Instructions For Form 8379 - Injured Spouse Allocation - 2010

ADVERTISEMENT

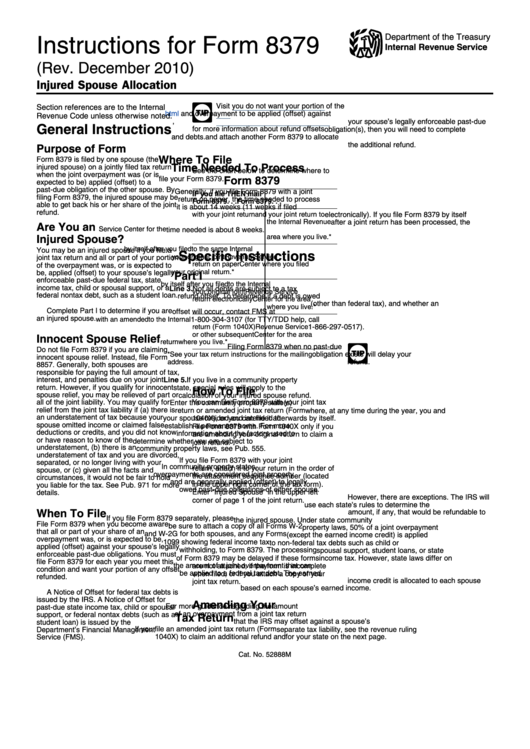

Instructions for Form 8379

Department of the Treasury

Internal Revenue Service

(Rev. December 2010)

Injured Spouse Allocation

Visit

you do not want your portion of the

Section references are to the Internal

html

and

overpayment to be applied (offset) against

TIP

Revenue Code unless otherwise noted.

,

your spouse’s legally enforceable past-due

General Instructions

for more information about refund offsets

obligation(s), then you will need to complete

and debts.

and attach another Form 8379 to allocate

the additional refund.

Purpose of Form

Where To File

Form 8379 is filed by one spouse (the

Time Needed To Process

injured spouse) on a jointly filed tax return

See the chart below to determine where to

when the joint overpayment was (or is

Form 8379

file your Form 8379.

expected to be) applied (offset) to a

past-due obligation of the other spouse. By

Generally, if you file Form 8379 with a joint

IF you file

THEN mail

filing Form 8379, the injured spouse may be

return on paper, the time needed to process

Form 8379. . .

Form 8379. . .

able to get back his or her share of the joint

it is about 14 weeks (11 weeks if filed

refund.

with your joint return

and your joint return to

electronically). If you file Form 8379 by itself

the Internal Revenue

after a joint return has been processed, the

Are You an

Service Center for the

time needed is about 8 weeks.

Injured Spouse?

area where you live.*

by itself after you filed

to the same Internal

You may be an injured spouse if you file a

Specific Instructions

your original joint

Revenue Service

joint tax return and all or part of your portion

return on paper

Center where you filed

of the overpayment was, or is expected to

your original return.*

be, applied (offset) to your spouse’s legally

Part I

enforceable past-due federal tax, state

by itself after you filed

to the Internal

income tax, child or spousal support, or a

Line 3. Not all debts are subject to a tax

your original joint

Revenue Service

federal nontax debt, such as a student loan.

refund offset. To determine if a debt is owed

return electronically

Center for the area

(other than federal tax), and whether an

where you live.*

Complete Part I to determine if you are

offset will occur, contact FMS at

an injured spouse.

1-800-304-3107 (for TTY/TDD help, call

with an amended

to the Internal

1-866-297-0517).

return (Form 1040X)

Revenue Service

or other subsequent

Center for the area

Innocent Spouse Relief

return

where you live.*

Filing Form 8379 when no past-due

Do not file Form 8379 if you are claiming

*See your tax return instructions for the mailing

obligation exists will delay your

TIP

innocent spouse relief. Instead, file Form

refund.

address.

8857. Generally, both spouses are

responsible for paying the full amount of tax,

interest, and penalties due on your joint

Line 5. If you live in a community property

return. However, if you qualify for innocent

state, special rules will apply to the

How To File

spouse relief, you may be relieved of part or

calculation of your injured spouse refund.

all of the joint liability. You may qualify for

You can file Form 8379 with your joint tax

Enter the community property state(s)

relief from the joint tax liability if (a) there is

return or amended joint tax return (Form

where, at any time during the year, you and

an understatement of tax because your

1040X), or you can file it afterwards by itself.

your spouse resided and intended to

spouse omitted income or claimed false

establish a permanent home. For more

File Form 8379 with Form 1040X only if you

deductions or credits, and you did not know

information about the factors used to

are amending your original return to claim a

or have reason to know of the

determine whether you are subject to

joint refund.

understatement, (b) there is an

community property laws, see Pub. 555.

understatement of tax and you are divorced,

If you file Form 8379 with your joint

separated, or no longer living with your

In community property states,

return, attach it to your return in the order of

spouse, or (c) given all the facts and

overpayments are considered joint property

the attachment sequence number (located

circumstances, it would not be fair to hold

and are generally applied (offset) to legally

in the upper right corner of the tax form).

you liable for the tax. See Pub. 971 for more

owed past-due obligations of either spouse.

details.

Enter “Injured Spouse” in the upper left

However, there are exceptions. The IRS will

corner of page 1 of the joint return.

use each state’s rules to determine the

When To File

amount, if any, that would be refundable to

If you file Form 8379 separately, please

the injured spouse. Under state community

File Form 8379 when you become aware

be sure to attach a copy of all Forms W-2

property laws, 50% of a joint overpayment

that all or part of your share of an

and W-2G for both spouses, and any Forms

(except the earned income credit) is applied

overpayment was, or is expected to be,

1099 showing federal income tax

to non-federal tax debts such as child or

applied (offset) against your spouse’s legally

withholding, to Form 8379. The processing

spousal support, student loans, or state

enforceable past-due obligations. You must

of Form 8379 may be delayed if these forms

income tax. However, state laws differ on

file Form 8379 for each year you meet this

are not attached, if the form is incomplete

the amount of a joint overpayment that can

condition and want your portion of any offset

be applied to a federal tax debt. The earned

when filed, or if you attach a copy of your

refunded.

income credit is allocated to each spouse

joint tax return.

based on each spouse’s earned income.

A Notice of Offset for federal tax debts is

issued by the IRS. A Notice of Offset for

Amending Your

For more guidance regarding the amount

past-due state income tax, child or spousal

of an overpayment from a joint tax return

support, or federal nontax debts (such as a

Tax Return

that the IRS may offset against a spouse’s

student loan) is issued by the U.S. Treasury

If you file an amended joint tax return (Form

separate tax liability, see the revenue ruling

Department’s Financial Management

1040X) to claim an additional refund and

for your state on the next page.

Service (FMS).

Cat. No. 52888M

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2