Instructions For Form 941 - Employer'S Quarterly Federal Tax Return - 2006

ADVERTISEMENT

Department of the Treasury

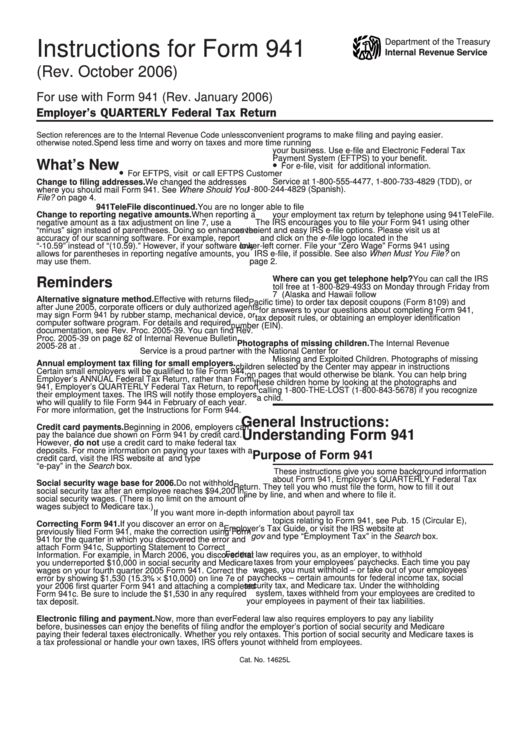

Instructions for Form 941

Internal Revenue Service

(Rev. October 2006)

For use with Form 941 (Rev. January 2006)

Employer’s QUARTERLY Federal Tax Return

Section references are to the Internal Revenue Code unless

convenient programs to make filing and paying easier.

otherwise noted.

Spend less time and worry on taxes and more time running

your business. Use e-file and Electronic Federal Tax

Payment System (EFTPS) to your benefit.

•

What’s New

For e-file, visit for additional information.

•

For EFTPS, visit or call EFTPS Customer

Service at 1-800-555-4477, 1-800-733-4829 (TDD), or

Change to filing addresses. We changed the addresses

1-800-244-4829 (Spanish).

where you should mail Form 941. See Where Should You

File? on page 4.

941TeleFile discontinued. You are no longer able to file

your employment tax return by telephone using 941TeleFile.

Change to reporting negative amounts. When reporting a

negative amount as a tax adjustment on line 7, use a

The IRS encourages you to file your Form 941 using other

“minus” sign instead of parentheses. Doing so enhances the

convenient and easy IRS e-file options. Please visit us at

accuracy of our scanning software. For example, report

and click on the e-file logo located in the

“-10.59” instead of “(10.59).” However, if your software only

lower-left corner. File your “Zero Wage” Forms 941 using

allows for parentheses in reporting negative amounts, you

IRS e-file, if possible. See also When Must You File? on

may use them.

page 2.

Where can you get telephone help? You can call the IRS

Reminders

toll free at 1-800-829-4933 on Monday through Friday from

7 a.m. to 10 p.m. local time (Alaska and Hawaii follow

Alternative signature method. Effective with returns filed

Pacific time) to order tax deposit coupons (Form 8109) and

after June 2005, corporate officers or duly authorized agents

for answers to your questions about completing Form 941,

may sign Form 941 by rubber stamp, mechanical device, or

tax deposit rules, or obtaining an employer identification

computer software program. For details and required

number (EIN).

documentation, see Rev. Proc. 2005-39. You can find Rev.

Proc. 2005-39 on page 82 of Internal Revenue Bulletin

Photographs of missing children. The Internal Revenue

2005-28 at /pub/irs-irbs/irb05-28.pdf.

Service is a proud partner with the National Center for

Missing and Exploited Children. Photographs of missing

Annual employment tax filing for small employers.

children selected by the Center may appear in instructions

Certain small employers will be qualified to file Form 944,

on pages that would otherwise be blank. You can help bring

Employer’s ANNUAL Federal Tax Return, rather than Form

these children home by looking at the photographs and

941, Employer’s QUARTERLY Federal Tax Return, to report

calling 1-800-THE-LOST (1-800-843-5678) if you recognize

their employment taxes. The IRS will notify those employers

a child.

who will qualify to file Form 944 in February of each year.

For more information, get the Instructions for Form 944.

General Instructions:

Credit card payments. Beginning in 2006, employers can

Understanding Form 941

pay the balance due shown on Form 941 by credit card.

However, do not use a credit card to make federal tax

deposits. For more information on paying your taxes with a

Purpose of Form 941

credit card, visit the IRS website at and type

“e-pay” in the Search box.

These instructions give you some background information

about Form 941, Employer’s QUARTERLY Federal Tax

Social security wage base for 2006. Do not withhold

Return. They tell you who must file the form, how to fill it out

social security tax after an employee reaches $94,200 in

line by line, and when and where to file it.

social security wages. (There is no limit on the amount of

wages subject to Medicare tax.)

If you want more in-depth information about payroll tax

topics relating to Form 941, see Pub. 15 (Circular E),

Correcting Form 941. If you discover an error on a

Employer’s Tax Guide, or visit the IRS website at

previously filed Form 941, make the correction using Form

gov and type “Employment Tax” in the Search box.

941 for the quarter in which you discovered the error and

attach Form 941c, Supporting Statement to Correct

Federal law requires you, as an employer, to withhold

Information. For example, in March 2006, you discover that

taxes from your employees’ paychecks. Each time you pay

you underreported $10,000 in social security and Medicare

wages, you must withhold – or take out of your employees’

wages on your fourth quarter 2005 Form 941. Correct the

error by showing $1,530 (15.3% × $10,000) on line 7e of

paychecks – certain amounts for federal income tax, social

security tax, and Medicare tax. Under the withholding

your 2006 first quarter Form 941 and attaching a completed

system, taxes withheld from your employees are credited to

Form 941c. Be sure to include the $1,530 in any required

your employees in payment of their tax liabilities.

tax deposit.

Electronic filing and payment. Now, more than ever

Federal law also requires employers to pay any liability

before, businesses can enjoy the benefits of filing and

for the employer’s portion of social security and Medicare

paying their federal taxes electronically. Whether you rely on

taxes. This portion of social security and Medicare taxes is

a tax professional or handle your own taxes, IRS offers you

not withheld from employees.

Cat. No. 14625L

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8