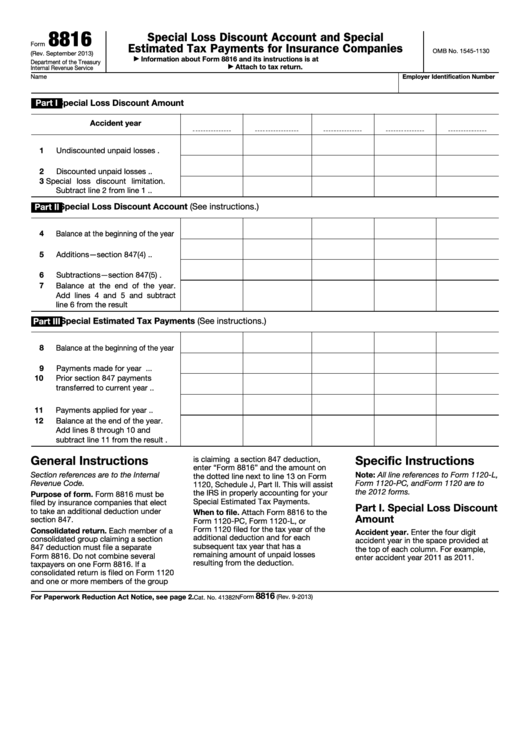

Form 8816 - Special Loss Discount Account And Special Estimated Tax Payments For Insurance Companies

ADVERTISEMENT

8816

Special Loss Discount Account and Special

Form

Estimated Tax Payments for Insurance Companies

OMB No. 1545-1130

(Rev. September 2013)

Information about Form 8816 and its instructions is at

Department of the Treasury

Attach to tax return.

Internal Revenue Service

Name

Employer Identification Number

Part I

Special Loss Discount Amount

Accident year

1

Undiscounted unpaid losses

.

2

Discounted unpaid losses

.

.

3

Special loss discount limitation.

Subtract line 2 from line 1

.

.

Special Loss Discount Account (See instructions.)

Part II

4

Balance at the beginning of the year

5

Additions—section 847(4)

.

.

6

Subtractions—section 847(5)

.

7

Balance at the end of the year.

Add lines 4 and 5 and subtract

line 6 from the result .

.

.

.

Special Estimated Tax Payments (See instructions.)

Part III

8

Balance at the beginning of the year

9

Payments made for year .

.

.

10

Prior section 847 payments

transferred to current year

.

.

11

Payments applied for year

.

.

12

Balance at the end of the year.

Add lines 8 through 10 and

subtract line 11 from the result .

General Instructions

is claiming a section 847 deduction,

Specific Instructions

enter “Form 8816” and the amount on

Section references are to the Internal

Note: All line references to Form 1120-L,

the dotted line next to line 13 on Form

Revenue Code.

Form 1120-PC, and Form 1120 are to

1120, Schedule J, Part II. This will assist

the 2012 forms.

the IRS in properly accounting for your

Purpose of form. Form 8816 must be

Special Estimated Tax Payments.

filed by insurance companies that elect

Part I. Special Loss Discount

to take an additional deduction under

When to file. Attach Form 8816 to the

Amount

section 847.

Form 1120-PC, Form 1120-L, or

Form 1120 filed for the tax year of the

Consolidated return. Each member of a

Accident year. Enter the four digit

additional deduction and for each

consolidated group claiming a section

accident year in the space provided at

subsequent tax year that has a

847 deduction must file a separate

the top of each column. For example,

remaining amount of unpaid losses

Form 8816. Do not combine several

enter accident year 2011 as 2011.

resulting from the deduction.

taxpayers on one Form 8816. If a

consolidated return is filed on Form 1120

and one or more members of the group

8816

For Paperwork Reduction Act Notice, see page 2.

Form

(Rev. 9-2013)

Cat. No. 41382N

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1