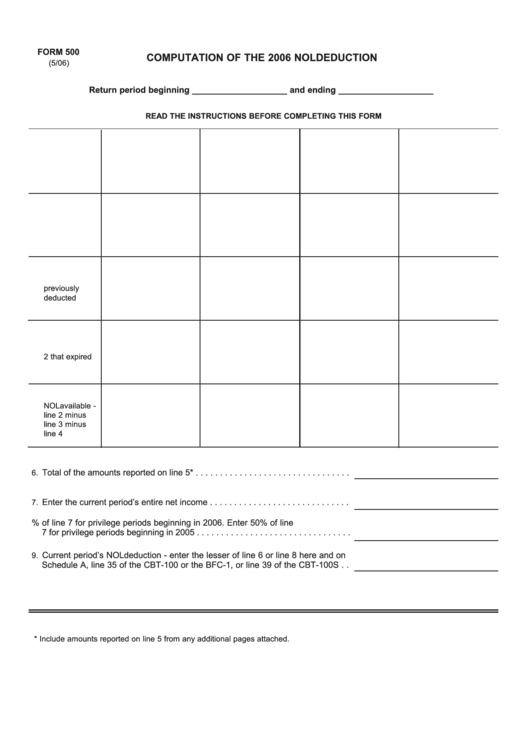

Form 500 - Computation Of The 2006 Nol Deduction

ADVERTISEMENT

FORM 500

COMPUTATION OF THE 2006 NOL DEDUCTION

(5/06)

Return period beginning ____________________ and ending ____________________

READ THE INSTRUCTIONS BEFORE COMPLETING THIS FORM

1. Return period

2. Entire net loss

3. Portion of line 2

previously

deducted

4. Portion of line

2 that expired

5. Current period

NOL available -

line 2 minus

line 3 minus

line 4

Total of the amounts reported on line 5* . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

Enter the current period’s entire net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

8. Enter 100% of line 7 for privilege periods beginning in 2006. Enter 50% of line

7 for privilege periods beginning in 2005 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Current period’s NOL deduction - enter the lesser of line 6 or line 8 here and on

9.

Schedule A, line 35 of the CBT-100 or the BFC-1, or line 39 of the CBT-100S . .

* Include amounts reported on line 5 from any additional pages attached.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2