Form A1-Apr Instructions

ADVERTISEMENT

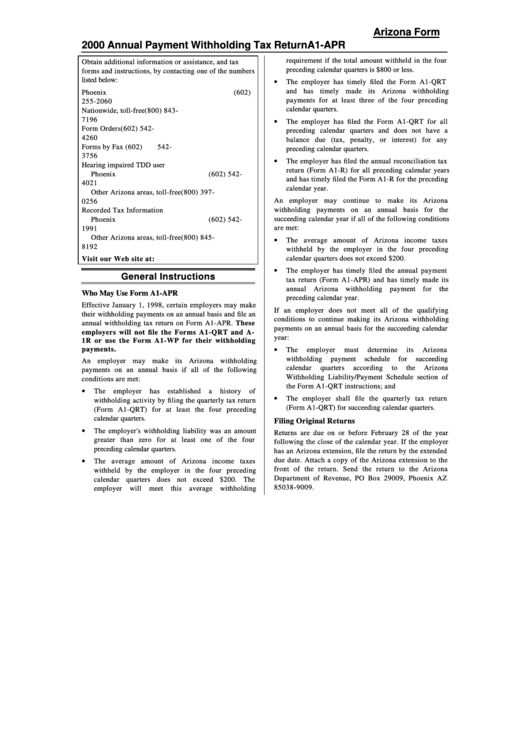

Arizona Form

2000 Annual Payment Withholding Tax Return

A1-APR

requirement if the total amount withheld in the four

Obtain additional information or assistance, and tax

preceding calendar quarters is $800 or less.

forms and instructions, by contacting one of the numbers

•

listed below:

The employer has timely filed the Form A1-QRT

and has timely made its Arizona withholding

Phoenix

(602)

payments for at least three of the four preceding

255-2060

calendar quarters.

Nationwide, toll-free

(800) 843-

•

7196

The employer has filed the Form A1-QRT for all

Form Orders

(602) 542-

preceding calendar quarters and does not have a

4260

balance due (tax, penalty, or interest) for any

Forms by Fax

(602)

542-

preceding calendar quarters.

3756

•

The employer has filed the annual reconciliation tax

Hearing impaired TDD user

return (Form A1-R) for all preceding calendar years

Phoenix

(602) 542-

and has timely filed the Form A1-R for the preceding

4021

calendar year.

Other Arizona areas, toll-free

(800) 397-

An employer may continue to make its Arizona

0256

withholding payments on an annual basis for the

Recorded Tax Information

succeeding calendar year if all of the following conditions

Phoenix

(602) 542-

are met:

1991

Other Arizona areas, toll-free

(800) 845-

•

The average amount of Arizona income taxes

8192

withheld by the employer in the four preceding

calendar quarters does not exceed $200.

Visit our Web site at:

•

The employer has timely filed the annual payment

General Instructions

tax return (Form A1-APR) and has timely made its

annual Arizona withholding payment for the

Who May Use Form A1-APR

preceding calendar year.

Effective January 1, 1998, certain employers may make

If an employer does not meet all of the qualifying

their withholding payments on an annual basis and file an

conditions to continue making its Arizona withholding

annual withholding tax return on Form A1-APR. These

payments on an annual basis for the succeeding calendar

employers will not file the Forms A1-QRT and A-

year:

1R or use the Form A1-WP for their withholding

•

payments.

The

employer

must

determine

its

Arizona

withholding

payment

schedule

for

succeeding

An employer may make its Arizona withholding

calendar

quarters

according

to

the

Arizona

payments on an annual basis if all of the following

Withholding Liability/Payment Schedule section of

conditions are met:

the Form A1-QRT instructions; and

•

The

employer

has

established

a

history

of

•

The employer shall file the quarterly tax return

withholding activity by filing the quarterly tax return

(Form A1-QRT) for succeeding calendar quarters.

(Form A1-QRT) for at least the four preceding

calendar quarters.

Filing Original Returns

•

The employer's withholding liability was an amount

Returns are due on or before February 28 of the year

greater than zero for at least one of the four

following the close of the calendar year. If the employer

preceding calendar quarters.

has an Arizona extension, file the return by the extended

•

due date. Attach a copy of the Arizona extension to the

The average amount of Arizona income taxes

front of the return. Send the return to the Arizona

withheld by the employer in the four preceding

Department of Revenue, PO Box 29009, Phoenix AZ

calendar quarters does not exceed $200. The

85038-9009.

employer

will

meet

this

average

withholding

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4