Form St-101.2 - Taxes On Selected Sales And Services

ADVERTISEMENT

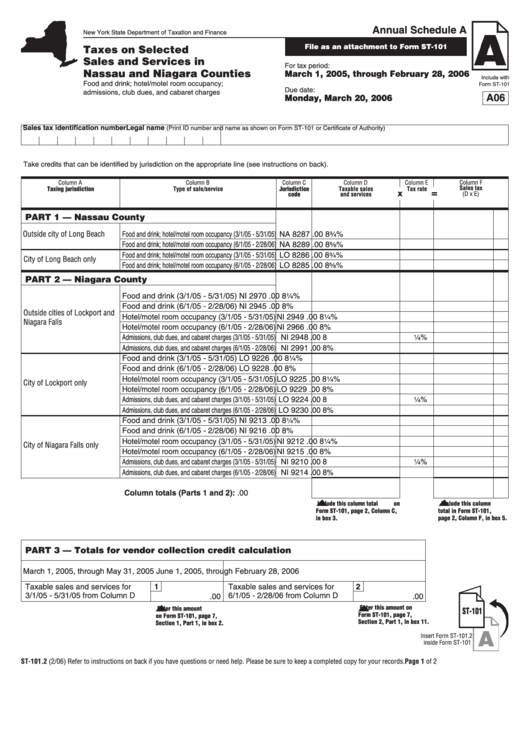

Annual Schedule A

New York State Department of Taxation and Finance

File as an attachment to Form ST-101

Taxes on Selected

Sales and Services in

For tax period:

Nassau and Niagara Counties

March 1, 2005, through February 28, 2006

Include with

Food and drink; hotel/motel room occupancy;

Form ST-101

Due date:

admissions, club dues, and cabaret charges

A06

Monday, March 20, 2006

Sales tax identification number

Legal name

(Print ID number and name as shown on Form ST-101 or Certificate of Authority)

Take credits that can be identified by jurisdiction on the appropriate line (see instructions on back).

Column A

Column B

Column C

Column D

Column E

Column F

Sales tax

Taxing jurisdiction

Type of sale/service

Jurisdiction

Taxable sales

Tax rate

=

(D x E)

code

and services

X

PART 1 — Nassau County

Outside city of Long Beach

Food and drink; hotel/motel room occupancy (3/1/05 - 5/31/05) NA 8287

.00

8:%

Food and drink; hotel/motel room occupancy (6/1/05 - 2/28/06) NA 8289

.00

8e%

Food and drink; hotel/motel room occupancy (3/1/05 - 5/31/05) LO 8286

.00

8:%

City of Long Beach only

Food and drink; hotel/motel room occupancy (6/1/05 - 2/28/06) LO 8285

.00

8e%

PART 2 — Niagara County

Food and drink (3/1/05 - 5/31/05)

NI 2970

.00

83%

Food and drink (6/1/05 - 2/28/06)

NI 2945

.00

8%

Outside cities of Lockport and

Hotel/motel room occupancy (3/1/05 - 5/31/05) NI 2949

.00

83%

Niagara Falls

Hotel/motel room occupancy (6/1/05 - 2/28/06) NI 2966

.00

8%

Admissions, club dues, and cabaret charges (3/1/05 - 5/31/05) NI 2948

.00

83%

Admissions, club dues, and cabaret charges (6/1/05 - 2/28/06) NI 2991

.00

8%

Food and drink (3/1/05 - 5/31/05)

LO 9226

.00

83%

Food and drink (6/1/05 - 2/28/06)

LO 9228

.00

8%

Hotel/motel room occupancy (3/1/05 - 5/31/05) LO 9225

.00

83%

City of Lockport only

Hotel/motel room occupancy (6/1/05 - 2/28/06) LO 9229

.00

8%

Admissions, club dues, and cabaret charges (3/1/05 - 5/31/05) LO 9224

.00

83%

Admissions, club dues, and cabaret charges (6/1/05 - 2/28/06) LO 9230

.00

8%

Food and drink (3/1/05 - 5/31/05)

NI 9213

.00

83%

Food and drink (6/1/05 - 2/28/06)

NI 9216

.00

8%

Hotel/motel room occupancy (3/1/05 - 5/31/05) NI 9212

.00

83%

City of Niagara Falls only

Hotel/motel room occupancy (6/1/05 - 2/28/06) NI 9215

.00

8%

Admissions, club dues, and cabaret charges (3/1/05 - 5/31/05) NI 9210

.00

83%

Admissions, club dues, and cabaret charges (6/1/05 - 2/28/06) NI 9214

.00

8%

Column totals (Parts 1 and 2):

.00

Include this column total on

Include this column

Form ST-101, page 2, Column C,

total in Form ST-101,

in box 3.

page 2, Column F, in box 5.

PART 3 — Totals for vendor collection credit calculation

March 1, 2005, through May 31, 2005

June 1, 2005, through February 28, 2006

1

2

Taxable sales and services for

Taxable sales and services for

3/1/05 - 5/31/05 from Column D

6/1/05 - 2/28/06 from Column D

.00

.00

Enter this amount on

Enter this amount

ST-101

Form ST-101, page 7,

on Form ST-101, page 7,

Section 2, Part 1, in box 11.

Section 1, Part 1, in box 2.

A

Insert Form ST-101.2

inside Form ST-101

ST-101.2 (2/06)

Refer to instructions on back if you have questions or need help.

Please be sure to keep a completed copy for your records.

Page 1 of 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1