Form Pte-1 - Income Taxable To Owners - 2009

ADVERTISEMENT

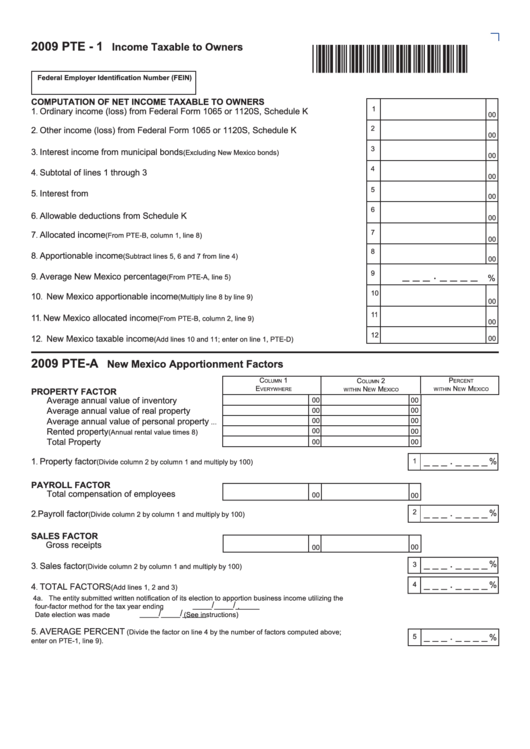

2009 PTE - 1

Income Taxable to Owners

*97190200*

Federal Employer Identification Number (FEIN)

COMPUTATION OF NET INCOME TAXABLE TO OWNERS

1

1

Ordinary income (loss) from Federal Form 1065 or 1120S, Schedule K

.

.........................

00

2

2

Other income (loss) from Federal Form 1065 or 1120S, Schedule K

.

...............................

00

3

3

Interest income from municipal bonds

.

(Excluding New Mexico bonds) .......................................

00

4

4

Subtotal of lines 1 through 3

.

............................................................................................................

00

5

5

Interest from U.S. government obligations or federally taxed New Mexico bonds

.

......

00

6

6

Allowable deductions from Schedule K

.

........................................................................................

00

7

7

Allocated income

.

(From PTE-B, column 1, line 8) ................................................................................

00

8

8

Apportionable income

.

(Subtract lines 5, 6 and 7 from line 4) .............................................................

00

_ _ _ . _ _ _ _

9

9

Average New Mexico percentage

.

(From PTE-A, line 5) ................................................................

%

10

10

New Mexico apportionable income

.

(Multiply line 8 by line 9) ........................................................

00

11

11

New Mexico allocated income

.

(From PTE-B, column 2, line 9) ......................................................

00

12

12

New Mexico taxable income

00

.

(Add lines 10 and 11; enter on line 1, PTE-D) ....................................

2009 PTE-A

New Mexico Apportionment Factors

C

1

P

C

2

olumn

olumn

erCent

e

n

m

n

m

PROPERTY FACTOR

verywhere

within

ew

exiCo

within

ew

exiCo

Average annual value of inventory

00

00

.......................

Average annual value of real property

00

00

............

Average annual value of personal property

00

00

...

Rented property

00

00

(Annual rental value times 8) ........

Total Property

00

00

................................................................

_ _ _ . _ _ _ _

%

1

Property factor

1

.

(Divide column 2 by column 1 and multiply by 100)..........................................................................

PAYROLL FACTOR

Total compensation of employees

....................

00

00

_ _ _ . _ _ _ _

2

%

2

Payroll factor

.

(Divide column 2 by column 1 and multiply by 100) ..............................................................................

SALES FACTOR

Gross receipts

...............................................................

00

00

_ _ _ . _ _ _ _

%

3

3

Sales factor

.

(Divide column 2 by column 1 and multiply by 100) .................................................................................

_ _ _ . _ _ _ _

%

4

4

TOTAL FACTORS

.

(Add lines 1, 2 and 3) ..................................................................................................................

4a. The entity submitted written notification of its election to apportion business income utilizing the

____/____/_____

four-factor method for the tax year ending

.

____/____/_____

Date election was made

(See instructions)

5

AVERAGE PERCENT

.

(Divide the factor on line 4 by the number of factors computed above;

_ _ _ . _ _ _ _

%

5

enter on PTE-1, line 9). ....................................................................................................................................................

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2