Form 72a006 (10-06) - Motor Fuel Tax Refund Application

ADVERTISEMENT

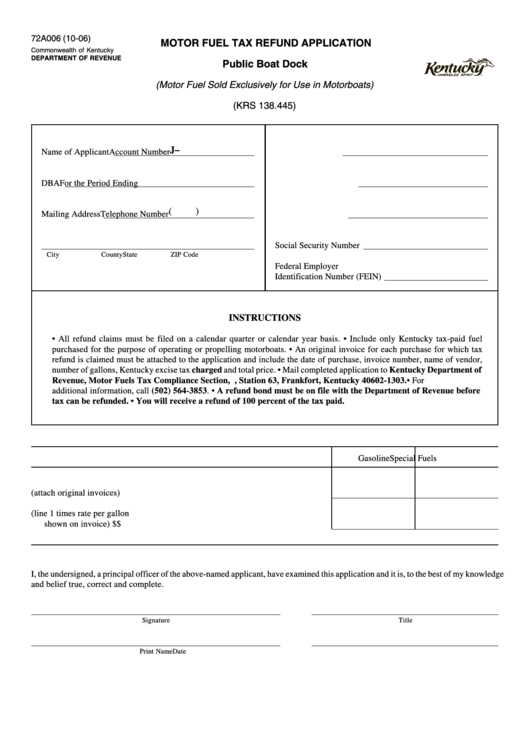

72A006 (10-06)

MOTOR FUEL TAX REFUND APPLICATION

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

Public Boat Dock

(Motor Fuel Sold Exclusively for Use in Motorboats)

(KRS 138.445)

J–

Name of Applicant

Account Number

DBA

For the Period Ending

(

)

Mailing Address

Telephone Number

P.O. Box or Number and Street

Social Security Number

City

County

State

ZIP Code

Federal Employer

Identification Number (FEIN)

INSTRUCTIONS

• All refund claims must be filed on a calendar quarter or calendar year basis. • Include only Kentucky tax-paid fuel

purchased for the purpose of operating or propelling motorboats. • An original invoice for each purchase for which tax

refund is claimed must be attached to the application and include the date of purchase, invoice number, name of vendor,

number of gallons, Kentucky excise tax charged and total price. • Mail completed application to Kentucky Department of

Revenue, Motor Fuels Tax Compliance Section, P.O. Box 1303, Station 63, Frankfort, Kentucky 40602-1303. • For

additional information, call (502) 564-3853. • A refund bond must be on file with the Department of Revenue before

tax can be refunded. • You will receive a refund of 100 percent of the tax paid.

Gasoline

Special Fuels

1. Number of gallons purchased (attach original invoices) ........................................

2. Motor fuel tax refund requested (line 1 times rate per gallon

shown on invoice) ...................................................................................................

$

$

I, the undersigned, a principal officer of the above-named applicant, have examined this application and it is, to the best of my knowledge

and belief true, correct and complete.

Signature

Title

Print Name

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1