Form 20es - Oregon Estimated Tax Worksheet

ADVERTISEMENT

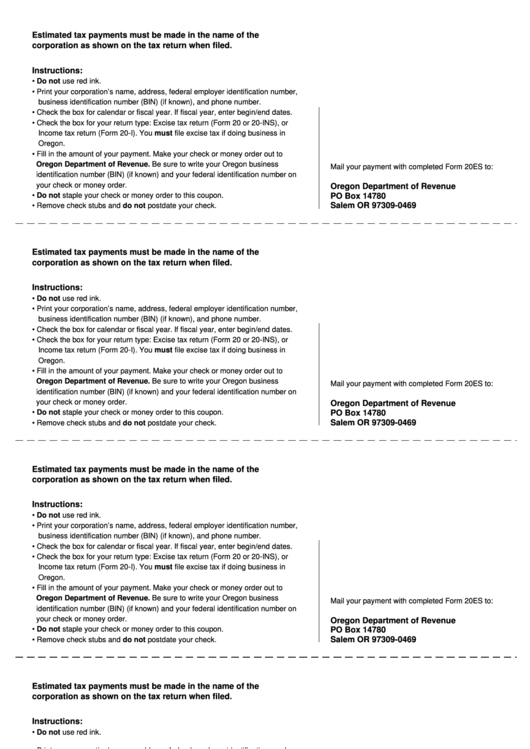

Estimated tax payments must be made in the name of the

corporation as shown on the tax return when filed.

Instructions:

• Do not use red ink.

• Print your corporation’s name, address, federal employer identification number,

business identification number (BIN) (if known), and phone number.

• Check the box for calendar or fiscal year. If fiscal year, enter begin/end dates.

• Check the box for your return type: Excise tax return (Form 20 or 20-INS), or

Income tax return (Form 20-I). You must file excise tax if doing business in

Oregon.

• Fill in the amount of your payment. Make your check or money order out to

Oregon Department of Revenue. Be sure to write your Oregon business

Mail your payment with completed Form 20ES to:

identification number (BIN) (if known) and your federal identification number on

your check or money order.

Oregon Department of Revenue

• Do not staple your check or money order to this coupon.

PO Box 14780

Salem OR 97309-0469

• Remove check stubs and do not postdate your check.

Estimated tax payments must be made in the name of the

corporation as shown on the tax return when filed.

Instructions:

• Do not use red ink.

• Print your corporation’s name, address, federal employer identification number,

business identification number (BIN) (if known), and phone number.

• Check the box for calendar or fiscal year. If fiscal year, enter begin/end dates.

• Check the box for your return type: Excise tax return (Form 20 or 20-INS), or

Income tax return (Form 20-I). You must file excise tax if doing business in

Oregon.

• Fill in the amount of your payment. Make your check or money order out to

Oregon Department of Revenue. Be sure to write your Oregon business

Mail your payment with completed Form 20ES to:

identification number (BIN) (if known) and your federal identification number on

your check or money order.

Oregon Department of Revenue

• Do not staple your check or money order to this coupon.

PO Box 14780

Salem OR 97309-0469

• Remove check stubs and do not postdate your check.

Estimated tax payments must be made in the name of the

corporation as shown on the tax return when filed.

Instructions:

• Do not use red ink.

• Print your corporation’s name, address, federal employer identification number,

business identification number (BIN) (if known), and phone number.

• Check the box for calendar or fiscal year. If fiscal year, enter begin/end dates.

• Check the box for your return type: Excise tax return (Form 20 or 20-INS), or

Income tax return (Form 20-I). You must file excise tax if doing business in

Oregon.

• Fill in the amount of your payment. Make your check or money order out to

Oregon Department of Revenue. Be sure to write your Oregon business

Mail your payment with completed Form 20ES to:

identification number (BIN) (if known) and your federal identification number on

your check or money order.

Oregon Department of Revenue

• Do not staple your check or money order to this coupon.

PO Box 14780

Salem OR 97309-0469

• Remove check stubs and do not postdate your check.

Estimated tax payments must be made in the name of the

corporation as shown on the tax return when filed.

Instructions:

• Do not use red ink.

• Print your corporation’s name, address, federal employer identification number,

business identification number (BIN) (if known), and phone number.

• Check the box for calendar or fiscal year. If fiscal year, enter begin/end dates.

• Check the box for your return type: Excise tax return (Form 20 or 20-INS), or

Income tax return (Form 20-I). You must file excise tax if doing business in

Oregon.

• Fill in the amount of your payment. Make your check or money order out to

Oregon Department of Revenue. Be sure to write your Oregon business

Mail your payment with completed Form 20ES to:

identification number (BIN) (if known) and your federal identification number on

your check or money order.

Oregon Department of Revenue

• Do not staple your check or money order to this coupon.

PO Box 14780

Salem OR 97309-0469

• Remove check stubs and do not postdate your check.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5