Form Gas-1200c - Motor Fuel Claim For Refund Qualified Power Takeoff Vehicles 2004 - North Carolina Department Of Revenue

ADVERTISEMENT

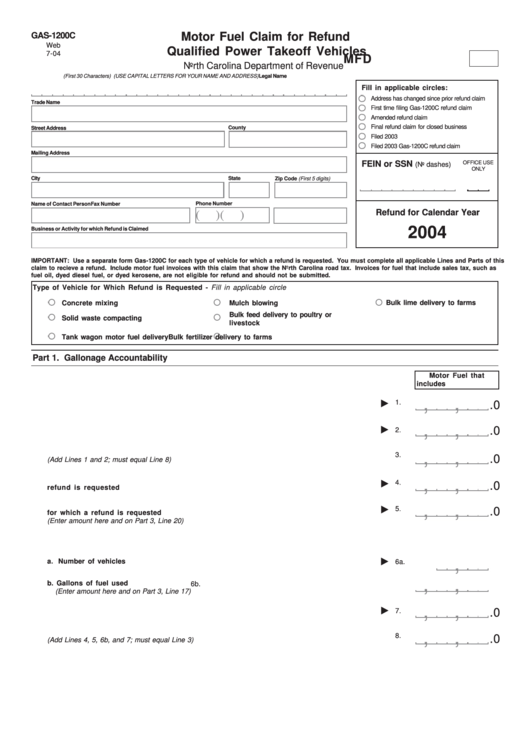

GAS-1200C

Motor Fuel Claim for Refund

Web

Qualified Power Takeoff Vehicles

7-04

MFD

North Carolina Department of Revenue

Legal Name

(First 30 Characters) (USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

Fill in applicable circles:

Address has changed since prior refund claim

Trade Name

First time filing Gas-1200C refund claim

Amended refund claim

Final refund claim for closed business

County

Street Address

Filed 2003 N.C. Income Tax Return

Filed 2003 Gas-1200C refund claim

Mailing Address

FEIN or SSN

OFFICE USE

(No dashes)

ONLY

City

State

Zip Code (First 5 digits)

Name of Contact Person

Phone Number

Fax Number

Refund for Calendar Year

(

)

(

)

2004

Business or Activity for which Refund is Claimed

IMPORTANT: Use a separate form Gas-1200C for each type of vehicle for which a refund is requested. You must complete all applicable Lines and Parts of this

claim to recieve a refund. Include motor fuel invoices with this claim that show the North Carolina road tax. Invoices for fuel that include sales tax, such as

fuel oil, dyed diesel fuel, or dyed kerosene, are not eligible for refund and should not be submitted.

Type of Vehicle for Which Refund is Requested - Fill in applicable circle

Bulk lime delivery to farms

Concrete mixing

Mulch blowing

Bulk feed delivery to poultry or

Solid waste compacting

livestock

Tank wagon motor fuel delivery

Bulk fertilizer delivery to farms

Part 1. Gallonage Accountability

Motor Fuel that

includes N.C. Road Tax

,

,

1.

Beginning inventory of N.C. tax-paid motor fuel on hand at first of year

1.

.0

,

,

.0

2.

Total gallons of N.C. tax-paid motor fuel purchased during 2004

2.

3.

Total gallons of N.C. tax-paid motor fuel to be accounted for

,

,

3.

.0

(Add Lines 1 and 2; must equal Line 8)

4.

Total gallons of N.C. tax-paid motor fuel used in licensed vehicles for which no

,

,

4.

.0

refund is requested

5.

Total gallons of N.C. tax-paid motor fuel used to operate nonhighway equipment

,

,

5.

.0

for which a refund is requested

(Enter amount here and on Part 3, Line 20)

6.

Total gallons of N.C. tax-paid motor fuel used to operate qualified power takeoff vehicles

,

a. Number of vehicles

6a.

,

,

b. Gallons of fuel used

6b.

(Enter amount here and on Part 3, Line 17)

,

,

.0

7.

Ending inventory of N.C. tax-paid motor fuel on hand at end of year

7.

8.

Total gallons of motor fuel accounted for

,

,

8.

.0

(Add Lines 4, 5, 6b, and 7; must equal Line 3)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3