Form Ct-8801 Line Instructions

ADVERTISEMENT

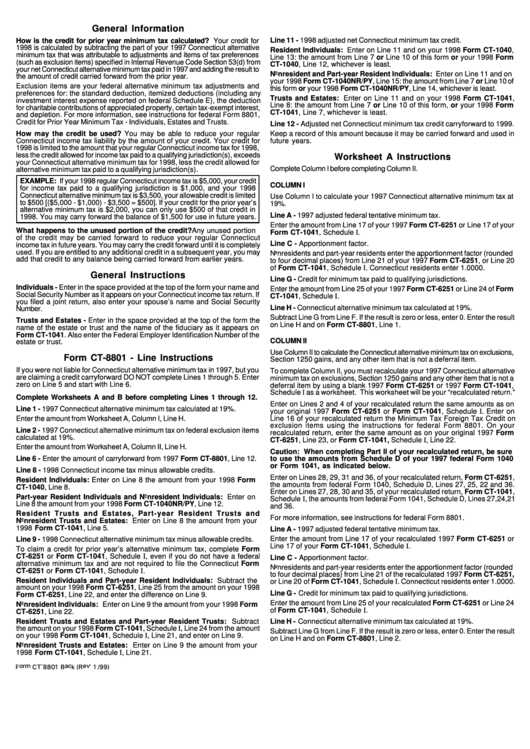

General Information

How is the credit for prior year minimum tax calculated? Your credit for

Line 11 - 1998 adjusted net Connecticut minimum tax credit.

1998 is calculated by subtracting the part of your 1997 Connecticut alternative

Resident Individuals: Enter on Line 11 and on your 1998 Form CT-1040,

minimum tax that was attributable to adjustments and items of tax preferences

Line 13: the amount from Line 7 or Line 10 of this form or your 1998 Form

(such as exclusion items) specified in Internal Revenue Code Section 53(d) from

CT-1040, Line 12, whichever is least.

your net Connecticut alternative minimum tax paid in 1997 and adding the result to

Nonresident and Part-year Resident Individuals: Enter on Line 11 and on

the amount of credit carried forward from the prior year.

your 1998 Form CT-1040NR/PY, Line 15: the amount from Line 7 or Line 10 of

Exclusion items are your federal alternative minimum tax adjustments and

this form or your 1998 Form CT-1040NR/PY, Line 14, whichever is least.

preferences for: the standard deduction, itemized deductions (including any

Trusts and Estates: Enter on Line 11 and on your 1998 Form CT-1041,

investment interest expense reported on federal Schedule E), the deduction

Line 8: the amount from Line 7 or Line 10 of this form, or your 1998 Form

for charitable contributions of appreciated property, certain tax-exempt interest,

CT-1041, Line 7, whichever is least.

and depletion. For more information, see instructions for federal Form 8801,

Credit for Prior Year Minimum Tax - Individuals, Estates and Trusts.

Line 12 - Adjusted net Connecticut minimum tax credit carryforward to 1999.

How may the credit be used? You may be able to reduce your regular

Keep a record of this amount because it may be carried forward and used in

Connecticut income tax liability by the amount of your credit. Your credit for

future years.

1998 is limited to the amount that your regular Connecticut income tax for 1998,

less the credit allowed for income tax paid to a qualifying jurisdiction(s), exceeds

Worksheet A Instructions

your Connecticut alternative minimum tax for 1998, less the credit allowed for

Complete Column I before completing Column II.

alternative minimum tax paid to a qualifying jurisdiction(s).

EXAMPLE: If your 1998 regular Connecticut income tax is $5,000, your credit

COLUMN I

for income tax paid to a qualifying jurisdiction is $1,000, and your 1998

Connecticut alternative minimum tax is $3,500, your allowable credit is limited

Use Column I to calculate your 1997 Connecticut alternative minimum tax at

to $500 [($5,000 - $1,000) - $3,500 = $500]. If your credit for the prior year’s

19%.

alternative minimum tax is $2,000, you can only use $500 of that credit in

Line A - 1997 adjusted federal tentative minimum tax.

1998. You may carry forward the balance of $1,500 for use in future years.

Enter the amount from Line 17 of your 1997 Form CT-6251 or Line 17 of your

What happens to the unused portion of the credit? Any unused portion

Form CT-1041, Schedule I.

of the credit may be carried forward to reduce your regular Connecticut

Line C - Apportionment factor.

income tax in future years. You may carry the credit forward until it is completely

used. If you are entitled to any additional credit in a subsequent year, you may

Nonresidents and part-year residents enter the apportionment factor (rounded

add that credit to any balance being carried forward from earlier years.

to four decimal places) from Line 21 of your 1997 Form CT-6251, or Line 20

of Form CT-1041, Schedule I . Connecticut residents enter 1.0000.

General Instructions

Line G - Credit for minimum tax paid to qualifying jurisdictions.

Individuals - Enter in the space provided at the top of the form your name and

Enter the amount from Line 25 of your 1997 Form CT-6251 or Line 24 of Form

Social Security Number as it appears on your Connecticut income tax return. If

CT-1041, Schedule I .

you filed a joint return, also enter your spouse’s name and Social Security

Line H - Connecticut alternative minimum tax calculated at 19%.

Number.

Subtract Line G from Line F. If the result is zero or less, enter 0. Enter the result

Trusts and Estates - Enter in the space provided at the top of the form the

on Line H and on Form CT-8801, Line 1.

name of the estate or trust and the name of the fiduciary as it appears on

Form CT-1041. Also enter the Federal Employer Identification Number of the

COLUMN II

estate or trust.

Use Column II to calculate the Connecticut alternative minimum tax on exclusions,

Form CT-8801 - Line Instructions

Section 1250 gains, and any other item that is not a deferral item.

If you were not liable for Connecticut alternative minimum tax in 1997, but you

To complete Column II, you must recalculate your 1997 Connecticut alternative

are claiming a credit carryforward DO NOT complete Lines 1 through 5. Enter

minimum tax on exclusions, Section 1250 gains and any other item that is not a

zero on Line 5 and start with Line 6.

deferral item by using a blank 1997 Form CT-6251 or 1997 Form CT-1041,

Schedule I as a worksheet. This worksheet will be your “recalculated return.”

Complete Worksheets A and B before completing Lines 1 through 12.

Enter on Lines 2 and 4 of your recalculated return the same amounts as on

Line 1 - 1997 Connecticut alternative minimum tax calculated at 19%.

your original 1997 Form CT-6251 or Form CT-1041, Schedule I . Enter on

Line 16 of your recalculated return the Minimum Tax Foreign Tax Credit on

Enter the amount from Worksheet A, Column I, Line H.

exclusion items using the instructions for federal Form 8801. On your

Line 2 - 1997 Connecticut alternative minimum tax on federal exclusion items

recalculated return, enter the same amount as on your original 1997 Form

calculated at 19%.

CT-6251, Line 23, or Form CT-1041, Schedule I , Line 22.

Enter the amount from Worksheet A, Column II, Line H.

Caution: When completing Part II of your recalculated return, be sure

Line 6 - Enter the amount of carryforward from 1997 Form CT-8801, Line 12.

to use the amounts from Schedule D of your 1997 federal Form 1040

or Form 1041, as indicated below.

Line 8 - 1998 Connecticut income tax minus allowable credits.

Enter on Lines 28, 29, 31 and 36, of your recalculated return, Form CT-6251,

Resident Individuals: Enter on Line 8 the amount from your 1998 Form

the amounts from federal Form 1040, Schedule D, Lines 27, 25, 22 and 36.

CT-1040, Line 8.

Enter on Lines 27, 28, 30 and 35, of your recalculated return, Form CT-1041,

Part-year Resident Individuals and Nonresident Individuals: Enter on

Schedule I , the amounts from federal Form 1041, Schedule D, Lines 27,24,21

Line 8 the amount from your 1998 Form CT-1040NR/PY, Line 12.

and 36.

Resident Trusts and Estates, Part-year Resident Trusts and

For more information, see instructions for federal Form 8801.

Nonresident Trusts and Estates: Enter on Line 8 the amount from your

1998 Form CT-1041, Line 5.

Line A - 1997 adjusted federal tentative minimum tax.

Enter the amount from Line 17 of your recalculated 1997 Form CT-6251 or

Line 9 - 1998 Connecticut alternative minimum tax minus allowable credits.

Line 17 of your Form CT-1041, Schedule I .

To claim a credit for prior year’s alternative minimum tax, complete Form

CT-6251 or Form CT-1041, Schedule I , even if you do not have a federal

Line C - Apportionment factor.

alternative minimum tax and are not required to file the Connecticut Form

Nonresidents and part-year residents enter the apportionment factor (rounded

CT-6251 or Form CT-1041, Schedule I .

to four decimal places) from Line 21 of the recalculated 1997 Form CT-6251,

Resident Individuals and Part-year Resident Individuals: Subtract the

or Line 20 of Form CT-1041, Schedule I . Connecticut residents enter 1.0000.

amount on your 1998 Form CT-6251, Line 25 from the amount on your 1998

Line G - Credit for minimum tax paid to qualifying jurisdictions.

Form CT-6251, Line 22, and enter the difference on Line 9.

Enter the amount from Line 25 of your recalculated Form CT-6251 or Line 24

Nonresident Individuals: Enter on Line 9 the amount from your 1998 Form

of Form CT-1041, Schedule I .

CT-6251, Line 22.

Resident Trusts and Estates and Part-year Resident Trusts: Subtract

Line H - Connecticut alternative minimum tax calculated at 19%.

the amount on your 1998 Form CT-1041, Schedule I , Line 24 from the amount

Subtract Line G from Line F. If the result is zero or less, enter 0. Enter the result

on your 1998 Form CT-1041, Schedule I , Line 21, and enter on Line 9.

on Line H and on Form CT-8801, Line 2.

Nonresident Trusts and Estates: Enter on Line 9 the amount from your

1998 Form CT-1041, Schedule I , Line 21.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1