Form Cd-400 Ms - Market-Based Sourcing Informational Report

ADVERTISEMENT

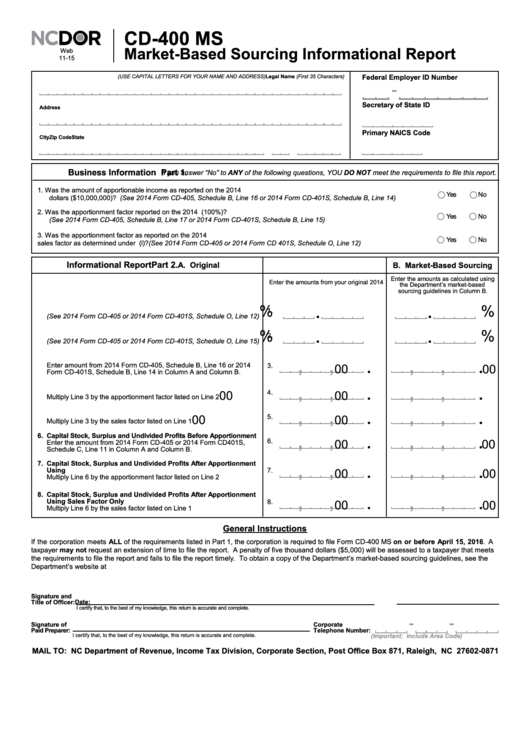

CD-400 MS

Market-Based Sourcing Informational Report

Web

11-15

Federal Employer ID Number

Legal Name (First 35 Characters)

(USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

Secretary of State ID

Address

Primary NAICS Code

City

State

Zip Code

Part 1.

Business Information

If you answer “No” to ANY of the following questions, YOU DO NOT meet the requirements to file this report.

1. Was the amount of apportionable income as reported on the 2014 N.C. Corporate Income Tax Return greater than ten million

Yes

No

dollars ($10,000,000)? (See 2014 Form CD-405, Schedule B, Line 16 or 2014 Form CD-401S, Schedule B, Line 14)

2. Was the apportionment factor reported on the 2014 N.C. Corporate Income Tax Return less than one hundred percent (100%)?

Yes

No

(See 2014 Form CD-405, Schedule B, Line 17 or 2014 Form CD-401S, Schedule B, Line 15)

3. Was the apportionment factor as reported on the 2014 N.C. Corporate Income Tax Return based in whole or in part on the

Yes

No

sales factor as determined under G.S. 105-130.4(l)? (See 2014 Form CD-405 or 2014 Form CD 401S, Schedule O, Line 12)

Part 2.

Informational Report

A. Original

B. Market-Based Sourcing

Enter the amounts as calculated using

Enter the amounts from your original 2014

the Department’s market-based

N.C. Corporate Tax Return in Column A.

sourcing guidelines in Column B.

.

.

%

%

1. Sales Factor

1.

(See 2014 Form CD-405 or 2014 Form CD-401S, Schedule O, Line 12)

.

.

%

%

2. N.C. Apportionment Factor

2.

(See 2014 Form CD-405 or 2014 Form CD-401S, Schedule O, Line 15)

,

,

,

,

.

.

3. Apportionable Income

Enter amount from 2014 Form CD-405, Schedule B, Line 16 or 2014

3.

00

00

Form CD-401S, Schedule B, Line 14 in Column A and Column B.

,

,

,

,

.

.

4. Income Apportioned to N.C.

00

00

4.

Multiply Line 3 by the apportionment factor listed on Line 2

,

,

,

,

.

.

5. Income Apportioned to N.C. Using Sales Factor Only

5.

00

00

Multiply Line 3 by the sales factor listed on Line 1

,

,

,

,

.

.

6.

Capital Stock, Surplus and Undivided Profits Before Apportionment

00

00

6.

Enter the amount from 2014 Form CD-405 or 2014 Form CD401S,

Schedule C, Line 11 in Column A and Column B.

,

,

,

,

.

.

7.

Capital Stock, Surplus and Undivided Profits After Apportionment

Using N.C. Apportionment Factor

7.

00

00

Multiply Line 6 by the apportionment factor listed on Line 2

,

,

,

,

.

.

8.

Capital Stock, Surplus and Undivided Profits After Apportionment

Using Sales Factor Only

8.

00

00

Multiply Line 6 by the sales factor listed on Line 1

General Instructions

If the corporation meets ALL of the requirements listed in Part 1, the corporation is required to file Form CD-400 MS on or before April 15, 2016. A

taxpayer may not request an extension of time to file the report. A penalty of five thousand dollars ($5,000) will be assessed to a taxpayer that meets

the requirements to file the report and fails to file the report timely. To obtain a copy of the Department’s market-based sourcing guidelines, see the

Department’s website at

Signature and

Title of Officer:

Date:

I certify that, to the best of my knowledge, this return is accurate and complete.

Signature of

Corporate

Paid Preparer:

Telephone Number:

I certify that, to the best of my knowledge, this return is accurate and complete.

(Important: Include Area Code)

MAIL TO: NC Department of Revenue, Income Tax Division, Corporate Section, Post Office Box 871, Raleigh, NC 27602-0871

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1