Form Cbt-160-A - Underpayment Of Estimated N.j. Corporation Business Tax

ADVERTISEMENT

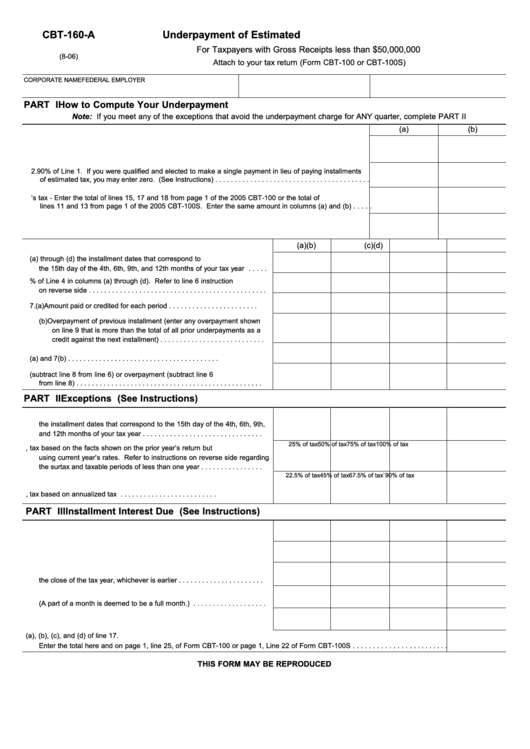

CBT-160-A

Underpayment of Estimated N.J. Corporation Business Tax

N.J. Division of Taxation

For Taxpayers with Gross Receipts less than $50,000,000

(8-06)

Attach to your tax return (Form CBT-100 or CBT-100S)

CORPORATE NAME

FEDERAL EMPLOYER I.D. NUMBER

N.J. CORPORATION NUMBER

PART I

How to Compute Your Underpayment

Note: If you meet any of the exceptions that avoid the underpayment charge for ANY quarter, complete PART II

(a)

(b)

1. Amount of 2006 Tax - Refer to line 1 instruction on reverse side. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. 90% of Line 1. If you were qualified and elected to make a single payment in lieu of paying installments

of estimated tax, you may enter zero. (See Instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3. Prior year’s tax - Enter the total of lines 15, 17 and 18 from page 1 of the 2005 CBT-100 or the total of

lines 11 and 13 from page 1 of the 2005 CBT-100S. Enter the same amount in columns (a) and (b) . . . . .

4. Enter the lesser of Lines 2 or 3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(a)

(b)

(c)

(d)

5. Enter in columns (a) through (d) the installment dates that correspond to

the 15th day of the 4th, 6th, 9th, and 12th months of your tax year . . . . .

6. Enter 25% of Line 4 in columns (a) through (d). Refer to line 6 instruction

on reverse side . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7. (a) Amount paid or credited for each period . . . . . . . . . . . . . . . . . . . . . . .

(b) Overpayment of previous installment (enter any overpayment shown

on line 9 that is more than the total of all prior underpayments as a

credit against the next installment) . . . . . . . . . . . . . . . . . . . . . . . . . . .

8. Add lines 7(a) and 7(b) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9. Underpayment (subtract line 8 from line 6) or overpayment (subtract line 6

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

from line 8)

PART II

Exceptions (See Instructions)

10. Total amount paid or credited from the beginning of the tax year through

the installment dates that correspond to the 15th day of the 4th, 6th, 9th,

and 12th months of your tax year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25% of tax

50% of tax

75% of tax

100% of tax

11. Exception 1, tax based on the facts shown on the prior year’s return but

using current year’s rates. Refer to instructions on reverse side regarding

the surtax and taxable periods of less than one year . . . . . . . . . . . . . . . .

22.5% of tax

45% of tax

67.5% of tax`

90% of tax

12. Exception 2, tax based on annualized tax . . . . . . . . . . . . . . . . . . . . . . . . .

PART III

Installment Interest Due (See Instructions)

13. Amount of underpayment from line 9 . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14. Enter same installment dates used above at line 5 . . . . . . . . . . . . . . . . . .

15. Enter the date of payment or the 15th day of the 4th month after

the close of the tax year, whichever is earlier . . . . . . . . . . . . . . . . . . . . . .

16. Number of months from the date on line 14 to the date on line 15.

(A part of a month is deemed to be a full month.) . . . . . . . . . . . . . . . . . . .

17. Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18. Installment interest due - Add columns (a), (b), (c), and (d) of line 17.

Enter the total here and on page 1, line 25, of Form CBT-100 or page 1, Line 22 of Form CBT-100S . . . . . . . . . . . . . . . . . . . . . . . .

THIS FORM MAY BE REPRODUCED

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1