Itemized Deductions Form-1998

Download a blank fillable Itemized Deductions Form-1998 in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Itemized Deductions Form-1998 with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

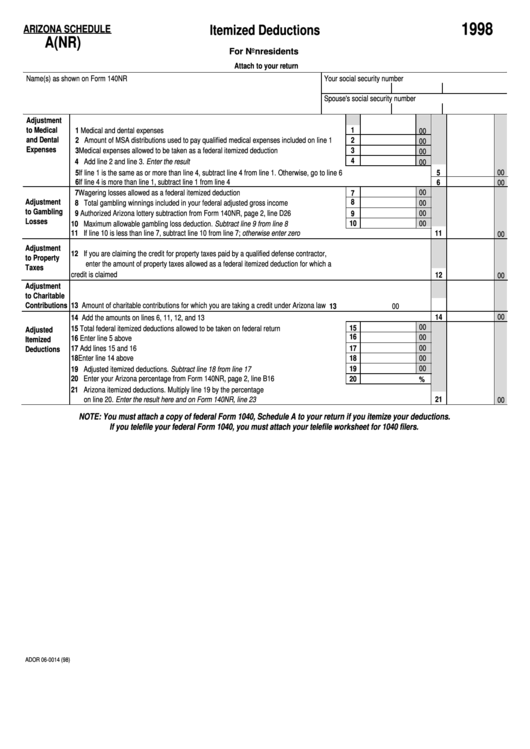

1998

Itemized Deductions

ARIZONA SCHEDULE

A(NR)

For Nonresidents

Attach to your return

Name(s) as shown on Form 140NR

Your social security number

Spouse's social security number

Adjustment

to Medical

1 Medical and dental expenses .................................................................................................

1

00

and Dental

2 Amount of MSA distributions used to pay qualified medical expenses included on line 1

2

00

Expenses

3

3 Medical expenses allowed to be taken as a federal itemized deduction ...............................

00

4

4 Add line 2 and line 3. Enter the result .....................................................................................

00

00

5 If line 1 is the same as or more than line 4, subtract line 4 from line 1. Otherwise, go to line 6 ............................................

5

6 If line 4 is more than line 1, subtract line 1 from line 4 ...........................................................................................................

6

00

00

7 Wagering losses allowed as a federal itemized deduction .....................................................

7

Adjustment

8

00

8 Total gambling winnings included in your federal adjusted gross income .............................

to Gambling

00

9 Authorized Arizona lottery subtraction from Form 140NR, page 2, line D26 .........................

9

Losses

10 Maximum allowable gambling loss deduction. Subtract line 9 from line 8 .............................

10

00

11 If line 10 is less than line 7, subtract line 10 from line 7; otherwise enter zero .......................................................................

11

00

Adjustment

12 If you are claiming the credit for property taxes paid by a qualified defense contractor,

to Property

enter the amount of property taxes allowed as a federal itemized deduction for which a

Taxes

credit is claimed ......................................................................................................................................................................

12

00

Adjustment

to Charitable

Contributions 13 Amount of charitable contributions for which you are taking a credit under Arizona law ........................................................

13

00

00

14

14 Add the amounts on lines 6, 11, 12, and 13 ...........................................................................................................................

00

15

15 Total federal itemized deductions allowed to be taken on federal return ...............................

Adjusted

16

00

16 Enter line 5 above ...................................................................................................................

Itemized

00

17 Add lines 15 and 16 ................................................................................................................

17

Deductions

18 Enter line 14 above .................................................................................................................

18

00

19

00

19 Adjusted itemized deductions. Subtract line 18 from line 17 ..................................................

20 Enter your Arizona percentage from Form 140NR, page 2, line B16 .....................................

20

%

21 Arizona itemized deductions. Multiply line 19 by the percentage

on line 20. Enter the result here and on Form 140NR, line 23 ...............................................................................................

21

00

NOTE: You must attach a copy of federal Form 1040, Schedule A to your return if you itemize your deductions.

If you telefile your federal Form 1040, you must attach your telefile worksheet for 1040 filers.

ADOR 06-0014 (98)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1