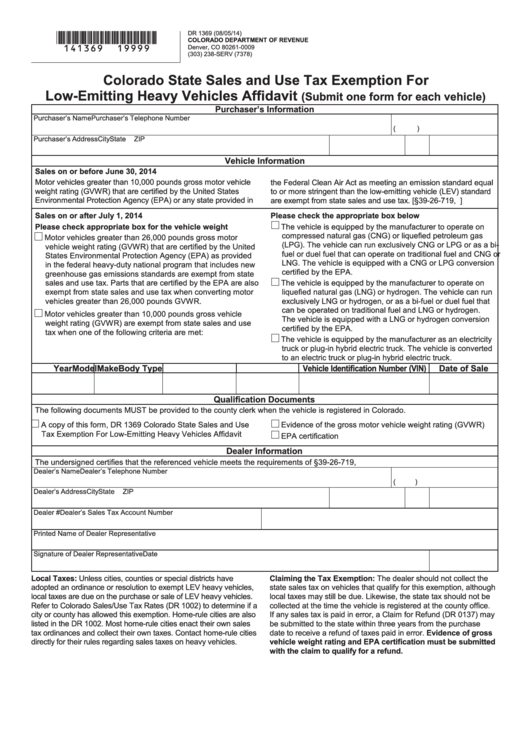

Form Dr 1369 - Colorado State Sales And Use Tax Exemption For Low-Emitting Heavy Vehicles Affidavit (Submit One Form For Each Vehicle)

ADVERTISEMENT

DR 1369 (08/05/14)

*141369==19999*

COLORADO DEPARTMENT OF REVENUE

Denver, CO 80261-0009

(303) 238-SERV (7378)

Colorado State Sales and Use Tax Exemption For

Low-Emitting Heavy Vehicles Affidavit

(Submit one form for each vehicle)

Purchaser’s Information

Purchaser’s Name

Purchaser’s Telephone Number

(

)

Purchaser’s Address

City

State

ZIP

Vehicle Information

Sales on or before June 30, 2014

Motor vehicles greater than 10,000 pounds gross motor vehicle

the Federal Clean Air Act as meeting an emission standard equal

weight rating (GVWR) that are certified by the United States

to or more stringent than the low-emitting vehicle (LEV) standard

Environmental Protection Agency (EPA) or any state provided in

are exempt from state sales and use tax. [§39-26-719, C.R.S.]

Sales on or after July 1, 2014

Please check the appropriate box below

Please check appropriate box for the vehicle weight

The vehicle is equipped by the manufacturer to operate on

compressed natural gas (CNG) or liquefied petroleum gas

Motor vehicles greater than 26,000 pounds gross motor

(LPG). The vehicle can run exclusively CNG or LPG or as a bi-

vehicle weight rating (GVWR) that are certified by the United

fuel or duel fuel that can operate on traditional fuel and CNG or

States Environmental Protection Agency (EPA) as provided

LNG. The vehicle is equipped with a CNG or LPG conversion

in the federal heavy-duty national program that includes new

certified by the EPA.

greenhouse gas emissions standards are exempt from state

sales and use tax. Parts that are certified by the EPA are also

The vehicle is equipped by the manufacturer to operate on

exempt from state sales and use tax when converting motor

liquefied natural gas (LNG) or hydrogen. The vehicle can run

vehicles greater than 26,000 pounds GVWR.

exclusively LNG or hydrogen, or as a bi-fuel or duel fuel that

can be operated on traditional fuel and LNG or hydrogen.

Motor vehicles greater than 10,000 pounds gross vehicle

The vehicle is equipped with a LNG or hydrogen conversion

weight rating (GVWR) are exempt from state sales and use

certified by the EPA.

tax when one of the following criteria are met:

The vehicle is equipped by the manufacturer as an electricity

truck or plug-in hybrid electric truck. The vehicle is converted

to an electric truck or plug-in hybrid electric truck.

Year

Model

Make

Body Type

Vehicle Identification Number (VIN)

Date of Sale

Qualification Documents

The following documents MUST be provided to the county clerk when the vehicle is registered in Colorado.

A copy of this form, DR 1369 Colorado State Sales and Use

Evidence of the gross motor vehicle weight rating (GVWR)

Tax Exemption For Low-Emitting Heavy Vehicles Affidavit

EPA certification

Dealer Information

The undersigned certifies that the referenced vehicle meets the requirements of §39-26-719, C.R.S.

Dealer’s Name

Dealer’s Telephone Number

(

)

Dealer’s Address

City

State

ZIP

Dealer #

Dealer’s Sales Tax Account Number

Printed Name of Dealer Representative

Signature of Dealer Representative

Date

Local Taxes: Unless cities, counties or special districts have

Claiming the Tax Exemption: The dealer should not collect the

adopted an ordinance or resolution to exempt LEV heavy vehicles,

state sales tax on vehicles that qualify for this exemption, although

local taxes are due on the purchase or sale of LEV heavy vehicles.

local taxes may still be due. Likewise, the state tax should not be

Refer to Colorado Sales/Use Tax Rates (DR 1002) to determine if a

collected at the time the vehicle is registered at the county office.

city or county has allowed this exemption. Home-rule cities are also

If any sales tax is paid in error, a Claim for Refund (DR 0137) may

listed in the DR 1002. Most home-rule cities enact their own sales

be submitted to the state within three years from the purchase

date to receive a refund of taxes paid in error. Evidence of gross

tax ordinances and collect their own taxes. Contact home-rule cities

directly for their rules regarding sales taxes on heavy vehicles.

vehicle weight rating and EPA certification must be submitted

with the claim to qualify for a refund.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1