Form W-8imy - Certificate Of Foreign Intermediary Foreign Partnership Or Certain U.s. Branches For United States Tax Withholding - 1998

ADVERTISEMENT

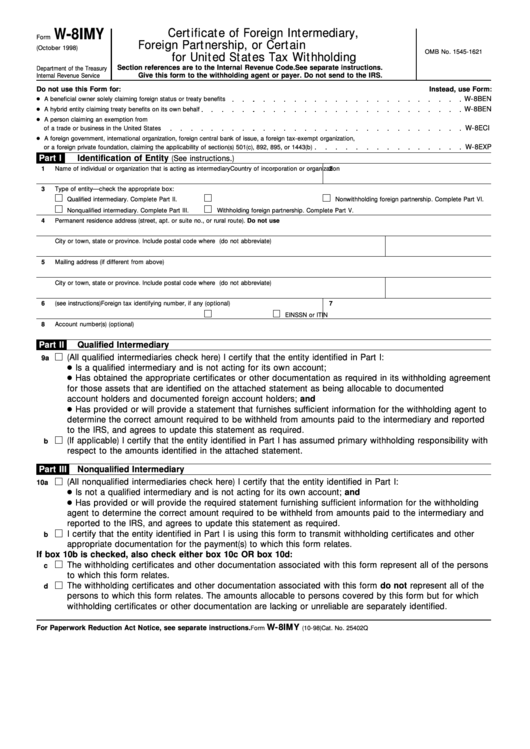

W-8IMY

Certificate of Foreign Intermediary,

Form

Foreign Partnership, or Certain U.S. Branches

(October 1998)

OMB No. 1545-1621

for United States Tax Withholding

Section references are to the Internal Revenue Code.

See separate instructions.

Department of the Treasury

Give this form to the withholding agent or payer. Do not send to the IRS.

Internal Revenue Service

Do not use this Form for:

Instead, use Form:

W-8BEN

A beneficial owner solely claiming foreign status or treaty benefits

W-8BEN

A hybrid entity claiming treaty benefits on its own behalf

A person claiming an exemption from U.S. withholding on income effectively connected with the conduct

W-8ECI

of a trade or business in the United States

A foreign government, international organization, foreign central bank of issue, a foreign tax-exempt organization,

W-8EXP

or a foreign private foundation, claiming the applicability of section(s) 501(c), 892, 895, or 1443(b)

Part I

Identification of Entity

(See instructions.)

1

Name of individual or organization that is acting as intermediary

2

Country of incorporation or organization

3

Type of entity—check the appropriate box:

Qualified intermediary. Complete Part II.

U.S. branch. Complete Part IV.

Nonwithholding foreign partnership. Complete Part VI.

Nonqualified intermediary. Complete Part III.

Withholding foreign partnership. Complete Part V.

4

Permanent residence address (street, apt. or suite no., or rural route). Do not use P.O. box.

City or town, state or province. Include postal code where appropriate.

Country (do not abbreviate)

5

Mailing address (if different from above)

City or town, state or province. Include postal code where appropriate.

Country (do not abbreviate)

6

U.S. taxpayer identification number (see instructions)

7

Foreign tax identifying number, if any (optional)

SSN or ITIN

EIN

8

Account number(s) (optional)

Part II

Qualified Intermediary

(All qualified intermediaries check here) I certify that the entity identified in Part I:

9a

Is a qualified intermediary and is not acting for its own account;

Has obtained the appropriate certificates or other documentation as required in its withholding agreement

for those assets that are identified on the attached statement as being allocable to documented U.S.

account holders and documented foreign account holders; and

Has provided or will provide a statement that furnishes sufficient information for the withholding agent to

determine the correct amount required to be withheld from amounts paid to the intermediary and reported

to the IRS, and agrees to update this statement as required.

(If applicable) I certify that the entity identified in Part I has assumed primary withholding responsibility with

b

respect to the amounts identified in the attached statement.

Part III

Nonqualified Intermediary

(All nonqualified intermediaries check here) I certify that the entity identified in Part I:

10a

Is not a qualified intermediary and is not acting for its own account; and

Has provided or will provide the required statement furnishing sufficient information for the withholding

agent to determine the correct amount required to be withheld from amounts paid to the intermediary and

reported to the IRS, and agrees to update this statement as required.

I certify that the entity identified in Part I is using this form to transmit withholding certificates and other

b

appropriate documentation for the payment(s) to which this form relates.

If box 10b is checked, also check either box 10c OR box 10d:

The withholding certificates and other documentation associated with this form represent all of the persons

c

to which this form relates.

The withholding certificates and other documentation associated with this form do not represent all of the

d

persons to which this form relates. The amounts allocable to persons covered by this form but for which

withholding certificates or other documentation are lacking or unreliable are separately identified.

W-8IMY

For Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 25402Q

Form

(10-98)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2