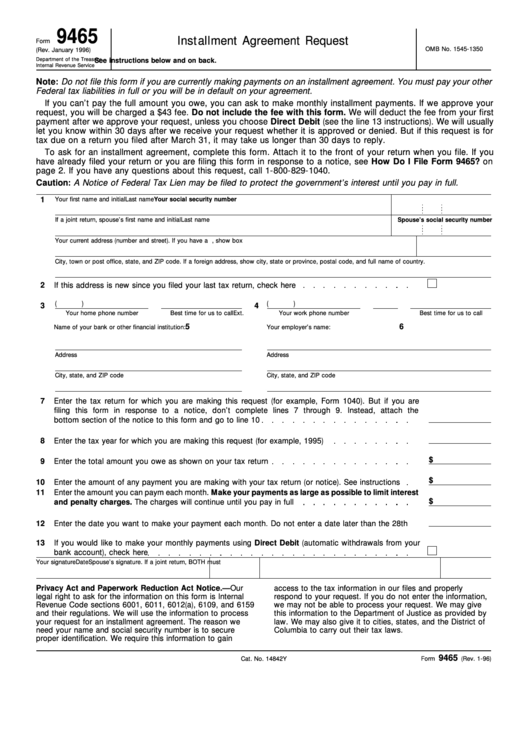

9465

Installment Agreement Request

Form

OMB No. 1545-1350

(Rev. January 1996)

Department of the Treasury

See instructions below and on back.

Internal Revenue Service

Note: Do not file this form if you are currently making payments on an installment agreement. You must pay your other

Federal tax liabilities in full or you will be in default on your agreement.

If you can’t pay the full amount you owe, you can ask to make monthly installment payments. If we approve your

request, you will be charged a $43 fee. Do not include the fee with this form. We will deduct the fee from your first

payment after we approve your request, unless you choose Direct Debit (see the line 13 instructions). We will usually

let you know within 30 days after we receive your request whether it is approved or denied. But if this request is for

tax due on a return you filed after March 31, it may take us longer than 30 days to reply.

To ask for an installment agreement, complete this form. Attach it to the front of your return when you file. If you

have already filed your return or you are filing this form in response to a notice, see How Do I File Form 9465? on

page 2. If you have any questions about this request, call 1-800-829-1040.

Caution: A Notice of Federal Tax Lien may be filed to protect the government’s interest until you pay in full.

1

Your first name and initial

Last name

Your social security number

If a joint return, spouse’s first name and initial

Last name

Spouse’s social security number

Your current address (number and street). If you have a P.O. box and no home delivery, show box number.

Apt. number

City, town or post office, state, and ZIP code. If a foreign address, show city, state or province, postal code, and full name of country.

2

If this address is new since you filed your last tax return, check here

(

)

(

)

3

4

Your home phone number

Best time for us to call

Your work phone number

Ext.

Best time for us to call

5

6

Name of your bank or other financial institution:

Your employer’s name:

Address

Address

City, state, and ZIP code

City, state, and ZIP code

7

Enter the tax return for which you are making this request (for example, Form 1040). But if you are

filing this form in response to a notice, don’t complete lines 7 through 9. Instead, attach the

bottom section of the notice to this form and go to line 10

8

Enter the tax year for which you are making this request (for example, 1995)

$

9

Enter the total amount you owe as shown on your tax return

$

10

Enter the amount of any payment you are making with your tax return (or notice). See instructions

11

Enter the amount you can paym each month. Make your payments as large as possible to limit interest

$

and penalty charges. The charges will continue until you pay in full

12

Enter the date you want to make your payment each month. Do not enter a date later than the 28th

13

If you would like to make your monthly payments using Direct Debit (automatic withdrawals from your

bank account), check here

Your signature

Date

Spouse’s signature. If a joint return, BOTH must sign.

Date

Privacy Act and Paperwork Reduction Act Notice.—Our

access to the tax information in our files and properly

legal right to ask for the information on this form is Internal

respond to your request. If you do not enter the information,

Revenue Code sections 6001, 6011, 6012(a), 6109, and 6159

we may not be able to process your request. We may give

and their regulations. We will use the information to process

this information to the Department of Justice as provided by

your request for an installment agreement. The reason we

law. We may also give it to cities, states, and the District of

need your name and social security number is to secure

Columbia to carry out their tax laws.

proper identification. We require this information to gain

9465

Cat. No. 14842Y

Form

(Rev. 1-96)

1

1