Instructions For Utility Users Tax Refund Claim Form

ADVERTISEMENT

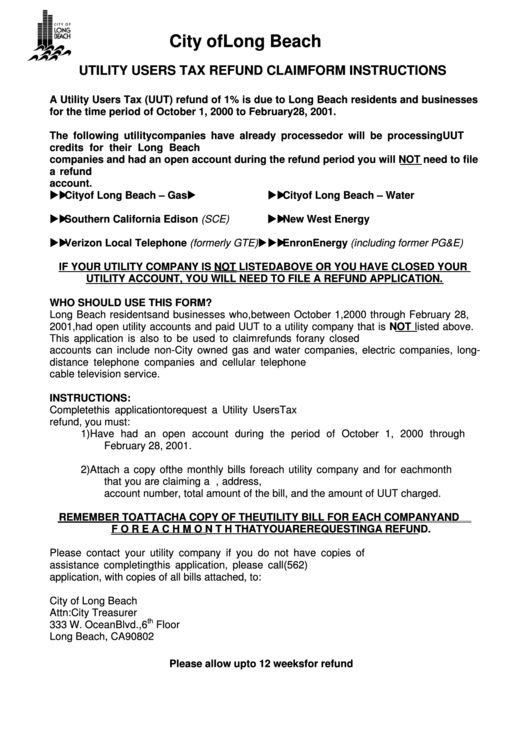

City of Long Beach

UTILITY USERS TAX REFUND CLAIM FORM INSTRUCTIONS

A Utility Users Tax (UUT) refund of 1% is due to Long Beach residents and businesses

for the time period of October 1, 2000 to February 28, 2001.

The following utility companies have already processed or will be processing UUT

credits for their Long Beach customers.

If you are a customer of one of these

companies and had an open account during the refund period you will NOT need to file

a refund application. Your UUT refund has or will be automatically credited to your

account.

City of Long Beach – Gas

City of Long Beach – Water

Southern California Edison (SCE)

New West Energy

Verizon Local Telephone (formerly GTE)

Enron Energy (including former PG&E)

IF YOUR UTILITY COMPANY IS NOT LISTED ABOVE OR YOU HAVE CLOSED YOUR

UTILITY ACCOUNT, YOU WILL NEED TO FILE A REFUND APPLICATION.

WHO SHOULD USE THIS FORM?

Long Beach residents and businesses who, between October 1, 2000 through February 28,

2001, had open utility accounts and paid UUT to a utility company that is NOT listed above.

This application is also to be used to claim refunds for any closed utility accounts. Utility

accounts can include non-City owned gas and water companies, electric companies, long-

distance telephone companies and cellular telephone companies. UUT is not applied to

cable television service.

INSTRUCTIONS:

Complete this application to request a Utility Users Tax refund. In order to qualify for a

refund, you must:

1)

Have had an open account during the period of October 1, 2000 through

February 28, 2001.

2)

Attach a copy of the monthly bills for each utility company and for each month

that you are claiming a refund. The utility bills must include your name, address,

account number, total amount of the bill, and the amount of UUT charged.

REMEMBER TO ATTACH A COPY OF THE UTILITY BILL FOR EACH COMPANY AND

FOR EACH MONTH THAT YOU ARE REQUESTING A REFUND.

Please contact your utility company if you do not have copies of your bills. If you need

assistance completing this application, please call (562) 570-5700. Return the completed

application, with copies of all bills attached, to:

City of Long Beach

Attn: City Treasurer

th

333 W. Ocean Blvd., 6

Floor

Long Beach, CA 90802

Please allow up to 12 weeks for refund

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1