Form Kwh 4 - Self-Assessing Purchaser Tax Return Form - Department Of Taxation - Ohio

ADVERTISEMENT

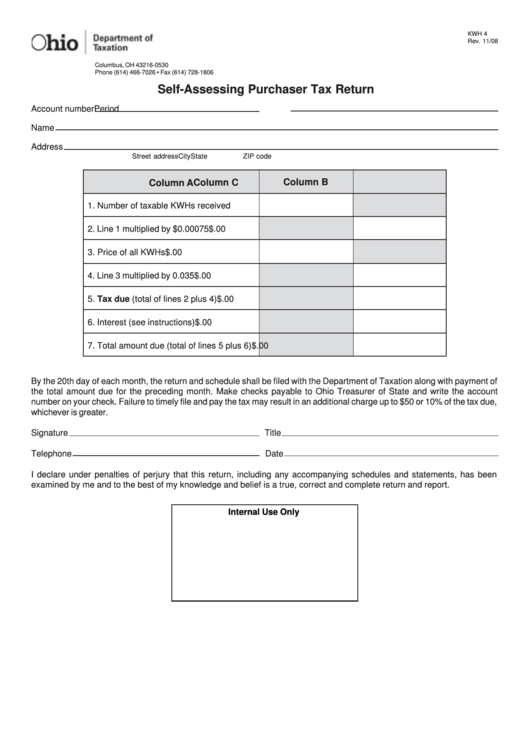

KWH 4

Rev. 11/08

P.O. Box 530

Columbus, OH 43216-0530

Phone (614) 466-7026 • Fax (614) 728-1806

Self-Assessing Purchaser Tax Return

Account number

Period

Name

Address

Street address

City

State

ZIP code

Column B

Column C

Column A

1. Number of taxable KWHs received

2. Line 1 multiplied by $0.00075

$

.00

3. Price of all KWHs

$

.00

4. Line 3 multiplied by 0.035

$

.00

5. Tax due (total of lines 2 plus 4)

$

.00

6. Interest (see instructions)

$

.00

7. Total amount due (total of lines 5 plus 6)

$

.00

By the 20th day of each month, the return and schedule shall be filed with the Department of Taxation along with payment of

the total amount due for the preceding month. Make checks payable to Ohio Treasurer of State and write the account

number on your check. Failure to timely file and pay the tax may result in an additional charge up to $50 or 10% of the tax due,

whichever is greater.

Signature

Title

Telephone

Date

I declare under penalties of perjury that this return, including any accompanying schedules and statements, has been

examined by me and to the best of my knowledge and belief is a true, correct and complete return and report.

Internal Use Only

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2