Form St-101 - New York State And Local Annual Sales And Use Tax Return Form - New York State Department Of Taxation And Finance Page 7

ADVERTISEMENT

A06

Sales tax identification number

ST-101 (2/06) Page 7 of 8

Annual

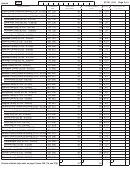

Vendor collection credit calculation worksheet

Section 1 — March 1, 2005, through May 31, 2005

Part 1

Total taxable sales and services reported for 3/1/05 through 5/31/05 in Step 3,

1

Column C

(only add amounts for this reporting period and enter in box 1; see Note below)

2

Amount from Schedule A, Part 3, box 1

3

Amount from Schedule B, Part 3, Section 1, Column C

4

Amount from Schedule N, Part 5, box 1

5

Amount from Schedule T, Part 2, box 1

6

Amount from Schedule FR, Step 5, box 16

7

Add boxes 1 through 6

8

Multiply box 7 by 43% (.0425)

Part 2

9

Multiply box 8 by 3½% (.035)

Enter box 9 amount

on page 6, Step 7A

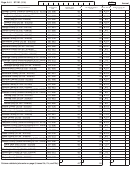

Section 2 — June 1, 2005, through February 28, 2006

Part 1

Total taxable sales and services reported for 6/1/05 through 2/28/06 in Step 3,

10

Column C

(only add amounts for this reporting period and enter in box 10; see Note below)

11

Amount from Schedule A, Part 3, box 2

12

Amount from Schedule B, Part 3, Section 2, Column C

13

Amount from Schedule N, Part 5, box 2

14

Amount from Schedule T, Part 2, box 2

15

Amount from Schedule FR, Step 5, box 23

16

Add boxes 10 through 15

17

Multiply box 16 by 4% (.04)

Part 2

18

Multiply box 17 by 32% (.035)

Enter box 18 amount

on page 6, Step 7B

Note: Do not include sales reported in boxes 9a or 9b on page 5, Step 3; these sales are subject to local tax only and do not qualify for the

vendor collection credit.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7