.

Credit for out-of-state taxes paid

-

5.

If late - a. Interest (1.08% per mo.) +

Street address

b. Penalty (10% of tax)

+

(Combine lines 3

6.

USE TAX DUE

$

through 5 b)

City or town ______________________State ________ ZIP code ____________

Make remittance payable to Comptroller of

I hereby certify that the information on this return is true and correct.

Maryland and return to:

Signature

________________________________________ Date __________

Compliance Division

301 W. Preston St., Room 203

Baltimore, Maryland 21201-2383

1

1