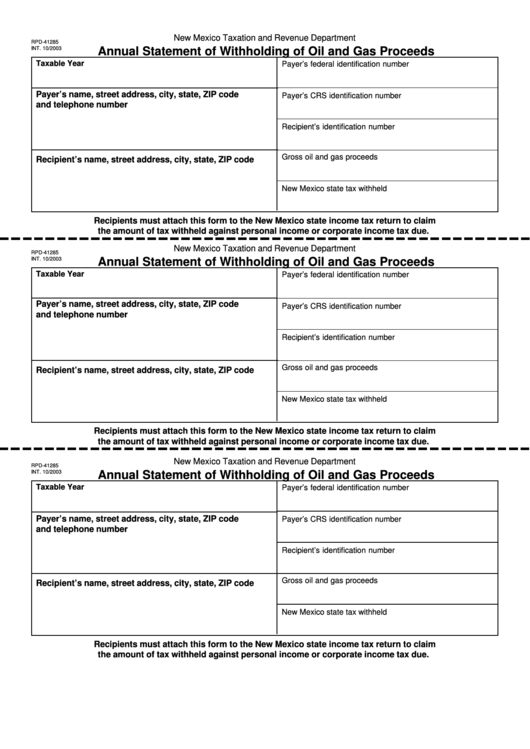

Form Rpd-41285 - Annual Statement Of Withholding Of Oil And Gas Proceeds - New Mexico Taxation And Revenue Department

ADVERTISEMENT

New Mexico Taxation and Revenue Department

RPD-41285

INT. 10/2003

Annual Statement of Withholding of Oil and Gas Proceeds

Taxable Year

Payer’s federal identification number

Payer’s name, street address, city, state, ZIP code

Payer’s CRS identification number

and telephone number

Recipient’s identification number

Gross oil and gas proceeds

Recipient’s name, street address, city, state, ZIP code

New Mexico state tax withheld

Recipients must attach this form to the New Mexico state income tax return to claim

the amount of tax withheld against personal income or corporate income tax due.

New Mexico Taxation and Revenue Department

RPD-41285

INT. 10/2003

Annual Statement of Withholding of Oil and Gas Proceeds

Taxable Year

Payer’s federal identification number

Payer’s name, street address, city, state, ZIP code

Payer’s CRS identification number

and telephone number

Recipient’s identification number

Gross oil and gas proceeds

Recipient’s name, street address, city, state, ZIP code

New Mexico state tax withheld

Recipients must attach this form to the New Mexico state income tax return to claim

the amount of tax withheld against personal income or corporate income tax due.

New Mexico Taxation and Revenue Department

RPD-41285

INT. 10/2003

Annual Statement of Withholding of Oil and Gas Proceeds

Taxable Year

Payer’s federal identification number

Payer’s name, street address, city, state, ZIP code

Payer’s CRS identification number

and telephone number

Recipient’s identification number

Gross oil and gas proceeds

Recipient’s name, street address, city, state, ZIP code

New Mexico state tax withheld

Recipients must attach this form to the New Mexico state income tax return to claim

the amount of tax withheld against personal income or corporate income tax due.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1