Reset Form

Print Form

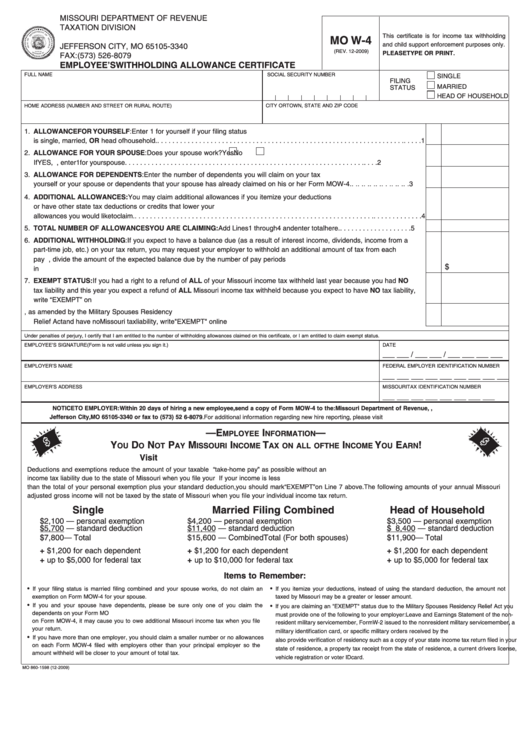

MISSOURI DEPARTMENT OF REVENUE

TAXATION DIVISION

This certificate is for income tax withholding

P.O. BOX 3340

MO W-4

and child support enforcement purposes only.

JEFFERSON CITY, MO 65105-3340

(REV. 12-2009)

PLEASE TYPE OR PRINT.

FAX:(573) 526-8079

EMPLOYEE’S WITHHOLDING ALLOWANCE CERTIFICATE

FULL NAME

SOCIAL SECURITY NUMBER

SINGLE

FILING

MARRIED

STATUS

HEAD OF HOUSEHOLD

CITY OR TOWN, STATE AND ZIP CODE

HOME ADDRESS (NUMBER AND STREET OR RURAL ROUTE)

1. ALLOWANCE FOR YOURSELF: Enter 1 for yourself if your filing status

is single, married, OR head of household. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2. ALLOWANCE FOR YOUR SPOUSE: Does your spouse work?

Yes

No

If YES, enter 0. If NO, enter 1 for your spouse . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3. ALLOWANCE FOR DEPENDENTS: Enter the number of dependents you will claim on your tax return. Do not claim

yourself or your spouse or dependents that your spouse has already claimed on his or her Form MO W-4. . . . . . . . . . . . . . . . . . . . 3

4. ADDITIONAL ALLOWANCES: You may claim additional allowances if you itemize your deductions

or have other state tax deductions or credits that lower your tax. Enter the number of additional

allowances you would like to claim. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5. TOTAL NUMBER OF ALLOWANCES YOU ARE CLAIMING: Add Lines 1 through 4 and enter total here. . . . . . . . . . . . . . . . . . . . 5

6. ADDITIONAL WITHHOLDING: If you expect to have a balance due (as a result of interest income, dividends, income from a

part-time job, etc.) on your tax return, you may request your employer to withhold an additional amount of tax from each

pay period. To calculate the amount needed, divide the amount of the expected balance due by the number of pay periods

$

in a year. Enter the additional amount to be withheld each pay period here. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7. EXEMPT STATUS: If you had a right to a refund of ALL of your Missouri income tax withheld last year because you had NO

tax liability and this year you expect a refund of ALL Missouri income tax withheld because you expect to have NO tax liability,

write “EXEMPT” on Line 7. See information below. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8. If you meet the conditions set forth under the Servicemember Civil Relief Act, as amended by the Military Spouses Residency

Relief Act and have no Missouri tax liability, write "EXEMPT" on line 8. See information below. . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

Under penalties of perjury, I certify that I am entitled to the number of withholding allowances claimed on this certificate, or I am entitled to claim exempt status.

EMPLOYEE’S SIGNATURE (Form is not valid unless you sign it.)

DATE

___ ___ / ___ ___ / ___ ___ ___ ___

EMPLOYER’S NAME

FEDERAL EMPLOYER IDENTIFICATION NUMBER

___ ___ ___ ___ ___ ___ ___ ___ ___

EMPLOYER’S ADDRESS

MISSOURI TAX IDENTIFICATION NUMBER

___ ___ ___ ___ ___ ___ ___ ___

NOTICE TO EMPLOYER: Within 20 days of hiring a new employee, send a copy of Form MO W-4 to the: Missouri Department of Revenue, P.O. Box 3340,

Jefferson City, MO 65105-3340 or fax to (573) 526-8079. For additional information regarding new hire reporting, please visit

—E

I

—

MPLOYEE

NFORMATION

Y

D

N

P

M

I

T

I

Y

E

!

OU

O

OT

AY

ISSOURI

NCOME

AX ON ALL OF THE

NCOME

OU

ARN

Visit to try our online withholding calculator.

Deductions and exemptions reduce the amount of your taxable income. Form MO W-4 is completed so you can have as much “take-home pay” as possible without an

income tax liability due to the state of Missouri when you file your return. Deductions and exemptions reduce the amount of your taxable income. If your income is less

than the total of your personal exemption plus your standard deduction, you should mark “EXEMPT” on Line 7 above. The following amounts of your annual Missouri

adjusted gross income will not be taxed by the state of Missouri when you file your individual income tax return.

Single

Married Filing Combined

Head of Household

$2,100 — personal exemption

$ 4,200 — personal exemption

$ 3,500 — personal exemption

$5,700 — standard deduction

$11,400 — standard deduction

$ 8,400 — standard deduction

$7,800 — Total

$15,600 — Combined Total (For both spouses)

$11,900 — Total

+ $1,200 for each dependent

+ $1,200 for each dependent

+ $1,200 for each dependent

+ up to $5,000 for federal tax

+ up to $10,000 for federal tax

+ up to $5,000 for federal tax

Items to Remember:

•

•

If your filing status is married filing combined and your spouse works, do not claim an

If you itemize your deductions, instead of using the standard deduction, the amount not

exemption on Form MO W-4 for your spouse.

taxed by Missouri may be a greater or lesser amount.

•

If you and your spouse have dependents, please be sure only one of you claim the

•

If you are claiming an "EXEMPT" status due to the Military Spouses Residency Relief Act you

dependents on your Form MO W-4. If both spouses claim the dependents as an allowance

must provide one of the following to your employer: Leave and Earnings Statement of the non-

on Form MO W-4, it may cause you to owe additional Missouri income tax when you file

resident military servicemember, Form W-2 issued to the nonresident military servicemember, a

your return.

military identification card, or specific military orders received by the servicemember. You must

•

If you have more than one employer, you should claim a smaller number or no allowances

also provide verification of residency such as a copy of your state income tax return filed in your

on each Form MO W-4 filed with employers other than your principal employer so the

state of residence, a property tax receipt from the state of residence, a current drivers license,

amount withheld will be closer to your amount of total tax.

vehicle registration or voter ID card.

MO 860-1598 (12-2009)

1

1