Instructions For Schedule C (Form 1065) - Additional Information For Schedule M-3 Filers - 2011

ADVERTISEMENT

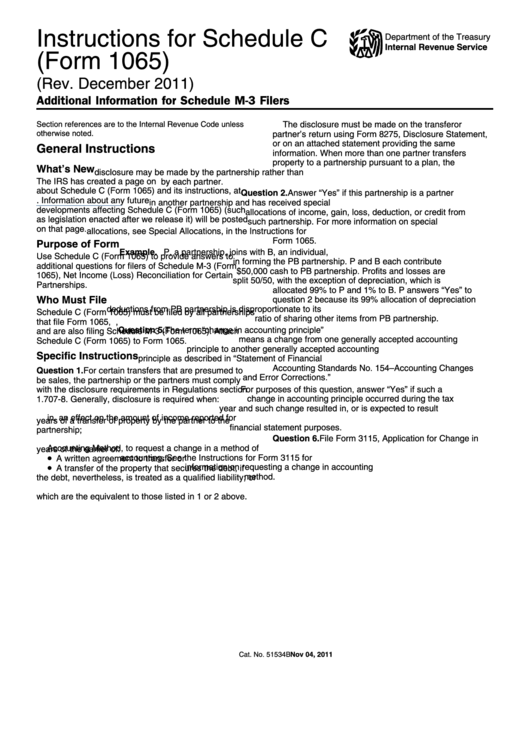

Instructions for Schedule C

Department of the Treasury

Internal Revenue Service

(Form 1065)

(Rev. December 2011)

Additional Information for Schedule M-3 Filers

Section references are to the Internal Revenue Code unless

The disclosure must be made on the transferor

otherwise noted.

partner’s return using Form 8275, Disclosure Statement,

or on an attached statement providing the same

General Instructions

information. When more than one partner transfers

property to a partnership pursuant to a plan, the

What’s New

disclosure may be made by the partnership rather than

The IRS has created a page on IRS.gov for information

by each partner.

about Schedule C (Form 1065) and its instructions, at

Question 2. Answer “Yes” if this partnership is a partner

Information about any future

in another partnership and has received special

developments affecting Schedule C (Form 1065) (such

allocations of income, gain, loss, deduction, or credit from

as legislation enacted after we release it) will be posted

such partnership. For more information on special

on that page.

allocations, see Special Allocations, in the Instructions for

Form 1065.

Purpose of Form

Example. P, a partnership, joins with B, an individual,

Use Schedule C (Form 1065) to provide answers to

in forming the PB partnership. P and B each contribute

additional questions for filers of Schedule M-3 (Form

$50,000 cash to PB partnership. Profits and losses are

1065), Net Income (Loss) Reconciliation for Certain

split 50/50, with the exception of depreciation, which is

Partnerships.

allocated 99% to P and 1% to B. P answers “Yes” to

Who Must File

question 2 because its 99% allocation of depreciation

deductions from PB partnership is disproportionate to its

Schedule C (Form 1065) must be filed by all partnerships

ratio of sharing other items from PB partnership.

that file Form 1065, U.S. Return of Partnership Income,

Question 5. The term “change in accounting principle”

and are also filing Schedule M-3 (Form 1065). Attach

means a change from one generally accepted accounting

Schedule C (Form 1065) to Form 1065.

principle to another generally accepted accounting

Specific Instructions

principle as described in “Statement of Financial

Accounting Standards No. 154–Accounting Changes

Question 1. For certain transfers that are presumed to

and Error Corrections.”

be sales, the partnership or the partners must comply

For purposes of this question, answer “Yes” if such a

with the disclosure requirements in Regulations section

change in accounting principle occurred during the tax

1.707-8. Generally, disclosure is required when:

year and such change resulted in, or is expected to result

1. Certain transfers to a partner are made within two

in, an effect on the amount of income reported for

years of a transfer of property by the partner to the

financial statement purposes.

partnership;

Question 6. File Form 3115, Application for Change in

2. Certain debt is incurred by a partner within two

Accounting Method, to request a change in a method of

years of the earlier of:

•

accounting. See the Instructions for Form 3115 for

A written agreement to transfer or

•

information on requesting a change in accounting

A transfer of the property that secures the debt, if

method.

the debt, nevertheless, is treated as a qualified liability; or

3. Transfers from a partnership to a partner occur

which are the equivalent to those listed in 1 or 2 above.

Nov 04, 2011

Cat. No. 51534B

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1