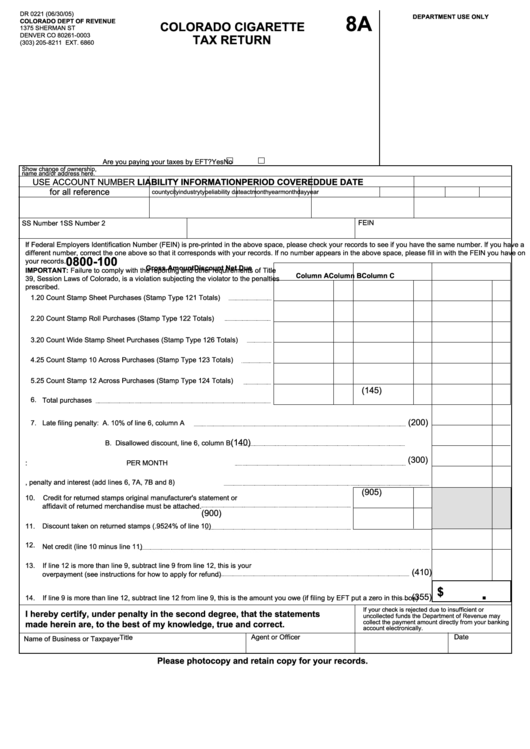

Form 8a - Colorado Cigarette Tax Return - Colorado Department Of Revenue

ADVERTISEMENT

DR 0221 (06/30/05)

DEPARTMENT USE ONLY

8A

COLORADO DEPT OF REVENUE

COLORADO CIGARETTE

1375 SHERMAN ST

DENVER CO 80261-0003

TAX RETURN

(303) 205-8211 EXT. 6860

Are you paying your taxes by EFT?

Yes

No

Show change of ownership,

name and/or address here.

USE ACCOUNT NUMBER

LIABILITY INFORMATION

PERIOD COVERED

DUE DATE

for all reference

county

city

industry

type

liability date

act

month

year

month

day

year

FEIN

SS Number 1

SS Number 2

If Federal Employers Identification Number (FEIN) is pre-printed in the above space, please check your records to see if you have the same number. If you have a

different number, correct the one above so that it corresponds with your records. If no number appears in the above space, please fill in with the FEIN you have on

0800-100

your records.

Gross Amount

Discount

Net Due

IMPORTANT: Failure to comply with the reporting and other requirements of Title

Column A

Column B

Column C

39, Session Laws of Colorado, is a violation subjecting the violator to the penalties

prescribed.

1. 20 Count Stamp Sheet Purchases (Stamp Type 121 Totals)

2. 20 Count Stamp Roll Purchases (Stamp Type 122 Totals)

3. 20 Count Wide Stamp Sheet Purchases (Stamp Type 126 Totals)

4. 25 Count Stamp 10 Across Purchases (Stamp Type 123 Totals)

5. 25 Count Stamp 12 Across Purchases (Stamp Type 124 Totals)

(145)

6. Total purchases

(200)

Late filing penalty: A. 10% of line 6, column A

7.

(140)

B. Disallowed discount, line 6, column B

(300)

8.

Late filing interest:

PER MONTH

9.

Total of tax, penalty and interest (add lines 6, 7A, 7B and 8)

(905)

10.

Credit for returned stamps original manufacturer's statement or

affidavit of returned merchandise must be attached.

(900)

Discount taken on returned stamps (.9524% of line 10)

11.

12.

Net credit (line 10 minus line 11)

13.

If line 12 is more than line 9, subtract line 9 from line 12, this is your

(410)

overpayment (see instructions for how to apply for refund)

.

$

(355)

14.

If line 9 is more than line 12, subtract line 12 from line 9, this is the amount you owe (if filing by EFT put a zero in this box)

If your check is rejected due to insufficient or

I hereby certify, under penalty in the second degree, that the statements

uncollected funds the Department of Revenue may

collect the payment amount directly from your banking

made herein are, to the best of my knowledge, true and correct.

account electronically.

Agent or Officer

Title

Date

Name of Business or Taxpayer

Please photocopy and retain copy for your records.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2