Form Dr 1485 - County Lodging Tax Return Instruction - Coloraado Department Of Revenue

ADVERTISEMENT

DR 1485 (04/29/15)

*DO=NOT=SEND*

COLORADO DEPARTMENT OF REVENUE

Denver CO 80261-0013

(303)238-SERV(7378)

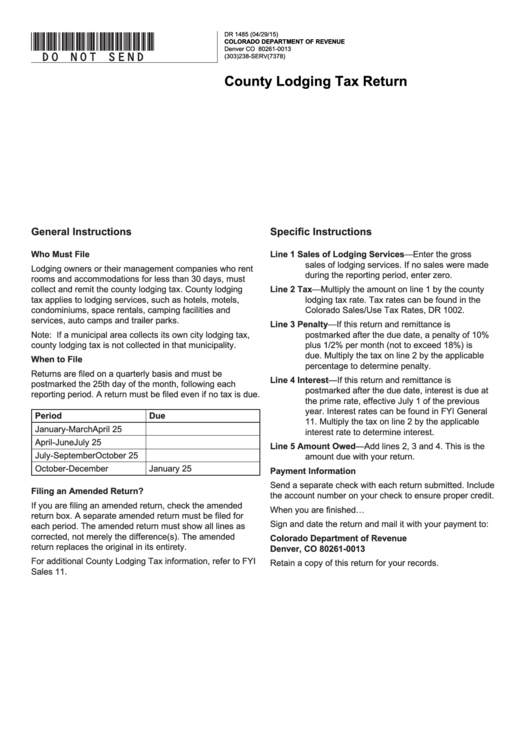

County Lodging Tax Return

General Instructions

Specific Instructions

Who Must File

Line 1

Sales of Lodging Services—Enter the gross

sales of lodging services. If no sales were made

Lodging owners or their management companies who rent

during the reporting period, enter zero.

rooms and accommodations for less than 30 days, must

Line 2

Tax—Multiply the amount on line 1 by the county

collect and remit the county lodging tax. County lodging

tax applies to lodging services, such as hotels, motels,

lodging tax rate. Tax rates can be found in the

condominiums, space rentals, camping facilities and

Colorado Sales/Use Tax Rates, DR 1002.

services, auto camps and trailer parks.

Line 3

Penalty—If this return and remittance is

Note: If a municipal area collects its own city lodging tax,

postmarked after the due date, a penalty of 10%

county lodging tax is not collected in that municipality.

plus 1/2% per month (not to exceed 18%) is

due. Multiply the tax on line 2 by the applicable

When to File

percentage to determine penalty.

Returns are filed on a quarterly basis and must be

Line 4

Interest—If this return and remittance is

postmarked the 25th day of the month, following each

postmarked after the due date, interest is due at

reporting period. A return must be filed even if no tax is due.

the prime rate, effective July 1 of the previous

year. Interest rates can be found in FYI General

Period

Due

11. Multiply the tax on line 2 by the applicable

January-March

April 25

interest rate to determine interest.

April-June

July 25

Line 5

Amount Owed—Add lines 2, 3 and 4. This is the

July-September

October 25

amount due with your return.

October-December

January 25

Payment Information

Send a separate check with each return submitted. Include

Filing an Amended Return?

the account number on your check to ensure proper credit.

If you are filing an amended return, check the amended

When you are finished…

return box. A separate amended return must be filed for

Sign and date the return and mail it with your payment to:

each period. The amended return must show all lines as

corrected, not merely the difference(s). The amended

Colorado Department of Revenue

return replaces the original in its entirety.

Denver, CO 80261-0013

For additional County Lodging Tax information, refer to FYI

Retain a copy of this return for your records.

Sales 11.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1