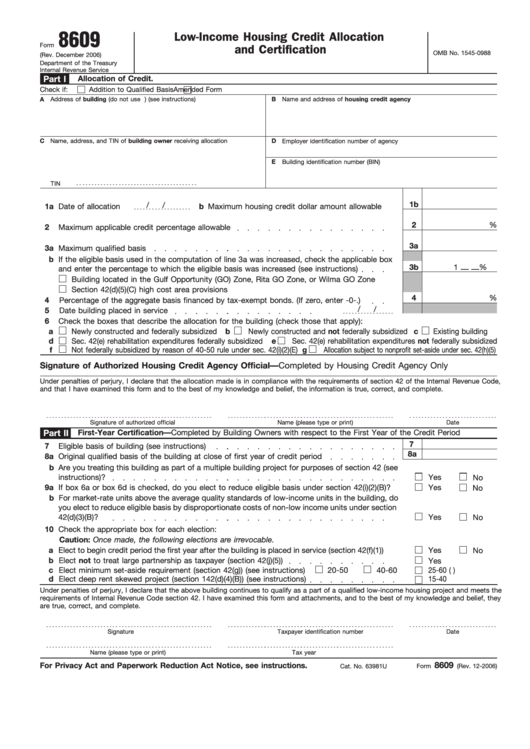

8609

Low-Income Housing Credit Allocation

Form

and Certification

OMB No. 1545-0988

(Rev. December 2006)

Department of the Treasury

Internal Revenue Service

Part I

Allocation of Credit.

Check if:

Addition to Qualified Basis

Amended Form

A Address of building (do not use P.O. box) (see instructions)

B Name and address of housing credit agency

C Name, address, and TIN of building owner receiving allocation

D Employer identification number of agency

E

Building identification number (BIN)

TIN

1b

/

/

1a

Date of allocation

b

Maximum housing credit dollar amount allowable

2

%

2

Maximum applicable credit percentage allowable

3a

3a

Maximum qualified basis

b

If the eligible basis used in the computation of line 3a was increased, check the applicable box

3b

1 — —

%

and enter the percentage to which the eligible basis was increased (see instructions)

Building located in the Gulf Opportunity (GO) Zone, Rita GO Zone, or Wilma GO Zone

Section 42(d)(5)(C) high cost area provisions

4

%

4

Percentage of the aggregate basis financed by tax-exempt bonds. (If zero, enter -0-.)

/

/

5

Date building placed in service

6

Check the boxes that describe the allocation for the building (check those that apply):

a

Newly constructed and federally subsidized

b

Newly constructed and not federally subsidized

c

Existing building

d

Sec. 42(e) rehabilitation expenditures federally subsidized

e

Sec. 42(e) rehabilitation expenditures not federally subsidized

f

Not federally subsidized by reason of 40-50 rule under sec. 42(i)(2)(E)

g

Allocation subject to nonprofit set-aside under sec. 42(h)(5)

Signature of Authorized Housing Credit Agency Official—Completed by Housing Credit Agency Only

Under penalties of perjury, I declare that the allocation made is in compliance with the requirements of section 42 of the Internal Revenue Code,

and that I have examined this form and to the best of my knowledge and belief, the information is true, correct, and complete.

Signature of authorized official

Name (please type or print)

Date

Part II

First-Year Certification—Completed by Building Owners with respect to the First Year of the Credit Period

7

7

Eligible basis of building (see instructions)

8a

8a

Original qualified basis of the building at close of first year of credit period

b

Are you treating this building as part of a multiple building project for purposes of section 42 (see

instructions)?

Yes

No

9a

If box 6a or box 6d is checked, do you elect to reduce eligible basis under section 42(i)(2)(B)?

Yes

No

b For market-rate units above the average quality standards of low-income units in the building, do

you elect to reduce eligible basis by disproportionate costs of non-low income units under section

42(d)(3)(B)?

Yes

No

10

Check the appropriate box for each election:

Caution: Once made, the following elections are irrevocable.

a

Elect to begin credit period the first year after the building is placed in service (section 42(f)(1))

Yes

No

b Elect not to treat large partnership as taxpayer (section 42(j)(5))

Yes

c Elect minimum set-aside requirement (section 42(g)) (see instructions)

20-50

40-60

25-60 (N.Y.C. only)

d Elect deep rent skewed project (section 142(d)(4)(B)) (see instructions)

15-40

Under penalties of perjury, I declare that the above building continues to qualify as a part of a qualified low-income housing project and meets the

requirements of Internal Revenue Code section 42. I have examined this form and attachments, and to the best of my knowledge and belief, they

are true, correct, and complete.

Signature

Taxpayer identification number

Date

Name (please type or print)

Tax year

8609

For Privacy Act and Paperwork Reduction Act Notice, see instructions.

Cat. No. 63981U

Form

(Rev. 12-2006)

1

1