Print Form

Reset Form

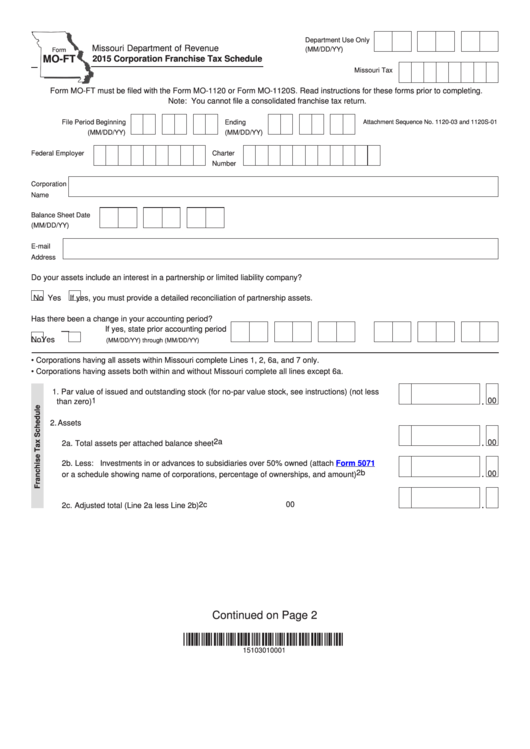

Department Use Only

Missouri Department of Revenue

(MM/DD/YY)

Form

MO-FT

2015 Corporation Franchise Tax Schedule

Missouri Tax

I.D. Number

Form MO-FT must be filed with the Form MO-1120 or Form MO-1120S. Read instructions for these forms prior to completing.

Note: You cannot file a consolidated franchise tax return.

File Period Beginning

Ending

Attachment Sequence No. 1120-03 and 1120S-01

(MM/DD/YY)

(MM/DD/YY)

Federal Employer

Charter

I.D. Number

Number

Corporation

Name

Balance Sheet Date

(MM/DD/YY)

E-mail

Address

Do your assets include an interest in a partnership or limited liability company?

No

Yes

If yes, you must provide a detailed reconciliation of partnership assets.

Has there been a change in your accounting period?

If yes, state prior accounting period

—

No

Yes

(MM/DD/YY) through (MM/DD/YY)

• Corporations having all assets within Missouri complete Lines 1, 2, 6a, and 7 only.

• Corporations having assets both within and without Missouri complete all lines except 6a.

1. Par value of issued and outstanding stock (for no-par value stock, see instructions) (not less

.

than zero) ......................................................................................................................................... 1

00

2. Assets

2a. Total assets per attached balance sheet .................................................................................... 2a

.

00

2b. Less: Investments in or advances to subsidiaries over 50% owned (attach

Form 5071

or a schedule showing name of corporations, percentage of ownerships, and amount) ................. 2b

.

00

.

00

2c. Adjusted total (Line 2a less Line 2b) .......................................................................................... 2c

Continued on Page 2

*15103010001*

15103010001

1

1 2

2