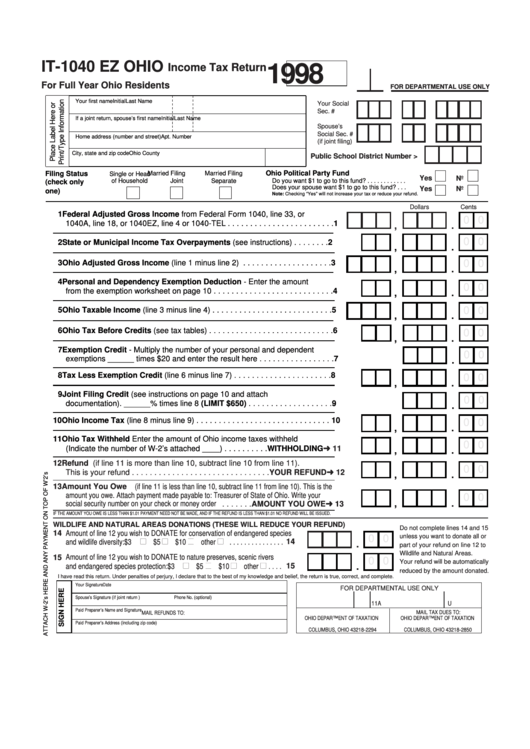

IT-1040 EZ

OHIO

Income Tax Return

1998

For Full Year Ohio Residents

FOR DEPARTMENTAL USE ONLY

Your first name

Initial

Last Name

Your Social

Sec. #

If a joint return, spouse’s first name

Initial

Last Name

Spouse’s

Social Sec. #

Home address (number and street)

Apt. Number

(if joint filing)

City, state and zip code

Ohio County

Public School District Number >

Ohio Political Party Fund

Filing Status

Single or Head

Married Filing

Married Filing

Yes

No

Do you want $1 to go to this fund? . . . . . . . . . . . .

of Household

Joint

Separate

(check only

Does your spouse want $1 to go to this fund? . . .

Yes

No

one)

X

X

X

Note: Checking “Yes” will not increase your tax or reduce your refund.

Dollars

Cents

1 Federal Adjusted Gross Income from Federal Form 1040, line 33, or

0 0

1040A, line 18, or 1040EZ, line 4 or 1040-TEL . . . . . . . . . . . . . . . . . . . . . . . . 1

,

.

0 0

2 State or Municipal Income Tax Overpayments (see instructions) . . . . . . . . 2

,

.

0 0

3 Ohio Adjusted Gross Income (line 1 minus line 2) . . . . . . . . . . . . . . . . . . . . 3

,

.

4 Personal and Dependency Exemption Deduction - Enter the amount

0 0

from the exemption worksheet on page 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

,

.

0 0

5 Ohio Taxable Income (line 3 minus line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

,

.

6 Ohio Tax Before Credits (see tax tables) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

0 0

,

.

7 Exemption Credit - Multiply the number of your personal and dependent

0 0

exemptions ______ times $20 and enter the result here . . . . . . . . . . . . . . . . . 7

.

8 Tax Less Exemption Credit (line 6 minus line 7) . . . . . . . . . . . . . . . . . . . . . . 8

0 0

,

.

9 Joint Filing Credit (see instructions on page 10 and attach

0 0

documentation). ______% times line 8 (LIMIT $650) . . . . . . . . . . . . . . . . . . . 9

.

10 Ohio Income Tax (line 8 minus line 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

0 0

,

.

11 Ohio Tax Withheld Enter the amount of Ohio income taxes withheld

0 0

(Indicate the number of W-2’s attached ____) . . . . . . . . . .WITHHOLDING

11

,

.

12 Refund (if line 11 is more than line 10, subtract line 10 from line 11).

0 0

This is your refund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .YOUR REFUND

12

,

.

13 Amount You Owe (if line 11 is less than line 10, subtract line 11 from line 10). This is the

amount you owe. Attach payment made payable to: Treasurer of State of Ohio. Write your

0 0

,

.

social security number on your check or money order . . . . . . .AMOUNT YOU OWE

13

IF THE AMOUNT YOU OWE IS LESS THAN $1.01 PAYMENT NEED NOT BE MADE, AND IF THE REFUND IS LESS THAN $1.01 NO REFUND WILL BE ISSUED.

WILDLIFE AND NATURAL AREAS DONATIONS (THESE WILL REDUCE YOUR REFUND)

Do not complete lines 14 and 15

14 Amount of line 12 you wish to DONATE for conservation of endangered species

unless you want to donate all or

0 0

and wildlife diversity: $3

$5

$10

other

. . . . . . . . . . . . . . . 14

.

part of your refund on line 12 to

Wildlife and Natural Areas.

15 Amount of line 12 you wish to DONATE to nature preserves, scenic rivers

0 0

Your refund will be automatically

and endangered species protection: $3

$5

$10

other

. . . . 15

.

reduced by the amount donated.

I have read this return. Under penalties of perjury, I declare that to the best of my knowledge and belief, the return is true, correct, and complete.

Your Signature

Date

FOR DEPARTMENTAL USE ONLY

Spouse’s Signature (if joint return )

Phone No. (optional)

11A

U

Paid Preparer’s Name and Signature

MAIL REFUNDS TO:

MAIL TAX DUES TO:

OHIO DEPARTMENT OF TAXATION

OHIO DEPARTMENT OF TAXATION

Paid Preparer’s Address (including zip code)

P.O. BOX 182294

P.O. BOX 182850

COLUMBUS, OHIO 43218-2294

COLUMBUS, OHIO 43218-2850

1

1