Form Lgt 142 - Instructions For Filing Credits Against County Taxes

ADVERTISEMENT

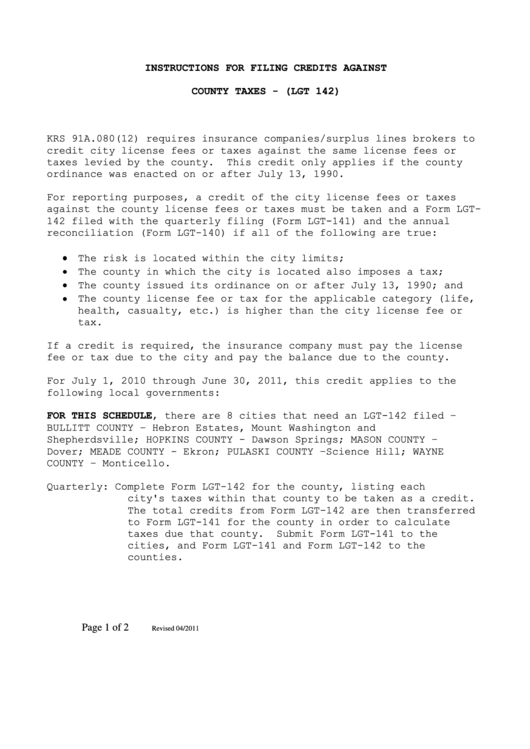

INSTRUCTIONS FOR FILING CREDITS AGAINST

COUNTY TAXES - (LGT 142)

KRS 91A.080(12) requires insurance companies/surplus lines brokers to

credit city license fees or taxes against the same license fees or

taxes levied by the county.

This credit only applies if the county

ordinance was enacted on or after July 13, 1990.

For reporting purposes, a credit of the city license fees or taxes

against the county license fees or taxes must be taken and a Form LGT-

142 filed with the quarterly filing (Form LGT-141) and the annual

reconciliation (Form LGT-140) if all of the following are true:

The risk is located within the city limits;

The county in which the city is located also imposes a tax;

The county issued its ordinance on or after July 13, 1990; and

The county license fee or tax for the applicable category (life,

health, casualty, etc.) is higher than the city license fee or

tax.

If a credit is required, the insurance company must pay the license

fee or tax due to the city and pay the balance due to the county.

For July 1, 2010 through June 30, 2011, this credit applies to the

following local governments:

FOR THIS SCHEDULE, there are 8 cities that need an LGT-142 filed –

BULLITT COUNTY – Hebron Estates, Mount Washington and

Shepherdsville; HOPKINS COUNTY - Dawson Springs; MASON COUNTY –

Dover; MEADE COUNTY - Ekron; PULASKI COUNTY –Science Hill; WAYNE

COUNTY – Monticello.

Quarterly:

Complete Form LGT-142 for the county, listing each

city's taxes within that county to be taken as a credit.

The total credits from Form LGT-142 are then transferred

to Form LGT-141 for the county in order to calculate

taxes due that county.

Submit Form LGT-141 to the

cities, and Form LGT-141 and Form LGT-142 to the

counties.

Page 1 of 2

Revised 04/2011

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2