Form 75-Imv - General Instructions

ADVERTISEMENT

General Instructions for Idaho Form 75-IMV

General Instructions for Idaho Form 75-IMV

TC75IMV1-2

General Instructions for Idaho Form 75-IMV

General Instructions for Idaho Form 75-IMV

General Instructions for Idaho Form 75-IMV

9-22-97

WHO MAY FILE

WHO MAY FILE

WHO MAY FILE

The records required when using a standard mpg

WHO MAY FILE

WHO MAY FILE

This form may be used by a person or entity who

are:

operates intrastate motor vehicles of any gross ve-

1) Taxable road miles;

hicle weight and/or interstate motor vehicles which

2) Tax-paid fuel purchases.

have gross vehicle weights of 26,000 pounds or

less that are not required to be licensed under the

OR

International Fuel Tax Agreement (IFTA) and use

Idaho tax-paid

tax-paid

tax-paid

tax-paid special fuels (undyed diesel, propane,

A Statutory MPG

Statutory MPG

Statutory MPG may be used in the event that the

Statutory MPG

tax-paid

Statutory MPG

or natural gas) from the main supply tank of the

special fuels consumer fails to keep sufficiently

motor vehicle for nontaxable uses. Nontaxable uses

detailed records to determine a calculated MPG. The

of Idaho tax-paid special fuels drawn from a motor

following MPGs for each vehicle weight may be

vehicle's main supply tank include operating the

used.

motor vehicle's power-take-off (PTO) equipment

and/or operating the motor vehicle on nontaxable

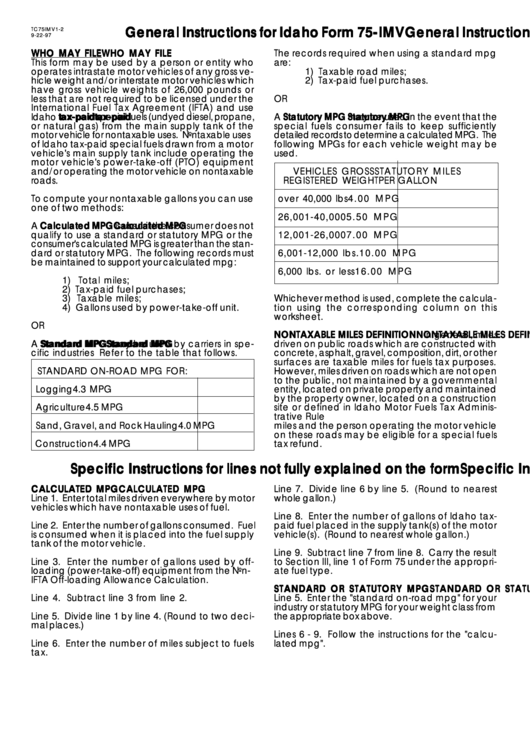

VEHICLES GROSS

STATUTORY MILES

roads.

REGISTERED WEIGHT

PER GALLON

To compute your nontaxable gallons you can use

over 40,000 lbs

4.00 MPG

one of two methods:

26,001-40,000

5.50 MPG

A Calculated MPG

Calculated MPG

Calculated MPG

Calculated MPG is used if the consumer does not

Calculated MPG

qualify to use a standard or statutory MPG or the

12,001-26,000

7.00 MPG

consumer's calculated MPG is greater than the stan-

dard or statutory MPG. The following records must

6,001-12,000 lbs.

10.00 MPG

be maintained to support your calculated mpg:

6,000 lbs. or less

16.00 MPG

1) Total miles;

2) Tax-paid fuel purchases;

3) Taxable miles;

Whichever method is used, complete the calcula-

4) Gallons used by power-take-off unit.

tion using the corresponding column on this

worksheet.

OR

NONTAXABLE MILES DEFINITION

NONTAXABLE MILES DEFINITION

NONTAXABLE MILES DEFINITION: In general, miles

NONTAXABLE MILES DEFINITION

NONTAXABLE MILES DEFINITION

A Standard MPG

Standard MPG

Standard MPG may be used by carriers in spe-

Standard MPG

driven on public roads which are constructed with

Standard MPG

cific industries Refer to the table that follows.

concrete, asphalt, gravel, composition, dirt, or other

surfaces are taxable miles for fuels tax purposes.

STANDARD ON-ROAD MPG FOR:

However, miles driven on roads which are not open

to the public, not maintained by a governmental

Logging

4.3 MPG

entity, located on private property and maintained

by the property owner, located on a construction

Agriculture

4.5 MPG

site or defined in Idaho Motor Fuels Tax Adminis-

trative Rule 290.02.b. are considered nontaxable

Sand, Gravel, and Rock Hauling

4.0 MPG

miles and the person operating the motor vehicle

on these roads may be eligible for a special fuels

Construction

4.4 MPG

tax refund.

Specific Instructions for lines not fully explained on the form

Specific Instructions for lines not fully explained on the form

Specific Instructions for lines not fully explained on the form

Specific Instructions for lines not fully explained on the form

Specific Instructions for lines not fully explained on the form

CALCULATED MPG

CALCULATED MPG

CALCULATED MPG

CALCULATED MPG

CALCULATED MPG

Line 7. Divide line 6 by line 5. (Round to nearest

Line 1. Enter total miles driven everywhere by motor

whole gallon.)

vehicles which have nontaxable uses of fuel.

Line 8. Enter the number of gallons of Idaho tax-

Line 2. Enter the number of gallons consumed. Fuel

paid fuel placed in the supply tank(s) of the motor

is consumed when it is placed into the fuel supply

vehicle(s). (Round to nearest whole gallon.)

tank of the motor vehicle.

Line 9. Subtract line 7 from line 8. Carry the result

Line 3. Enter the number of gallons used by off-

to Section III, line 1 of Form 75 under the appropri-

loading (power-take-off) equipment from the Non-

ate fuel type.

IFTA Off-loading Allowance Calculation.

STANDARD OR STATUTORY MPG

STANDARD OR STATUTORY MPG

STANDARD OR STATUTORY MPG

STANDARD OR STATUTORY MPG

STANDARD OR STATUTORY MPG

Line 4. Subtract line 3 from line 2.

Line 5. Enter the "standard on-road mpg" for your

industry or statutory MPG for your weight class from

Line 5. Divide line 1 by line 4. (Round to two deci-

the appropriate box above.

mal places.)

Lines 6 - 9. Follow the instructions for the "calcu-

Line 6. Enter the number of miles subject to fuels

lated mpg".

tax.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1