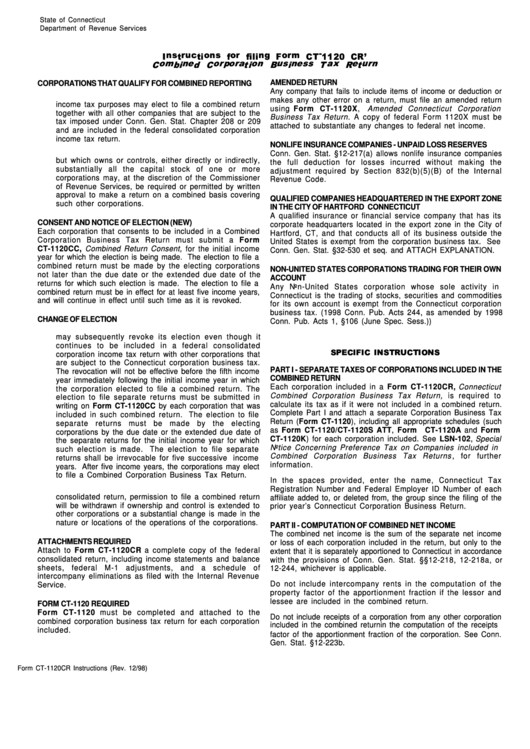

Form Ct-1120cr - Instructions For Filling Form

ADVERTISEMENT

State of Connecticut

Department of Revenue Services

AMENDED RETURN

CORPORATIONS THAT QUALIFY FOR COMBINED REPORTING

Any company that fails to include items of income or deduction or

A.

Any taxpayer included in a consolidated return for federal

makes any other error on a return, must file an amended return

income tax purposes may elect to file a combined return

using Form CT-1120X, Amended Connecticut Corporation

together with all other companies that are subject to the

Business Tax Return . A copy of federal Form 1120X must be

tax imposed under Conn. Gen. Stat. Chapter 208 or 209

attached to substantiate any changes to federal net income.

and are included in the federal consolidated corporation

income tax return.

NONLIFE INSURANCE COMPANIES - UNPAID LOSS RESERVES

B.

Any taxpayer not included in a federal consolidated return

Conn. Gen. Stat. §12-217(a) allows nonlife insurance companies

but which owns or controls, either directly or indirectly,

the full deduction for losses incurred without making the

substantially all the capital stock of one or more

adjustment required by Section 832(b)(5)(B) of the Internal

corporations may, at the discretion of the Commissioner

Revenue Code.

of Revenue Services, be required or permitted by written

approval to make a return on a combined basis covering

QUALIFIED COMPANIES HEADQUARTERED IN THE EXPORT ZONE

such other corporations.

IN THE CITY OF HARTFORD CONNECTICUT

A qualified insurance or financial service company that has its

CONSENT AND NOTICE OF ELECTION (NEW)

corporate headquarters located in the export zone in the City of

Each corporation that consents to be included in a Combined

Hartford, CT, and that conducts all of its business outside the

Corporation Business Tax Return must submit a Form

United States is exempt from the corporation business tax. See

CT-1120CC, Combined Return Consent, for the initial income

Conn. Gen. Stat. §32-530 et seq. and ATTACH EXPLANATION.

year for which the election is being made. The election to file a

combined return must be made by the electing corporations

NON-UNITED STATES CORPORATIONS TRADING FOR THEIR OWN

not later than the due date or the extended due date of the

ACCOUNT

returns for which such election is made. The election to file a

Any Non-United States corporation whose sole activity in

combined return must be in effect for at least five income years,

Connecticut is the trading of stocks, securities and commodities

and will continue in effect until such time as it is revoked.

for its own account is exempt from the Connecticut corporation

business tax. (1998 Conn. Pub. Acts 244, as amended by 1998

CHANGE OF ELECTION

Conn. Pub. Acts 1, §106 (June Spec. Sess.))

A.

Any corporation that has elected to file a combined return

may subsequently revoke its election even though it

continues to be included in a federal consolidated

corporation income tax return with other corporations that

are subject to the Connecticut corporation business tax.

PART I - SEPARATE TAXES OF CORPORATIONS INCLUDED IN THE

The revocation will not be effective before the fifth income

COMBINED RETURN

year immediately following the initial income year in which

Each corporation included in a Form CT-1120CR, Connecticut

the corporation elected to file a combined return. The

Combined Corporation Business Tax Return, is required to

election to file separate returns must be submitted in

calculate its tax as if it were not included in a combined return.

writing on Form CT-1120CC by each corporation that was

Complete Part I and attach a separate Corporation Business Tax

included in such combined return. The election to file

Return (Form CT-1120), including all appropriate schedules (such

separate returns must be made by the electing

as Form CT-1120/CT-1120S ATT, Form

CT-1120A and Form

corporations by the due date or the extended due date of

CT-1120K) for each corporation included. See LSN-102, Special

the separate returns for the initial income year for which

Notice Concerning Preference Tax on Companies included in

such election is made. The election to file separate

Combined Corporation Business Tax Returns , for further

returns shall be irrevocable for five successive income

information.

years. After five income years, the corporations may elect

to file a Combined Corporation Business Tax Return.

In the spaces provided, enter the name, Connecticut Tax

B.

In the case of a corporation not included in a federal

Registration Number and Federal Employer ID Number of each

consolidated return, permission to file a combined return

affiliate added to, or deleted from, the group since the filing of the

will be withdrawn if ownership and control is extended to

prior year’s Connecticut Corporation Business Return.

other corporations or a substantial change is made in the

nature or locations of the operations of the corporations.

PART II - COMPUTATION OF COMBINED NET INCOME

The combined net income is the sum of the separate net income

ATTACHMENTS REQUIRED

or loss of each corporation included in the return, but only to the

Attach to Form CT-1120CR a complete copy of the federal

extent that it is separately apportioned to Connecticut in accordance

consolidated return, including income statements and balance

with the provisions of Conn. Gen. Stat. §§12-218, 12-218a, or

sheets, federal M-1 adjustments, and a schedule of

12-244, whichever is applicable.

intercompany eliminations as filed with the Internal Revenue

Do not include intercompany rents in the computation of the

Service.

property factor of the apportionment fraction if the lessor and

lessee are included in the combined return.

FORM CT-1120 REQUIRED

Form CT-1120 must be completed and attached to the

Do not include receipts of a corporation from any other corporation

combined corporation business tax return for each corporation

included in the combined return in the computation of the receipts

included.

factor of the apportionment fraction of the corporation. See Conn.

Gen. Stat. §12-223b.

Form CT-1120CR Instructions (Rev. 12/98)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4