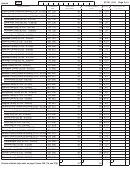

Form St-101 - New York State And Local Annual Sales And Use Tax Return Form - New York State Department Of Taxation And Finance Page 3

ADVERTISEMENT

A06

Sales tax identification number

ST-101 (2/06) Page 3 of 8

Annual

Column A

Column B

Column C

Column D

Column E

Column F

=

+

×

Taxing jurisdiction

Jurisdiction

Taxable sales

Purchases subject

Tax rate

Sales and use tax

code

and services

to tax

(C + D) x E

Fulton County (outside the following) (3/1/05 - 5/31/05) FU 1701

.00

.00 73%

Fulton County (outside the following) (6/1/05 - 11/30/05) FU 1711

.00

.00

7%

Fulton County (outside the following) (12/1/05 - 2/28/06) FU 1791

.00

.00

8%

Gloversville (city) (3/1/05 - 5/31/05)

GL 1761

.00

.00 73%

Gloversville (city) (6/1/05 - 11/30/05)

GL 1781

.00

.00

7%

Gloversville (city) (12/1/05 - 2/28/06)

GL 1741

.00

.00

8%

Johnstown (city) (3/1/05 - 5/31/05)

JO 1771

.00

.00 73%

Johnstown (city) (6/1/05 - 11/30/05)

JO 1721

.00

.00

7%

Johnstown (city) (12/1/05 - 2/28/06)

JO 1751

.00

.00

8%

Genesee County (3/1/05 - 5/31/05)

GE 1801

.00

.00 83%

Genesee County (6/1/05 - 2/28/06)

GE 1811

.00

.00

8%

Greene County (3/1/05 - 5/31/05)

GR 1901

.00

.00 83%

Greene County (6/1/05 - 2/28/06)

GR 1911

.00

.00

8%

Hamilton County (3/1/05 - 5/31/05)

HA 2001

.00

.00 73%

Hamilton County (6/1/05 - 2/28/06)

HA 2011

.00

.00

7%

Herkimer County (3/1/05 - 5/31/05)

HE 2101

.00

.00 83%

Herkimer County (6/1/05 - 2/28/06)

HE 2111

.00

.00

8%

Jefferson County (3/1/05 - 5/31/05)

JE 2211

.00

.00

8%

Jefferson County (6/1/05 - 2/28/06)

JE 2221

.00

.00 7:%

Lewis County (3/1/05 - 5/31/05)

LE 2311

.00

.00

8%

Lewis County (6/1/05 - 2/28/06)

LE 2321

.00

.00 7:%

Livingston County (3/1/05 - 5/31/05)

LI 2401

.00

.00 83%

Livingston County (6/1/05 - 2/28/06)

LI 2411

.00

.00

8%

Madison County (outside the following) (3/1/05 - 5/31/05) MA 2501

.00

.00 83%

Madison County (outside the following) (6/1/05 - 2/28/06) MA 2511

.00

.00

8%

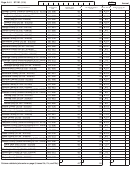

Oneida (city) (3/1/05 - 5/31/05)

ON 2531

.00

.00 83%

Oneida (city) (6/1/05 - 2/28/06)

ON 2541

.00

.00

8%

Monroe County (3/1/05 - 5/31/05)

MO 2601

.00

.00 83%

Monroe County (6/1/05 - 2/28/06)

MO 2611

.00

.00

8%

Montgomery County (3/1/05 - 5/31/05)

MO 2791

.00

.00 83%

Montgomery County (6/1/05 - 2/28/06)

MO 2781

.00

.00

8%

Nassau County (3/1/05 - 5/31/05)

NA 2801

.00

.00 8:%

Nassau County (6/1/05 - 2/28/06)

NA 2811

.00

.00 8e%*

Niagara County (3/1/05 - 5/31/05)

NI 2901

.00

.00 83%

Niagara County (6/1/05 - 2/28/06)

NI 2911

.00

.00

8%

Oneida County (outside the following) (3/1/05 - 5/31/05) ON 3011

.00

.00 9:%

Oneida County (outside the following) (6/1/05 - 2/28/06) ON 3081

.00

.00 92%

Rome (city) (3/1/05 - 5/31/05)

RO 3031

.00

.00 9:%

Rome (city) (6/1/05 - 2/28/06)

RO 3091

.00

.00 92%

Sherrill (city) (3/1/05 - 5/31/05)

SH 3071

.00

.00 9:%

Sherrill (city) (6/1/05 - 2/28/06)

SH 3014

.00

.00 92%

Utica (city) (3/1/05 - 5/31/05)

UT 3061

.00

.00 9:%

Utica (city) (6/1/05 - 2/28/06)

UT 3016

.00

.00 92%

Onondaga County (3/1/05 - 5/31/05)

ON 3111

.00

.00 83%

Onondaga County (6/1/05 - 2/28/06)

ON 3121

.00

.00

8%

Ontario County (outside the following) (3/1/05 - 5/31/05) ON 3271

.00

.00 73%

Ontario County (outside the following) (6/1/05 - 2/28/06) ON 3281

.00

.00

7%

Canandaigua (city) (3/1/05 - 5/31/05)

CA 3231

.00

.00 73%

Canandaigua (city) (6/1/05 - 2/28/06)

CA 3251

.00

.00

7%

Geneva (city) (3/1/05 - 5/31/05)

GE 3241

.00

.00 73%

Geneva (city) (6/1/05 - 2/28/06)

GE 3261

.00

.00

7%

Orange County (3/1/05 - 5/31/05)

OR 3311

.00

.00 83%

Orange County (6/1/05 - 2/28/06)

OR 3321

.00

.00 8c%*

Orleans County (3/1/05 - 5/31/05)

OR 3471

.00

.00 83%

Orleans County (6/1/05 - 2/28/06)

OR 3481

.00

.00

8%

6b

7b

8b

Column subtotals (also enter on page 5, boxes 10b, 11b, and 12b):

.00

.00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7