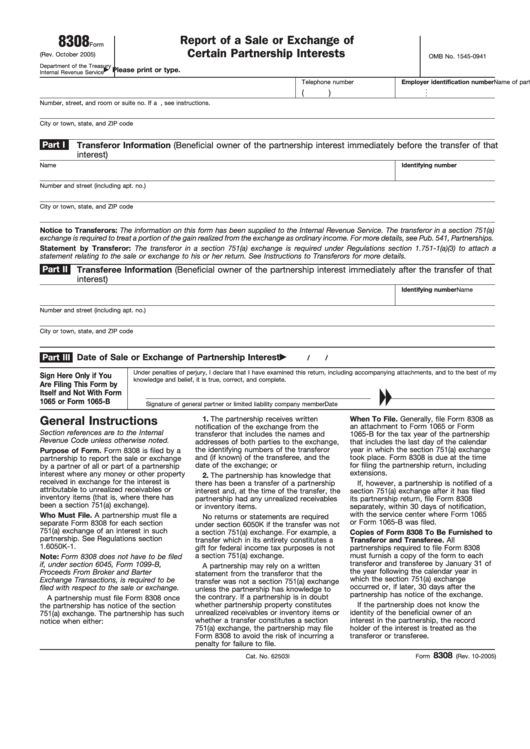

8308

Report of a Sale or Exchange of

Form

Certain Partnership Interests

(Rev. October 2005)

OMB No. 1545-0941

Department of the Treasury

Please print or type.

Internal Revenue Service

Name of partnership

Telephone number

Employer identification number

(

)

Number, street, and room or suite no. If a P.O. box, see instructions.

City or town, state, and ZIP code

Part I

Transferor Information (Beneficial owner of the partnership interest immediately before the transfer of that

interest)

Name

Identifying number

Number and street (including apt. no.)

City or town, state, and ZIP code

Notice to Transferors: The information on this form has been supplied to the Internal Revenue Service. The transferor in a section 751(a)

exchange is required to treat a portion of the gain realized from the exchange as ordinary income. For more details, see Pub. 541, Partnerships.

Statement by Transferor: The transferor in a section 751(a) exchange is required under Regulations section 1.751-1(a)(3) to attach a

statement relating to the sale or exchange to his or her return. See Instructions to Transferors for more details.

Part II

Transferee Information (Beneficial owner of the partnership interest immediately after the transfer of that

interest)

Name

Identifying number

Number and street (including apt. no.)

City or town, state, and ZIP code

Part III

Date of Sale or Exchange of Partnership Interest

/

/

Under penalties of perjury, I declare that I have examined this return, including accompanying attachments, and to the best of my

Sign Here Only if You

knowledge and belief, it is true, correct, and complete.

Are Filing This Form by

Itself and Not With Form

1065 or Form 1065-B

Signature of general partner or limited liability company member

Date

General Instructions

1. The partnership receives written

When To File. Generally, file Form 8308 as

notification of the exchange from the

an attachment to Form 1065 or Form

Section references are to the Internal

transferor that includes the names and

1065-B for the tax year of the partnership

Revenue Code unless otherwise noted.

addresses of both parties to the exchange,

that includes the last day of the calendar

the identifying numbers of the transferor

year in which the section 751(a) exchange

Purpose of Form. Form 8308 is filed by a

and (if known) of the transferee, and the

took place. Form 8308 is due at the time

partnership to report the sale or exchange

date of the exchange; or

for filing the partnership return, including

by a partner of all or part of a partnership

extensions.

interest where any money or other property

2. The partnership has knowledge that

received in exchange for the interest is

there has been a transfer of a partnership

If, however, a partnership is notified of a

attributable to unrealized receivables or

interest and, at the time of the transfer, the

section 751(a) exchange after it has filed

inventory items (that is, where there has

partnership had any unrealized receivables

its partnership return, file Form 8308

been a section 751(a) exchange).

or inventory items.

separately, within 30 days of notification,

with the service center where Form 1065

Who Must File. A partnership must file a

No returns or statements are required

or Form 1065-B was filed.

separate Form 8308 for each section

under section 6050K if the transfer was not

751(a) exchange of an interest in such

a section 751(a) exchange. For example, a

Copies of Form 8308 To Be Furnished to

partnership. See Regulations section

transfer which in its entirety constitutes a

Transferor and Transferee. All

1.6050K-1.

gift for federal income tax purposes is not

partnerships required to file Form 8308

a section 751(a) exchange.

must furnish a copy of the form to each

Note: Form 8308 does not have to be filed

transferor and transferee by January 31 of

if, under section 6045, Form 1099-B,

A partnership may rely on a written

the year following the calendar year in

Proceeds From Broker and Barter

statement from the transferor that the

which the section 751(a) exchange

Exchange Transactions, is required to be

transfer was not a section 751(a) exchange

occurred or, if later, 30 days after the

filed with respect to the sale or exchange.

unless the partnership has knowledge to

partnership has notice of the exchange.

the contrary. If a partnership is in doubt

A partnership must file Form 8308 once

whether partnership property constitutes

If the partnership does not know the

the partnership has notice of the section

unrealized receivables or inventory items or

identity of the beneficial owner of an

751(a) exchange. The partnership has such

whether a transfer constitutes a section

interest in the partnership, the record

notice when either:

751(a) exchange, the partnership may file

holder of the interest is treated as the

Form 8308 to avoid the risk of incurring a

transferor or transferee.

penalty for failure to file.

8308

Cat. No. 62503I

Form

(Rev. 10-2005)

1

1