4

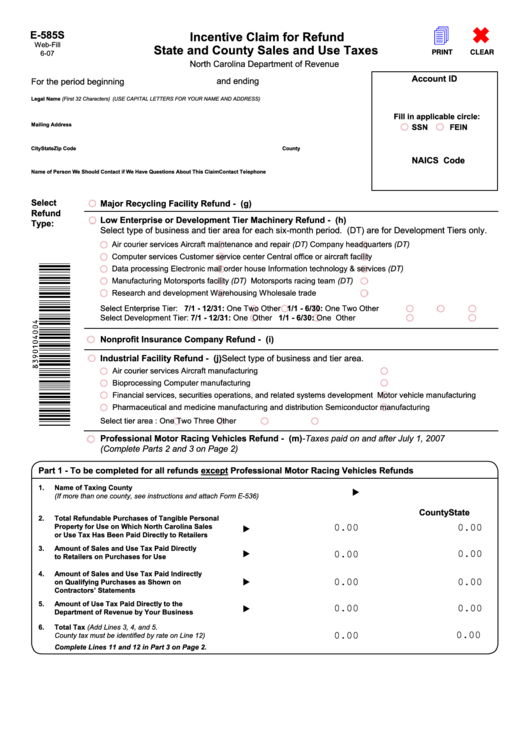

E-585S

Incentive Claim for Refund

Web-Fill

State and County Sales and Use Taxes

6-07

PRINT

CLEAR

North Carolina Department of Revenue

Account ID

and ending

For the period beginning

Legal Name (First 32 Characters)

(USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

Fill in applicable circle:

Mailing Address

SSN

FEIN

City

State

Zip Code

County

NAICS Code

Name of Person We Should Contact if We Have Questions About This Claim

Contact Telephone

Select

Major Recycling Facility Refund - G.S. 105-164.14(g)

Refund

Low Enterprise or Development Tier Machinery Refund - G.S. 105-164.14(h)

Type:

Select type of business and tier area for each six-month period. (DT) are for Development Tiers only.

Air courier services

Aircraft maintenance and repair (DT)

Company headquarters (DT)

Computer services

Customer service center

Central office or aircraft facility

Data processing

Electronic mail order house

Information technology & services (DT)

Manufacturing

Motorsports facility (DT)

Motorsports racing team (DT)

Research and development

Warehousing

Wholesale trade

Select Enterprise Tier:

7/1 - 12/31:

One

Two

Other

1/1 - 6/30:

One

Two

Other

Select Development Tier:

7/1 - 12/31:

One

Other

1/1 - 6/30:

One

Other

Nonprofit Insurance Company Refund - G.S. 105-164.14(i)

Industrial Facility Refund - G.S. 105-164.14(j) Select type of business and tier area.

Air courier services

Aircraft manufacturing

Bioprocessing

Computer manufacturing

Financial services, securities operations, and related systems development

Motor vehicle manufacturing

Pharmaceutical and medicine manufacturing and distribution

Semiconductor manufacturing

Select tier area :

One

Two

Three

Other

Professional Motor Racing Vehicles Refund - G.S. 105-164.14(m) -Taxes paid on and after July 1, 2007

(Complete Parts 2 and 3 on Page 2)

Part 1 - To be completed for all refunds except Professional Motor Racing Vehicles Refunds

1.

Name of Taxing County

(If more than one county, see instructions and attach Form E-536)

State

County

2.

Total Refundable Purchases of Tangible Personal

Property for Use on Which North Carolina Sales

0.00

0.00

or Use Tax Has Been Paid Directly to Retailers

3.

Amount of Sales and Use Tax Paid Directly

0.00

0.00

to Retailers on Purchases for Use

4.

Amount of Sales and Use Tax Paid Indirectly

on Qualifying Purchases as Shown on

0.00

0.00

Contractors’ Statements

5.

Amount of Use Tax Paid Directly to the

0.00

0.00

Department of Revenue by Your Business

6.

Total Tax (Add Lines 3, 4, and 5.

County tax must be identified by rate on Line 12)

0.00

0.00

Complete Lines 11 and 12 in Part 3 on Page 2.

1

1 2

2