Form Gas-1201c - Motor Fuel Claim For Refund Tax-Paid Motor Fuel Used Off-Highway 2004 - North Carolina Department Of Revenue

ADVERTISEMENT

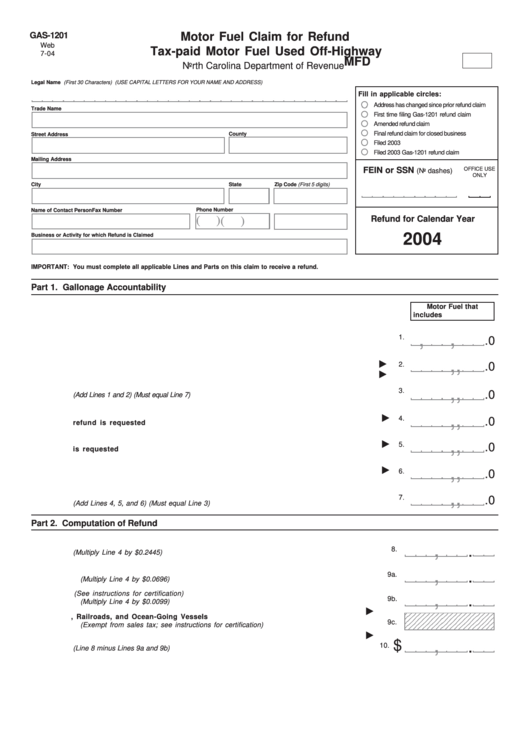

GAS-1201

Motor Fuel Claim for Refund

Web

Tax-paid Motor Fuel Used Off-Highway

7-04

MFD

North Carolina Department of Revenue

Legal Name

(First 30 Characters) (USE CAPITAL LETTERS FOR YOUR NAME AND ADDRESS)

Fill in applicable circles:

Address has changed since prior refund claim

Trade Name

First time filing Gas-1201 refund claim

Amended refund claim

Final refund claim for closed business

County

Street Address

Filed 2003 N.C. Income Tax Return

Filed 2003 Gas-1201 refund claim

Mailing Address

OFFICE USE

FEIN or SSN

(No dashes)

ONLY

City

State

Zip Code (First 5 digits)

Phone Number

Name of Contact Person

Fax Number

(

)

Refund for Calendar Year

(

)

2004

Business or Activity for which Refund is Claimed

IMPORTANT: You must complete all applicable Lines and Parts on this claim to receive a refund.

Part 1. Gallonage Accountability

Motor Fuel that

includes N.C. Road Tax

,

,

1.

Beginning inventory of tax-paid motor fuel on hand at first of year

1.

.0

,

,

2.

Total gallons of tax-paid motor fuel purchased during 2004

2.

.0

3.

Total gallons of tax-paid motor fuel to be accounted for

,

,

3.

.0

(Add Lines 1 and 2) (Must equal Line 7)

4.

Total gallons of tax-paid motor fuel used in off-highway equipment for which

,

,

4.

.0

refund is requested

,

,

5.

Total gallons of tax-paid motor fuel used in licensed vehicles for which no refund

5.

.0

is requested

,

,

6.

Ending inventory of tax-paid motor fuel on hand at end of year

6.

.0

,

,

7.

Total gallons of tax-paid motor fuel accounted for

7.

.0

(Add Lines 4, 5, and 6) (Must equal Line 3)

Part 2. Computation of Refund

8.

Refund due on tax-paid motor fuel used in off-highway equipment

,

8.

.

(Multiply Line 4 by $0.2445)

9.

Sales tax due on motor fuel used in off-highway equipment

,

a. General off-highway use

9a.

.

(Multiply Line 4 by $0.0696)

b. Manufacturers and Farmers (See instructions for certification)

,

9b.

.

(Multiply Line 4 by $0.0099)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

c. Commercial Fishermen, Railroads, and Ocean-Going Vessels

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

9c.

(Exempt from sales tax; see instructions for certification)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1

10. Total Refund Due

,

$

10.

.

(Line 8 minus Lines 9a and 9b)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2