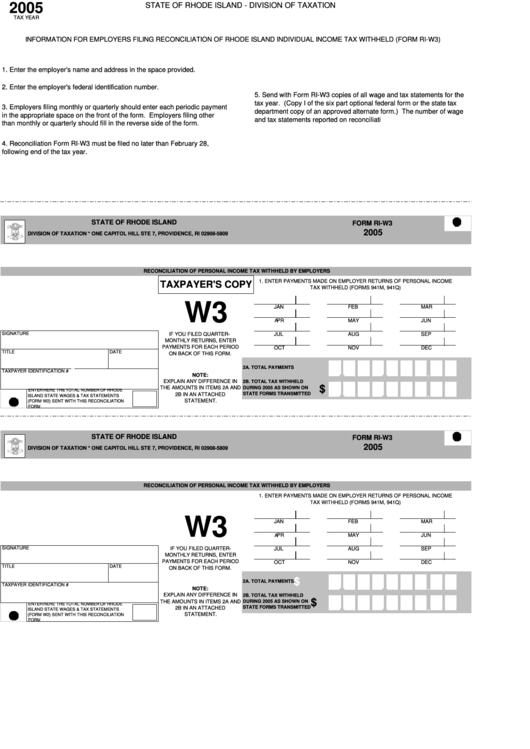

Form Ri-W3 - Information For Employers Filing Reconciliation Of Rhode Island Individual Income Tax Withheld

ADVERTISEMENT

2005

STATE OF RHODE ISLAND - DIVISION OF TAXATION

TAX YEAR

INFORMATION FOR EMPLOYERS FILING RECONCILIATION OF RHODE ISLAND INDIVIDUAL INCOME TAX WITHHELD (FORM RI-W3)

1. Enter the employer's name and address in the space provided.

2. Enter the employer's federal identification number.

5. Send with Form RI-W3 copies of all wage and tax statements for the

tax year. (Copy I of the six part optional federal form or the state tax

3. Employers filing monthly or quarterly should enter each periodic payment

department copy of an approved alternate form.) The number of wage

in the appropriate space on the front of the form. Employers filing other

and tax statements reported on reconciliati

than monthly or quarterly should fill in the reverse side of the form.

4. Reconciliation Form RI-W3 must be filed no later than February 28,

following end of the tax year.

STATE OF RHODE ISLAND

FORM RI-W3

2005

DIVISION OF TAXATION * ONE CAPITOL HILL STE 7, PROVIDENCE, RI 02908-5809

RECONCILIATION OF PERSONAL INCOME TAX WITHHELD BY EMPLOYERS

1. ENTER PAYMENTS MADE ON EMPLOYER RETURNS OF PERSONAL INCOME

TAXPAYER'S COPY

TAX WITHHELD (FORMS 941M, 941Q)

W3

JAN

FEB

MAR

APR

MAY

JUN

SIGNATURE

IF YOU FILED QUARTER-

JUL

AUG

SEP

MONTHLY RETURNS, ENTER

PAYMENTS FOR EACH PERIOD

OCT

NOV

DEC

TITLE

DATE

ON BACK OF THIS FORM.

$

2A. TOTAL PAYMENTS

TAXPAYER IDENTIFICATION #

NOTE:

EXPLAIN ANY DIFFERENCE IN

2B. TOTAL TAX WITHHELD

$

THE AMOUNTS IN ITEMS 2A AND

DURING 2005 AS SHOWN ON

ENTER HERE THE TOTAL NUMBER OF RHODE

2B IN AN ATTACHED

STATE FORMS TRANSMITTED

ISLAND STATE WAGES & TAX STATEMENTS

STATEMENT.

(FORM W2) SENT WITH THIS RECONCILIATION

FORM

STATE OF RHODE ISLAND

FORM RI-W3

2005

DIVISION OF TAXATION * ONE CAPITOL HILL STE 7, PROVIDENCE, RI 02908-5809

RECONCILIATION OF PERSONAL INCOME TAX WITHHELD BY EMPLOYERS

1. ENTER PAYMENTS MADE ON EMPLOYER RETURNS OF PERSONAL INCOME

TAX WITHHELD (FORMS 941M, 941Q)

W3

JAN

FEB

MAR

APR

MAY

JUN

SIGNATURE

IF YOU FILED QUARTER-

JUL

AUG

SEP

MONTHLY RETURNS, ENTER

PAYMENTS FOR EACH PERIOD

OCT

NOV

DEC

TITLE

DATE

ON BACK OF THIS FORM.

$

2A. TOTAL PAYMENTS

TAXPAYER IDENTIFICATION #

NOTE:

EXPLAIN ANY DIFFERENCE IN

2B. TOTAL TAX WITHHELD

$

THE AMOUNTS IN ITEMS 2A AND

DURING 2005 AS SHOWN ON

ENTER HERE THE TOTAL NUMBER OF RHODE

STATE FORMS TRANSMITTED

2B IN AN ATTACHED

ISLAND STATE WAGES & TAX STATEMENTS

STATEMENT.

(FORM W2) SENT WITH THIS RECONCILIATION

FORM

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2