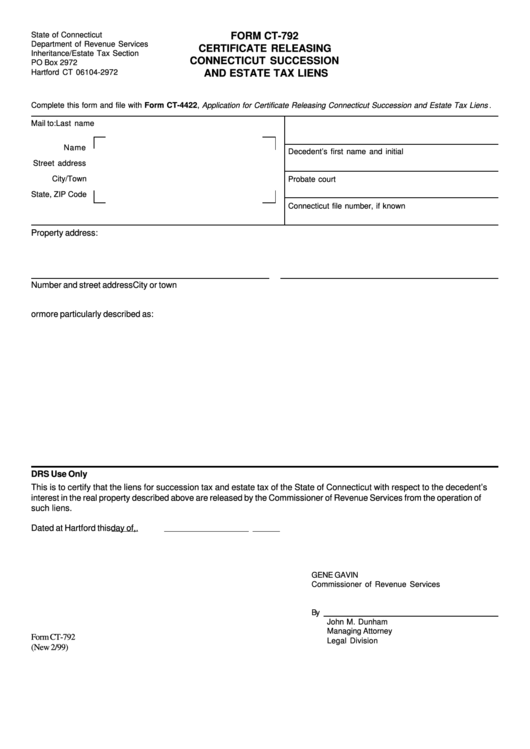

Form Ct-792 - Certificate Releasing Connecticut Succession And Estate Tax Liens

ADVERTISEMENT

State of Connecticut

FORM CT-792

Department of Revenue Services

CERTIFICATE RELEASING

Inheritance/Estate Tax Section

CONNECTICUT SUCCESSION

PO Box 2972

Hartford CT 06104-2972

AND ESTATE TAX LIENS

Complete this form and file with Form CT-4422, Application for Certificate Releasing Connecticut Succession and Estate Tax Liens .

Mail to:

Last name

Name

Decedent’s first name and initial

Street address

City/Town

Probate court

State, ZIP Code

Connecticut file number, if known

Property address:

Number and street address

City or town

or more particularly described as:

DRS Use Only

This is to certify that the liens for succession tax and estate tax of the State of Connecticut with respect to the decedent’s

interest in the real property described above are released by the Commissioner of Revenue Services from the operation of

such liens.

Dated at Hartford this

day of

,

.

GENE GAVIN

Commissioner of Revenue Services

By

John M. Dunham

Managing Attorney

Form CT-792

Legal Division

(New 2/99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1