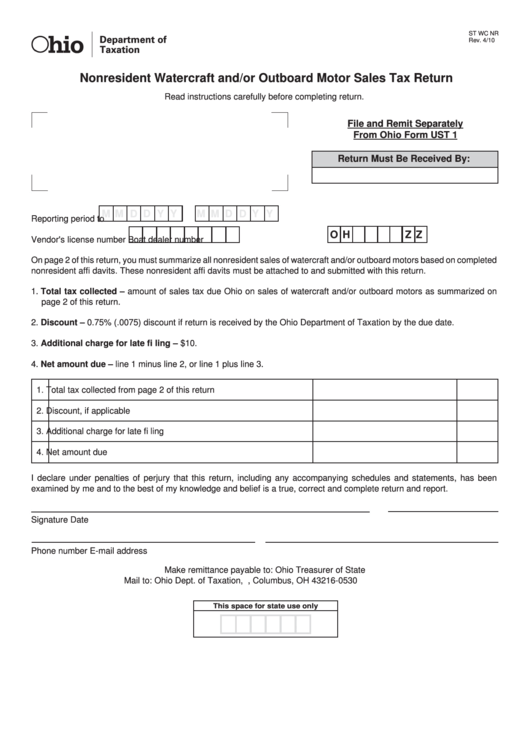

Form St Wc Nr - Nonresident Watercraft And/or Outboard Motor Sales Tax Return

ADVERTISEMENT

hio

ST WC NR

Department of

Rev. 4/10

Taxation

Nonresident Watercraft and/or Outboard Motor Sales Tax Return

Read instructions carefully before completing return.

File and Remit Separately

From Ohio Form UST 1

Return Must Be Received By:

M

D

Y

M

D

Y

M

D

Y

M

D

Y

Reporting period

to

O H

Z Z

Vendor's license number

Boat dealer number

On page 2 of this return, you must summarize all nonresident sales of watercraft and/or outboard motors based on completed

nonresident affi davits. These nonresident affi davits must be attached to and submitted with this return.

1. Total tax collected – amount of sales tax due Ohio on sales of watercraft and/or outboard motors as summarized on

page 2 of this return.

2. Discount – 0.75% (.0075) discount if return is received by the Ohio Department of Taxation by the due date.

3. Additional charge for late fi ling – $10.

4. Net amount due – line 1 minus line 2, or line 1 plus line 3.

1.

Total tax collected from page 2 of this return

2.

Discount, if applicable

3.

Additional charge for late fi ling

4.

Net amount due

I declare under penalties of perjury that this return, including any accompanying schedules and statements, has been

examined by me and to the best of my knowledge and belief is a true, correct and complete return and report.

Signature

Date

Phone number

E-mail address

Make remittance payable to: Ohio Treasurer of State

Mail to: Ohio Dept. of Taxation, P.O. Box 530, Columbus, OH 43216-0530

This space for state use only

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2